Texas M&A update: Q1 2019

Baker Tilly Capital, LLC’s Texas M&A update provides a recap of middle-market transactions where the target is located in Texas. For purposes of this newsletter, the “middle market” is defined as majority-ownership transactions with enterprise values between $10 and $200 million.

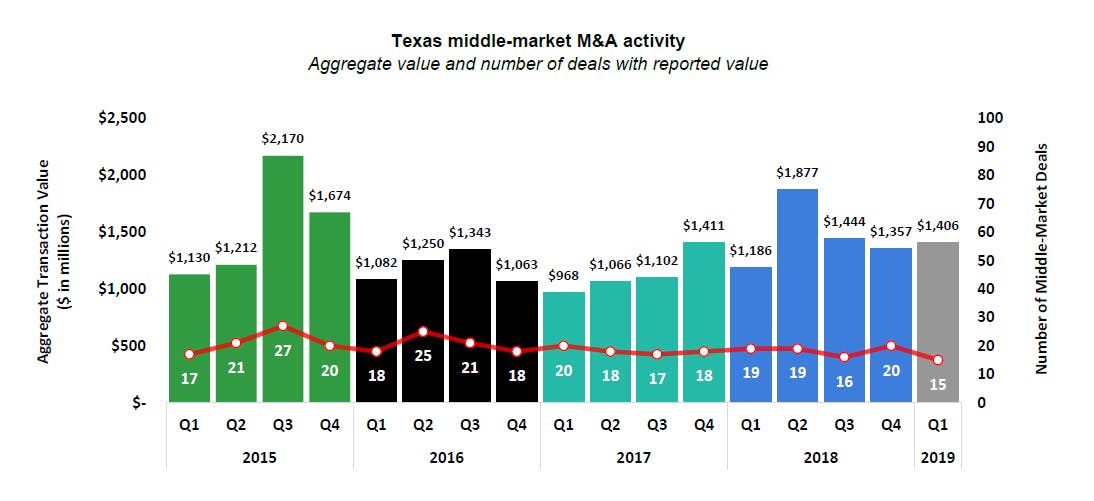

M&A activity in Texas declined to a five-year low in volume while staying relatively flat in value to start 2019. The first quarter (Q1 2019) had four less deals than the year prior (Q1 2018) and five less than the previous quarter (Q4 2018). Despite a decrease in transaction volume, aggregate transaction value in Q1 2019 was the highest first-quarter reading since 2014 when it was $3.05 billion. Aggregate transaction values for middle-market deals reported during Q1 2019 was $1.41 billion.

Source: Capital IQ and Baker Tilly Capital, LLC Insights