Hedge against an increase in the capital gain tax

Hedge against an increase in the capital gain tax

The tax platform of President-elect Biden includes an increase in the capital gain rate, potentially to match ordinary income rates. An opportunity zone (OZ) investment offers a potential hedge against an increase in the capital gain tax rate, and time remains for eligible gains from 2019 to be invested into a Qualified Opportunity Fund (QOF) by Dec. 31, 2020.

Reinvesting capital gains into a QOF provides a deferral on the payment of the capital gain tax and a 10% reduction of the gain when reported on the 2026 return. However, the deferred gain is taxed at the capital gain rate in effect for the 2026 tax return.

Taken on its own, that sounds daunting, but when taken in the context with the more significant OZ tax benefits for holding the QOF investment for 10 years — the elimination of depreciation recapture and capital gains — investing in a QOF is actually a hedge against rising capital gain rates.

Example

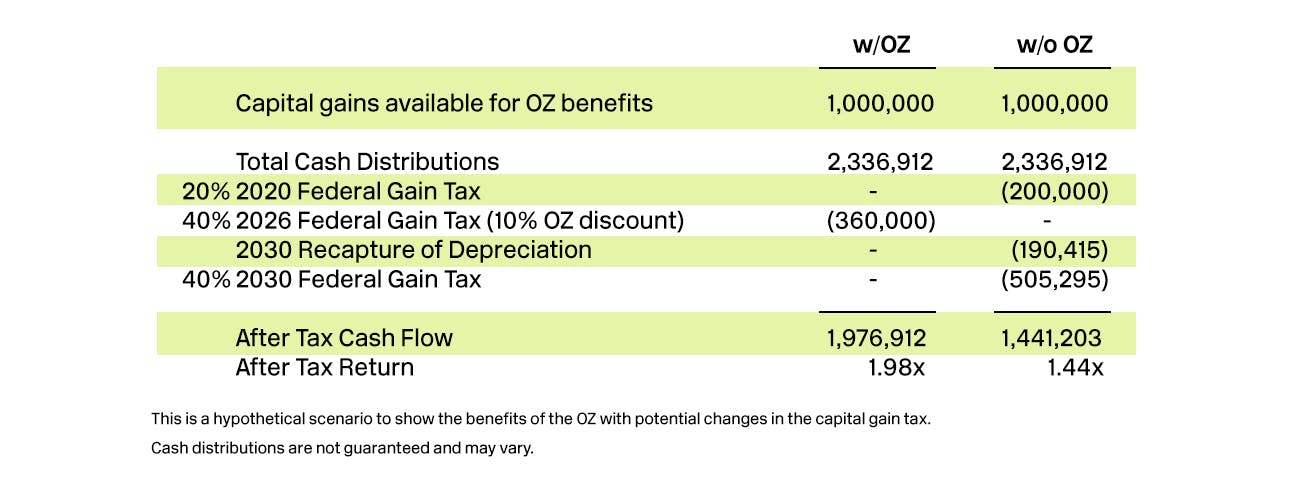

An individual with a gain of $1 million finds an attractive real estate development that happens to qualify for OZ benefits. The individual is concerned that the federal capital gain tax rate will double from 20% to 40% and isn’t sure if they should elect OZ status. The choice is to pay the 20% gain tax today or risk a higher capital gain rate in the future in order to receive the long-term OZ benefits.

The after-tax cash flow by making the OZ election is 37% greater than locking in the 20% capital gain rate today and paying taxes on the gains of the subsequent investment.

As shown in the example above, the totality of OZ tax benefits are significant — representing a savings of $535,710, net of a doubling in the federal capital gain rate.

It’s also fair to point out that the tax rate in 2026 and beyond won’t be determined until we have one more presidential and two more congressional elections in 2022, 2024 and 2026.

For more information on this topic, or to learn how Baker Tilly specialists can help, contact our team.

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.