What to know about real estate tokenization

Some people just prefer the traditional, the tangible. They like the feel of cash in their pocket, not a debit card. The steering wheel of a car, not an Uber account. Or the painting on the wall, not an NFT.

If that’s you, tokens may not be your thing. But for everyone else, the prospect and benefits of tokenizing real estate is intriguing.

What is tokenization?

Tokenization is the process through which an ownership interest in a real estate asset(s) is represented in the form of a blockchain-based token.

It is an example of the growing use of fintech (financial technology) to provide for the democratization of assets among a larger pool of potential investors, as well as elimination of the traditional gatekeepers.

A token for real estate is the equivalent of an NFT for a work of art. However, while an NFT represents a nonfungible token (a specific unique identifier), real estate tokens can be considered fungible tokens. One real estate investment may be represented by 1,000 or more tokens, each representing a fraction of the overall investment.

The token can represent a variety of different real estate investments — from a portion of a real estate deed to an equity interest in a legal entity (such as an LLC) or ownership of collateralized debt.

Lifecycle of a real estate token

Tokenizing real estate generally consists of the following.

Creating the legal documentation

The legal documents for tokenized real estate are similar to the documentation required for a traditional real estate investment. However, various disclosures and provisions must be adapted to reflect the tokenization.

Minting the token

Minting refers to the process of creating the token, which includes confirming the information and creating a new block containing that information on the blockchain.

The resulting real estate token is a digital form of proof of ownership. It also manages transferability.

Programming the token

Through smart contracts (computer code that automatically implements and enforces agreements), tokens can be programmed to make rent distributions to token holders, They can also be programmed to enforce compliance requirements, such as one year lock-up periods.

Making the capital contribution

In exchange for tokens, investors contribute capital to the real estate venture using traditional methods such as wire transfers or, alternatively, via cryptocurrency. The tokens represent the investors’ shares in the venture.

Trading and collateralizing

Investors can generally trade tokens on secondary markets, as long as they comply with any applicable regulatory requirements. They can also be used as collateral.

Distributing returns on the investment

The underlying real estate venture has a variety of methods at its disposal to distribute returns to investors. Among them are payments using dollars, cryptocurrency and wire transfers.

Advantages of tokenized real estate

Tokenized real estate investments provide investors with a number of key advantages.

Tokens are more liquid than the underlying real estate assets and offer the option of fractionalized shares.

Real estate owners and funds have more efficient access to capital and new pools of investors.

The nature of blockchain provides transparency and traceability of transactions and proof of ownership. Along with smart contracts, it also standardizes processes and enhances administrative efficiency.

Risks of tokenized real estate

The general risks of owning any real estate asset also apply to owning tokenized real estate, such as prolonged tenant vacancies and eviction issues, market fluctuation, and repair and maintenance costs.

Other risks include the opportunity for fraud, the competence and business acumen of the issuer and those inherent in any new technology.

Given the new and evolving nature of tokenized real estate, the risks also include various areas of uncertainty, such as future regulation.

The regulatory environment

Absent more specific guidance from the SEC, real estate tokens are generally treated as securities subject to registration with the SEC. There are, however, exemptions, including those listed below.

Because of the complexity and evolving nature of real estate tokenization, it’s important to consult with an experienced securities attorney before proceeding.

506(c) under Regulation D

Investors are restricted to accredited investors that meet income or net worth requirements.

- Annual income must exceed $200,000 ($300,000 for married) for the previous two years, including a reasonable expectation of the same for the current year.

- Net worth must exceed $1 million (single or married) without considering the value or debt of the primary home, as long as the mortgage is less than the home value.

There is no requirement for a prospectus and no restriction on advertising.

There are no financial reporting requirements. However, the SEC requires Form D 15 days after the initial sale is made.

There are no limits on the amount of funds that can be raised.

Investors are generally restricted from transferring their interests for one year.

Regulation S

According to Rule 901 there are no registration requirements for offers and sales outside the United States.

Rule 903 provides a safe harbor. The offer and sale is deemed to occur outside the United States if made via an offshore transaction and there is no effort made to sell in the United States. There are additional requirements outlined in 903(b).

Taxation of tokenized real estate

As noted, a real estate token can represent a variety of different investments. The following assumes a tokenized interest of an equity interest in a legal entity structured as an LLC (generally taxed as a partnership).

Typically, each tokenized investment offering is a separate LLC interest, with the LLC acquiring one or more real estate assets.

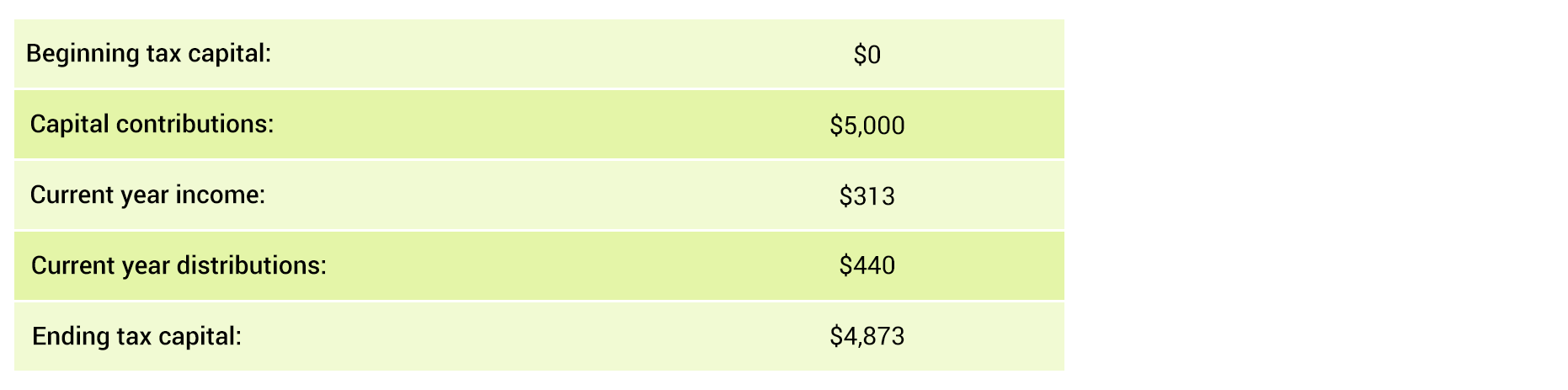

As an investor, your ownership in the LLC is based on your initial cost per token multiplied by the number of tokens you own, then divided by the total cost of all tokens minted for the investment.

For example, an LLC that acquires a $500,000 house may mint 10,000 tokens at an original issuance cost of $50 per token. If you acquire 100 tokens, you own one percent of the LLC and have a capital contribution and cost basis of $5,000.

The underlying real estate held by the LLC is taxed according to the general rules for taxing real estate. The cost basis of the underlying real property owned by the LLC includes an allocation of land and an allocation of building/improvements. The land is not depreciable. However, for residential real estate, the cost of the home can be depreciated over 27.5 years.

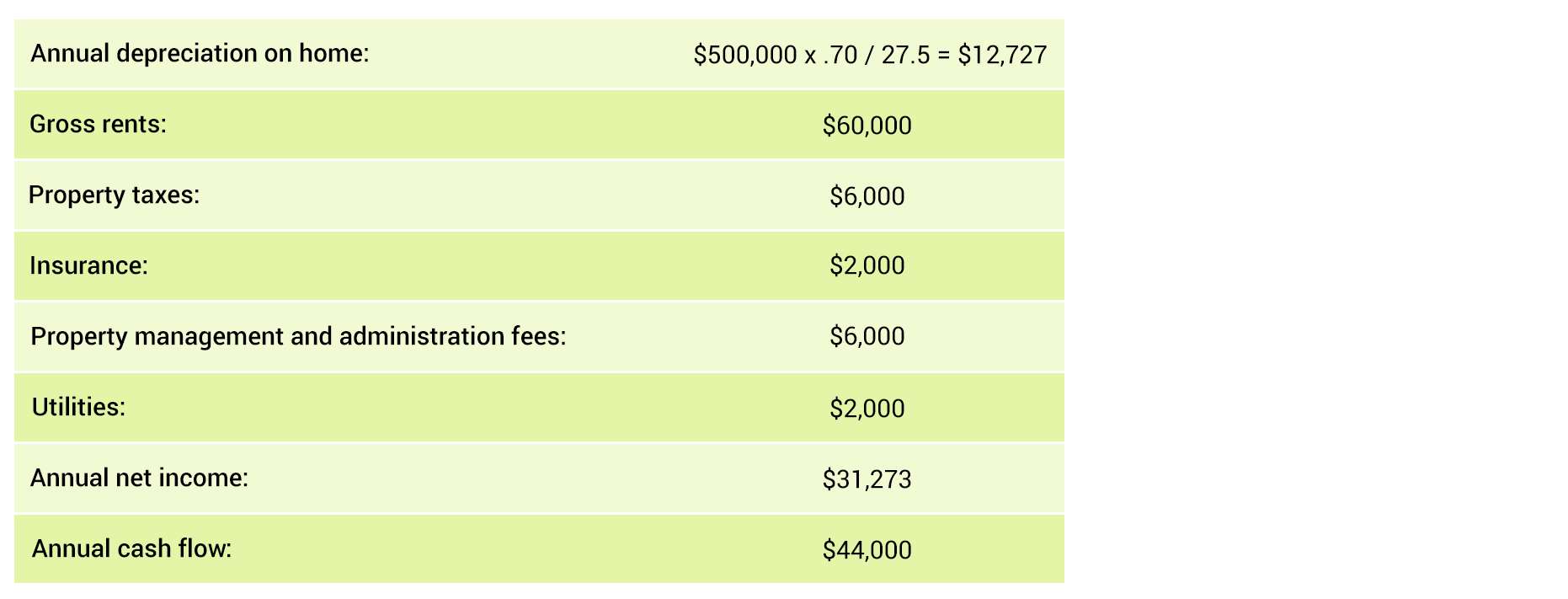

The net rental income allocated to each member of the LLC is generally equal to the rents received from the tenant(s), less operating costs (e.g. real estate property taxes, maintenance, insurance, property management fees, utilities), less depreciation on the home, all then multiplied by the LLC member’s ownership percentage.

Example 1

$500,000 tokenized LLC

Home acquired for $500,000 (land value 30%, house value 70%)

Assuming each dollar of net rental income is distributed each year, you (as a one percent owner) are allocated $440 of distributions and $313 of rent income.

Tax reporting for LLC investments is done via Schedule K-1. You receive a K-1 for each individual tokenized investment, reflecting the following based on the above example:

Example 2

Sale of a tokenized interest

Traditional real estate investments are generally considered long-term investments. That’s due, in part, to the high costs to sell the underlying property or to find another investor to acquire the LLC interest.

The emergence of liquid secondary markets for tokenized assets has the potential to see owners and investors buy and sell more frequently.

Holding period

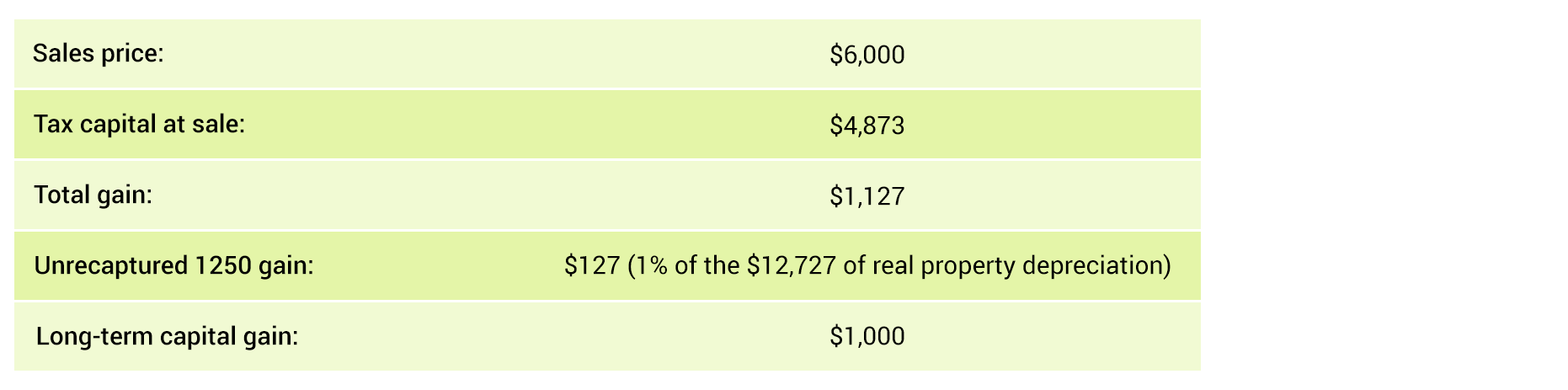

The tax consequences of selling a partnership interest depend on your holding period.

If you held the interest for more than one year, it is generally considered a long-term capital gain. An interest held less than one year results in a short-term capital gain.

Unrecaptured 1250 gain

The sale of a real estate partnership interest typically includes an allocation of unrecaptured 1250 gain based on the partner’s share of depreciation taken on real property.

Unrecaptured 1250 gain is taxed at a 25 percent rate, excluding any applicable net investment income tax.

Calculating gain

The gain on the sale of the partnership interest is equal to the sales price on the secondary market less the partner’s tax basis. Contrary to a typical stock or cryptocurrency investment, the partner’s tax basis fluctuates each year based on the activity of the partnership. It increases by allocations of income and decreases by distributions received.

Example

Based on numbers from previous example:

Tokenized LLC interest acquired Jan. 1, 2020 and sold Jan. 2, 2021

Additional tax complications

IRS Schedule K-1

If you’re not already familiar with the tax reporting for partnership or other pass-through investments, Schedule K-1 can be a bigger burden than the Form 1099 used to report traditional stock or bond investments.

Each K-1 includes separate tax compliance considerations and can complicate tax reporting in a hurry if investors decide to day trade an investment type (real estate) that has traditionally been illiquid.

For tokenized real estate platforms — an investment opportunity that democratizes investing and lowers the barrier of entry — may also result in a substantially larger investor pool than traditional real estate investing, with the number of participants in each LLC potentially exceeding 100 investors.

With a worldwide investor pool, foreign investors may also carry additional compliance burdens, such as withholding on income and on the sale of the LLC interest.

State tax

The state each property is located in may carry additional compliance requirements for the LLC and its investors.

While Washington does not have an income tax, the majority of states do impose a separate state income tax, generally resulting in the issuance of a state K-1 to each investor and potential state withholding requirements to navigate.

Real estate tokenization is an extremely new and rapidly developing ownership option, with the potential to upend the industry. Questions remain, including navigating an uncertain and complicated regulatory environment.