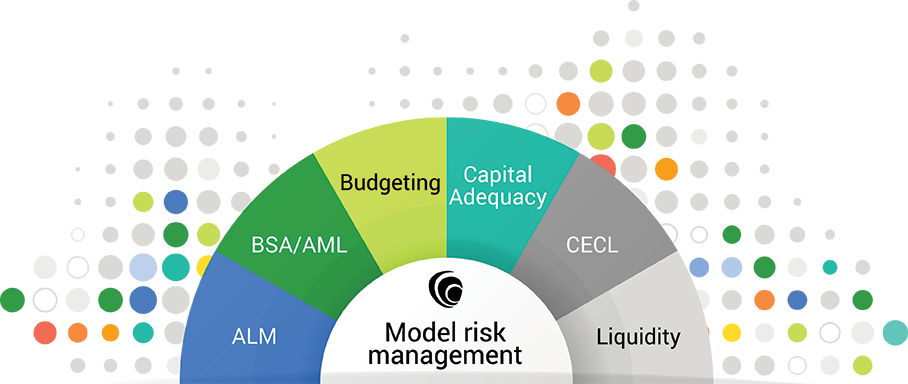

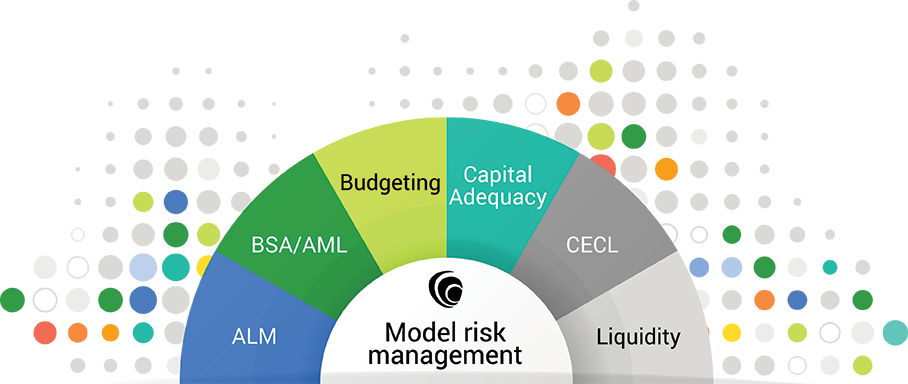

Financial institutions have long used models in their everyday activities to measure and manage risk – asset-liability management (ALM), Bank Secrecy Act/Anti-money laundering (BSA/AML), budgeting, capital adequacy, current expected credit losses (CECL), liquidity, and more. As the list and complexity of models, data assumptions and regulatory requirements continue to grow, so does the need for a flexible model risk management strategy that centralizes your data for consistent enterprise-wide reporting you can trust.

Data is one of a financial institution’s most valuable resources. Baker Tilly’s experienced team of professionals helps clients at every stage of model risk management and regulatory compliance. From framework development and model governance to model validation and model tuning, we prepare your data to be transformed into valuable insights that guide your most important business decisions.