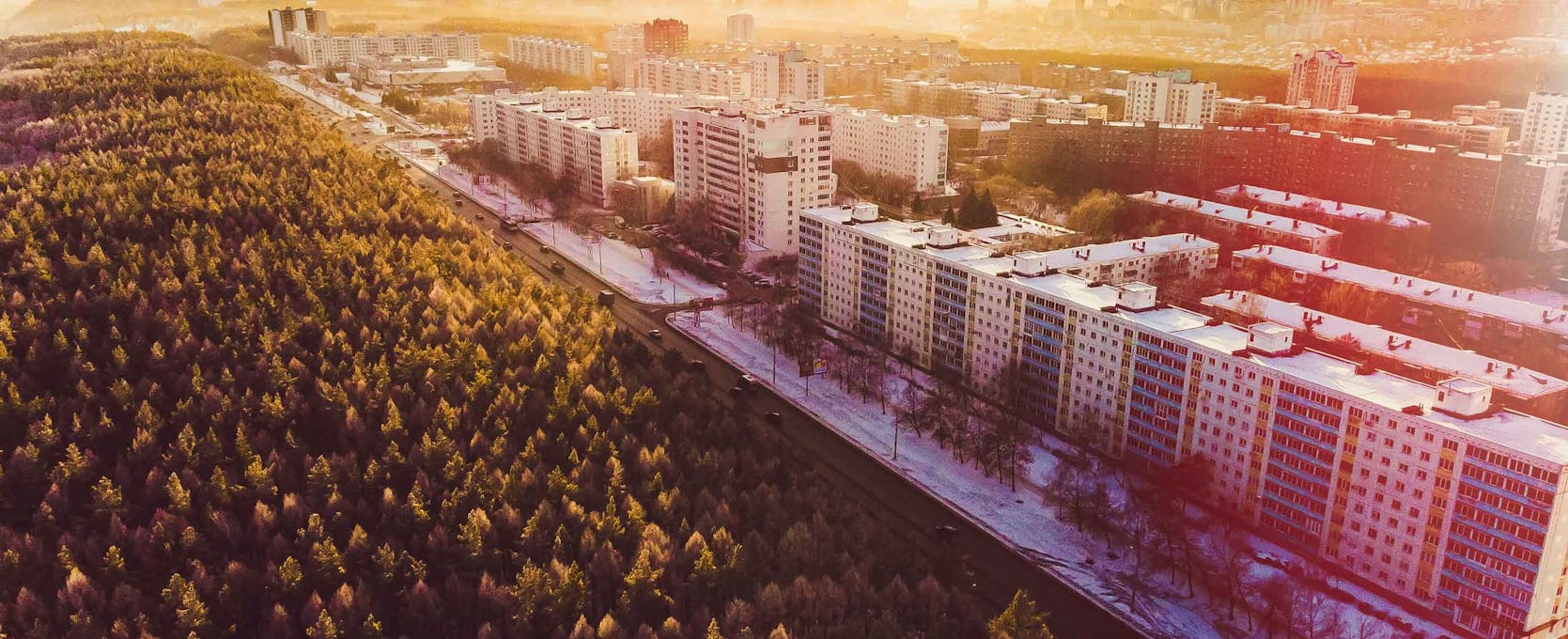

Multifamily Housing

Multifamily Housing

Donald N. Bernards

CPA

Principal

Jeff T. Blattner

CPA

Principal

Todd Carpenter

Managing Principal

Russ Fleming

CPA

Principal

Garrick Gibson

CPA

Principal

Kevin O'Connell

CPA, CGMA

Principal

Wayne T. Schiferl

CPA

Principal

Nuwandi Trahan

CPA

Principal

Marvalette Hunter

Director

Let’s build the future of housing, together.

Success in the housing industry requires a deep understanding of complex real estate transactions, a passion for supporting the goals of community stakeholders and a commitment to the financial and operational health of your organization in an increasingly regulated environment.

For-profit and not-for-profit developers, housing authorities, property managers, state housing credit agencies, syndicators, and lenders rely on our real estate development and transaction expertise to build and maintain many types of rural and urban housing communities throughout the country, including:

- Affordable

- Workforce

- Market rate

- Public

- Senior

- Student

- Tribal

Conceptualization to completion

Our affordable housing consultants can help you minimize risk and optimize your development opportunities, guiding you from initial project conceptualization to completion and helping you with:

- Tax credits and other project financing

- Development advisory

- Opportunity Zone strategy consulting

- Transaction advisory services

- Housing market and impact studies

- Tax, assurance and accounting services

- Outsourced accounting/client accounting services (CAS)

- Real estate valuation and valuation of partnership interests

- Regulatory compliance and reporting

- Construction risk management

- Cybersecurity and IT risk advisory

- LIHTC year 15 exit planning

- Corporate renewal and turnaround services

- Cost certifications for HUD and Section 42 tax credit projects

Funding your project

With a broad range of state and federal programs at the center of many housing projects, long-term success in the arena depends on your ability to secure these scarce resources as well as adhere to a host of reporting and regulatory obligations.

Our engagements are led by practice leaders and team members who are on the cutting edge of new housing programs and have the proven deal experience, technical expertise and creativity necessary to route the complex interplays among all financial stakeholders. Our experience includes:

- Low-income housing tax credits

- Tax-exempt bonds and various taxable debt

- Federal Home Loan Bank AHP

- Federal and local grant programs

- Public Housing Mixed Finance

- Historic Tax Credits

- Energy tax credits

- Opportunity Zones

- Capital Magnet Fund

- New Markets Tax Credits

Our commitment to underrepresented developers

Baker Tilly's DevelUP™

Join our communications list for future updates about DevelUP!

From an investor limited partner perspective, I was very impressed with Baker Tilly’s commitment to providing excellent customer service. Though my company was not responsible for engaging Baker Tilly for their services, they understood the impact and importance of the cost segregation results on the investor limited partner. They could have easily submitted one draft and pushed to finalize the report, but instead they revisited the scope of the work and investigated some new aspects of the information provided and were able to produce results that really helped the investor. They did this for no additional fee but incurred additional time and effort to help meet our needs.Low-income housing tax credit syndicator

Featured case studies and insights

Featured services and related industries

Real Estate Advisory Services

Baker Tilly’s real estate advisory services are designed to help leaders across various industries and communities with their ever-changing real estate and infrastructure needs.

CFO Advisory Services

Baker Tilly provides critical advisory services and support to financial leaders, business owners and investors that meet the unique challenges, complexities and the ever changing environment the office of the CFO faces.

Corporate Renewal & Turnaround Services

Baker Tilly works with companies to design and execute a comprehensive turnaround plan to help mitigate risk and improve operations during an economic downturn.

Cost Segregation

Individuals and companies that build, purchase, remodel or expand any kind of real estate can benefit financially from using cost segregation.

Cybersecurity

Proactively protect and address your cybersecurity and information technology (IT) risks.

Development Advisory

Guiding clients through development projects from conception to completion.

ESG & Sustainability

Leading in specialties including compliance, risk, controls, assurance, sustainability, decarbonization strategy development and technology consulting, we provide comprehensive environmental, social and governance (ESG) and sustainability advisory that spans solutions for any company, function or challenge.

Federal Tax

Baker Tilly offers specialized federal tax management services including compliance and planning expertise to help businesses optimize value while minimizing their tax burden.

Financial Statement Audit

Baker Tilly marries technology with the extensive experience to provide clients with an innovative financial statement audit service.

Historic Tax Credits

The trend to revitalize historic buildings nationwide is becoming more prevalent with the availability and value of Historic Tax Credits.

Incentives Advisory

Every year, federal, state and city governments across the United States invest over $170 billion of incentive funding into private businesses. Taking advantage of available incentives programs can fill financing gaps and turn planned projects into a reality.

Inflation Reduction Act Tax Credit Solutions

The Inflation Reduction Act (IRA) includes the largest clean energy incentive effort in U.S. history. Find out how your organization can leverage IRA tax credits to save as much as 50% or more on qualifying project costs.

New Markets Tax Credits

Optimize your project’s approach to capital with the New Markets Tax Credit program.

Opportunity Zones

A powerful tax incentive for real estate investors, venture capital, private wealth, family offices and private equity.

Project Finance

We take a comprehensive view of available federal, state and local tax credit and incentive programs and loan programs when developing a project’s capital stack.

Real Estate Valuation Services

Our accurate and reliable real estate valuation services paired with strategic advisory encompass the entire transaction lifecycle.

Real Estate Services for Family Offices

Real estate portfolio services for family offices and high-net-worth individuals.

Site Selection & Location Strategy

From inception to site selection, we assist companies through the process of determining the optimal location to operate their business.

Healthcare & Life Sciences

Baker Tilly helps organizations win now, and explore the options for tomorrow, through an orchestrated approach and understanding encompassing all facets of the healthcare ecosystem.

Manufacturing & Distribution

Providing manufacturing consulting solutions to help businesses reduce risk and improve efficiencies across the supply chain.

Not-for-Profit

Drive your mission forward with Baker Tilly's not-for-profit navigators.

Senior Services

Helping create the future of senior services.

Real Estate

Innovative real estate consulting, tax and assurance solutions for developers, owners, investors and property managers.

LIHTC Year 15 Exit Planning Resource Center

As LIHTC properties approach their fifteenth anniversary, general partners must decide how to move forward with them after the initial LIHTC compliance period. A variety of factors must be evaluated in this decision. Will the property remain in the affordable housing stock? Does the property need significant capital repairs? Is there additional value that can be unlocked because of an improved market?

We rely on Baker Tilly’s breadth of experience to deliver services beyond audit and tax. They consistently add value through cost segregation studies, market studies, project consulting and more.Brett Oumedian, Controller, Cinnaire

Our clients

© 2024 Baker Tilly US, LLP