SEC votes to propose much-anticipated rule requiring climate disclosures

On Monday, March 21, 2022, the U.S. Securities and Exchange Commission (SEC) held an open meeting and voted to propose amendments to rules intended to enhance and standardize registrants’ climate-related disclosures for investors. While environmental, social and governance (ESG) has become part of our reporting and disclosure lexicon, it is important to clarify this proposal is focused on climate-related risks and disclosures. The SEC’s regulatory agenda includes separate projects on human capital management, including workforce diversity and corporate board diversity. [1]

Rulemaking background

SEC rulemaking on climate disclosure was expected and follows a host of related Commission actions, including a March 2021 request for public comment on climate change disclosures [2], public statements from Commissioners [3], and increasing attention to issuers’ disclosures from both the Division of Corporation Finance [4] and the Division of Enforcement [5], among other actions.

As climate issues have been a focus of the Biden administration, the SEC has also faced mounting pressure from members of Congress [6] to make meaningful progress on rulemaking. The SEC’s proposal was originally expected to be released by the end of 2021.

The vote and proposal

The vote was split 3-1 in favor of the proposal, which Chair Gensler described as providing “consistent, comparable, and decision-useful information” for investment and voting decisions [7]. Commissioner Peirce expressed the dissenting view, citing concerns about the scope of the SEC’s authority, reliability of the information, costs to comply, and other concerns [8].

The proposal is 510 pages long and open to a public comment period, after which time the Commission will analyze comments and meet again to vote on a final rule [9].

Proposal highlights

The following is a brief summary of key aspects of the rule. Baker Tilly’s ESG team is analyzing the proposal and we will publish further alerts in this series with more detail.

Reporting framework

The proposal is modeled in part on the recommendations of the task force on Climate-Related Financial Disclosure (TCFD), as TCFD recommendations have been incorporated into several existing voluntary disclosure frameworks, including the newly-released prototype the International Financial Reporting Standards (IFRS) Foundation provided to the International Sustainability Standards Board (ISSB) as a potential starting point for its standard setting initiative [10].

For quantitative disclosures of greenhouse gas (GHG) emissions, the proposal utilizes the framework of the Greenhouse Gas Protocol, which is broadly utilized and also incorporated into existing frameworks. The GHG Protocol’s Corporate Accounting and Reporting Standard provides uniform methods to measure and report greenhouse gasses, and its concept of “scopes” are critical to understanding the requirements of the SEC’s proposal:

- Scope 1 emissions – direct GHG emissions that occur from sources owned or controlled by the reporting entity (e.g. company owned or controlled machinery or vehicles)

- Scope 2 emissions – indirect emissions primarily resulting from purchased energy consumed by the reporting entity

- Scope 3 emissions – all other indirect emissions not accounted for in Scope 2; these are a consequence of the entity’s activities but are generated from sources that are neither owned nor controlled by the reporting entity, such as upstream emissions from the entire supply chain and downstream emissions from the use of a company’s products or services by customers and subsequent end users

Disclosure requirements

The proposal adds disclosure requirements under both Regulation S-K and Regulation S-X, which will require new sections of the registration statement or annual report and a new footnote in the audited financial statements.

By virtue of inclusion in the financial statements, the Regulation S-X disclosures would be subject to audit and within the scope of the registrant’s internal control over financial reporting (ICFR).

The details of the disclosure requirements are extensive, and registrants will be required to disclose a host of both qualitative and quantitative climate information, summarized as follows:

Disclosures of climate-related risks

- How management and the board of directors oversee risks

- How such risks have had or are likely to have a material impact on the business or financial statements over the short-, medium-, or long-term

- How any identified risks have affected or are likely to affect strategy, business model, and outlook

- The process for identifying, assessing, and managing risks and whether such processes are integrated into the registrant’s overall risk management system or processes

- If the registrant has a transition plan to reduce climate-related risks, a description of the plan and relevant metrics and targets used to identify and manage any physical and transition risks

Disclosures of events, GHG emissions and plans

- The impact of climate-related events (e.g. severe weather events or other physical risk identified) on the line items of the consolidated financial statements and related expenditures, as well as financial estimates and assumptions impacted by such events and transition activities

- Scope 1 and 2 GHG emissions metrics

– disclosed both disaggregated by constituent GHG categories and in aggregate

– in absolute terms, not including offsets, and in terms of intensity (per unit of economic value or production) - Scope 3 GHG emissions, if material [11], or if the registrant has set a GHG emissions reduction target or goal that includes Scope 3

– Notes: Scope 3 emissions disclosures are subject to a safe harbor provision in the proposal. Additionally, Smaller Reporting Companies are exempt from this requirement. - Climate-related targets or goals and transition plan, if the registrant has publicly disclosed such targets or goals; explicitly requires information about:

– The scope of activities and emissions included

– The time horizon by which the target is intended to be achieved, and any interim targets

– How the registrant intends to meet the targets, data relevant to measuring progress, and updates each fiscal year

– The extent to which carbon offsets or renewable energy certificates are used as part of the plan to achieve the identified targets

Attestation requirements

For accelerated and large accelerated filers, the proposal requires attestation of Scope 1 and Scope 2 emissions disclosures. The attestation engagement and reporting requirements are modeled after AICPA Statements on Standards for Attestation Engagements, but the rule does not specify a particular framework, in part because the attestation provider is not required to be a CPA. Accordingly, the proposal also requires registrants to disclose information about the attestation provider to help investors better evaluate the reliability of the attestation results. These additional disclosures include the provider’s qualifications, professional license or accreditation, and oversight programs. Regardless of whether the attestation provider is a CPA, independence is required.

Finally, the attestation requirement is also subject to a phase-in for the level of assurance required by the attestation report, which is addressed in the following section. First, it is important to understand the distinction between limited and reasonable assurance. Here again, the proposal utilizes definitions similar to those in AICPA professional standards, but we have quoted the proposal for clarity:

For a limited assurance engagement, under prevailing attestation standards, the conclusion would typically state whether the provider is aware of any material modifications that should be made to the subject matter in order for the disclosure to be in accordance with (or based on) the requirements specified in Item 1504, or for the registrant’s assertion about such subject matter to be fairly stated.

For a reasonable assurance engagement, the attestation provider would typically provide an opinion on whether the subject matter is in accordance with (or based on) the requirements specified in Item 1504 in all material respects, or that the registrant’s assertion about its subject matter is fairly stated, in all material respects.

In short, limited assurance is akin to an interim review of a registrant’s financial statements in Form 10-Q, while reasonable assurance is akin to an audit of a registrant’s financial statements and/or ICFR in Form 10-K.

Effective dates and phase-in periods

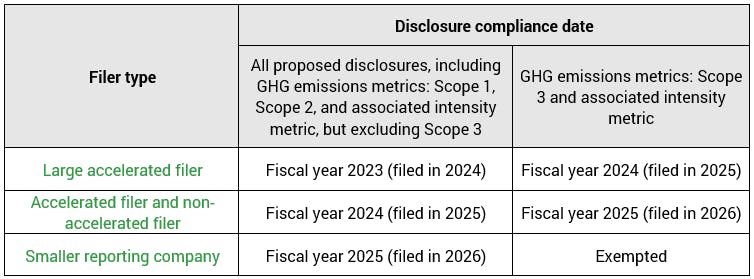

All requirements of the proposal will be phased in, with the effective dates dependent on the registrant’s filer status.

The proposal provides illustrative tables assuming the proposed rules will be adopted with an effective date in December 2022 and the registrant has a December 31 fiscal year end, as follows:

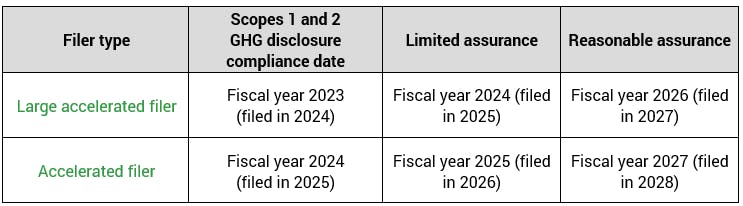

For attestation requirements of accelerated and large accelerated filers, the following table summarizes the progression from initial compliance with disclosure requirements to obtaining limited assurance and ultimately to reasonable assurance over the Scope 1 and 2 GHG disclosures.

Regarding the initial transition and the historical periods for which the disclosures are required, the proposal states the following:

…we have proposed requiring a registrant to provide its GHG emissions data for the same number of years as it is required to provide data on its income and cash flow statement, to the extent such emissions data is reasonably available.

It goes on to state:

A registrant, however, would not otherwise be required to provide a corresponding GHG emissions metric for a fiscal year preceding its current reporting fiscal year if, for example, it was not required to and has not previously presented such metric for such fiscal year and the historical information necessary to calculate or estimate such metric is not reasonably available to the registrant without unreasonable effort or expense.

Given the attention likely to be paid to compliance with initial disclosure requirements and the transitions some registrants have between filer classifications, careful planning and consultation with securities counsel are advised to ensure compliance.

Resistance expected

Despite growing demand for clearer disclosure rules, voluntary disclosures by many of the largest U.S. public companies, and significant progress in the consolidation of reporting frameworks and standard setting bodies, the proposal is likely to encounter resistance, particularly on the topic of whether certain disclosures required by the proposal can be viewed as “material” to investors in the context of current federal securities laws, and thus subject to disclosure [12]. Each of the Commissioners welcomed further public comment from stakeholders, and the volume of comment letters is expected to be significant.

Next steps

As the ESG landscape evolves, it will be important for registrants to engage with stakeholders to understand their needs, while ensuring ESG risks and metrics are aligned with and tailored to corporate strategy and operations. Understanding all points of view will be critical to assessing materiality, particularly for qualitative risks and disclosures.

With the likely transition to mandatory disclosure in registration statements and Form 10-K, registrants should also ensure that ESG reporting personnel are not “siloed” in the organization. Boards of directors, audit committees, internal audit, finance, and legal teams all play a crucial role in the reporting supply chain, as entities will need to design adequate processes and controls over the preparation and disclosure of the relevant information, and these groups are best positioned to use existing frameworks to ensure the quality and reliability of climate or other ESG disclosures. One specific example of a need for cross-functional coordination relates to the setting and disclosure of boundaries for Scope 1, 2, and 3 emissions. These determinations can be complex, and the SEC’s proposal blends GHG Protocol concepts with U.S. GAAP guidance.

We encourage all clients and stakeholders to review the proposal and engage with the SEC via the comment letter process. Look for more from Baker Tilly’s ESG team soon and if you have any questions, please contact us.

Resources

[1] On June 11, 2021, the SEC issued a press release announcing the annual regulatory agenda

[2] On March 15, 2021, public input was requested from investors, registrants and other market participants on climate change disclosure. Read the statement from Acting Chair Allison Herren Lee.

[3] See, e.g., Chair Gensler’s July 28, 2021 speech.

[4] On Sept. 22, 2021, the Division of Corporation Finance reinforced expectations regarding existing disclosure guidance (Feb. 8, 2010 release) and provided a sample comment letter.

[5] On March 4, 2021, the Commission created a Climate and ESG Task Force in the Division of Enforcement, the scope of which included both issuers’ disclosure and compliance by investment advisers and funds. Read the press release.

[6] See, e.g., letter from Senator Warren to Chair Gensler, Feb. 9, 2022.

[7] On March 21, 2022, Chair Gary Gensler issued a statement on proposed mandatory climate risk disclosures.

[8] In response to Chari Gary Gensler's statement [7], Commissioner Hester M. Pierce responded with a statement, "We are Not the Securities and Environment Commission – At Least Not Yet"

[9] A press release on March 21, 2022, stating the SEC was proposing rules to enhance and standardize climate-related disclosures for investors.

[10] On Nov. 3, 2021 at COP26, the IFRS Foundation announced the creation of the International ISSB. The ISSB will consolidate several existing bodies, including the Value Reporting Foundation (VRF houses the Integrated Reporting Framework and the Sustainability Accounting Standards Board) and the Climate Disclosure Standards Board. This consolidation is expected to occur by June 2022. Read the announcement.

[11] The proposal includes guidance for assessing materiality for Scope 3 disclosures. This is an area requiring careful examination by registrants, as it should not be a purely quantitative assessment, and many entities will likely conclude Scope 3 emissions are indeed material.

[12] Several state attorneys general and U.S. senators have previously challenged the SEC’s statutory authority to require climate disclosures. See Climate Change Disclosures and Public Input on Climate Change Disclosures.

Other resources

Fact sheet: Enhancement and Standardization of Climate-Related Disclosures

Proposed rule: The Enhancement and Standardization of Climate-Related Disclosures for Investors