Healthcare M&A update: H1 2021

2021 healthcare M&A off to a strong start

M&A activity trended up in H1 2021 from H2 2020.

After the COVID-19 pandemic sent healthcare provider stocks plummeting in H1 2020, all five sectors rebounded in the back half of 2020 and first six months of 2021. For the 12 months ending June 30, 2021, long-term care and acute care were up 153% and 149%, respectively, as the market priced in a backup of demand for routine healthcare services and elective services, and an aging population felt more comfortable returning to long-term care facilities.

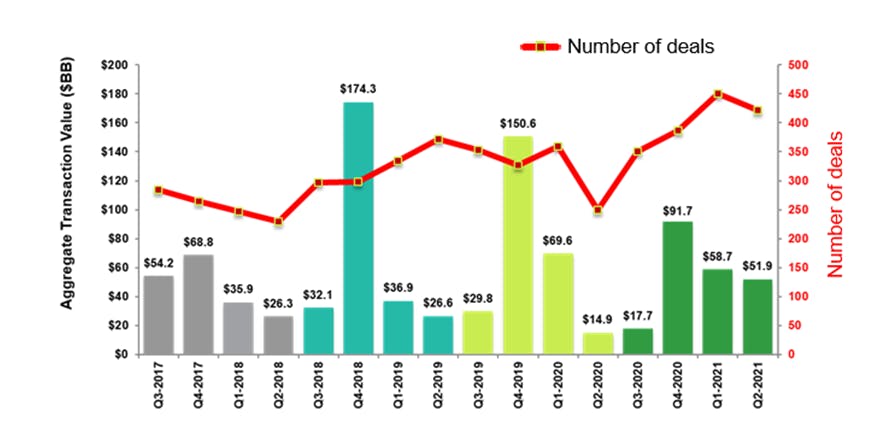

There were 872 reported M&A transactions that closed during H1 2021, up from the 738 transactions during H2 2020. Reported closed transactions in H1 2021 increased 43% compared to 608 closed deals for the same period in 2020.

The aggregate deal value of the closed M&A transactions with reported values was $110.6 billion during H1 2021. This was a slight increase from the total reported deal value of $109.4 billion in H2 2020, as many of the announced deals had smaller transaction values or transaction values that were not publicly reported. The largest acquisition in the first half of 2021 was Siemens’ acquisition of Varian Medical Systems for $17.2 billion.

Quarterly U.S. healthcare M&A activity for transactions closed, aggregate transaction value and number of deals

Source: S&P Capital IQ

The growth of behavioral health

The pandemic has had both short and long-term implications for mental health.

A few factors have led to significant growth in the space over the last 15 months:

- Mental health impact of disasters outlasts the physical impact, suggesting today’s elevated mental health needs will continue beyond the coronavirus outbreak itself

- Psychological distress can last up to three years

- Due to the financial crisis accompanying the pandemic, there are also implications for mortality due to “deaths of despair”

With strong industry tailwinds, it is no surprise behavioral health is proving to be one of the hottest sectors for deals, such as:

- LifeStance Health raised $720 million in its initial public offering in early June

- Online therapy app Talkspace plans to go public through a merger with a special-purpose acquisition company (SPAC), valuing Talkspace at $1.4 billion

- LifePoint Health entered into a definitive agreement to acquire Kindred Healthcare in late June

Get the pulse of the industry

Download your free copy of the healthcare M&A update: H1 2021 for more information on:

- Financial performance of various healthcare sectors

- COVID-19 effects on healthcare M&A in H1 2021

- Notable H1 2021 closed healthcare provider deals

- Challenges and growth opportunities in the behavioral health sector