Great Lakes regional M&A update: H1 2021

M&A activity in the Great Lakes region largely stagnant in 2021

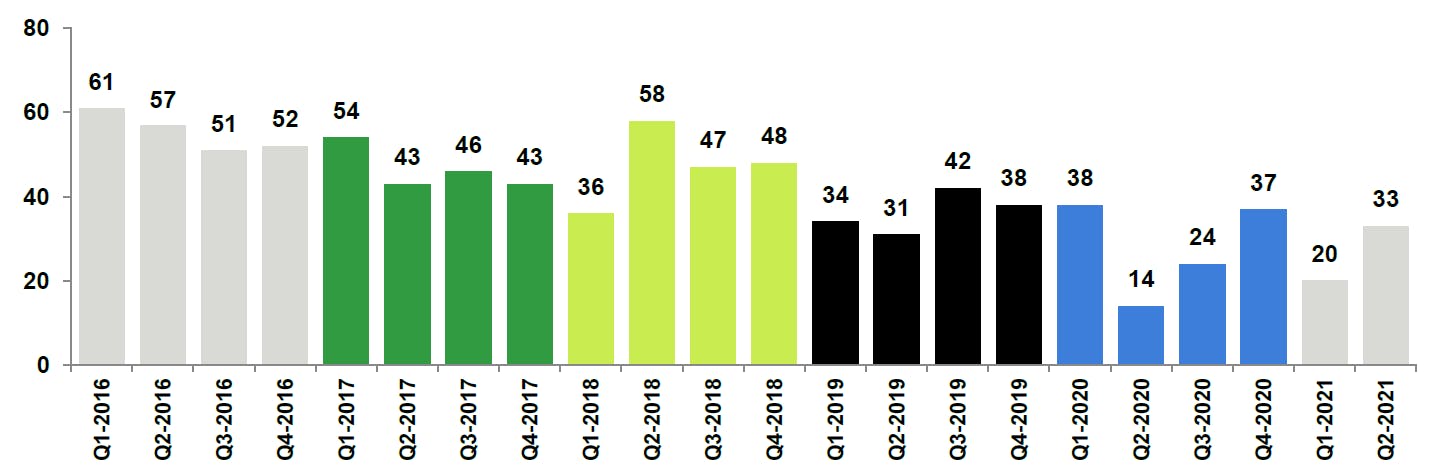

Due to the COVID-19 pandemic, middle market M&A activity in Great Lakes in the first and second quarters of 2021 was stagnant. The year started out on a strong decline from H2 2020, but transactions experienced a meaningful rebound in Q2 2021.

There were a total of 53 reported M&A transactions closed during H1 2021, slightly lower than the 61 closed transactions during H2 2020. The aggregate disclosed value of M&A transactions totaled $8.1 billion during H1 2021. This is an increase from the aggregate disclosed deal value of $7.5 billion in H2 2020 and a large increase from the aggregated disclosed deal value of $6.5 billion in H1 2020.

Great Lakes middle market M&A transactions / Number of closed transactions (1)

Source: S&P Capital IQ.

(1) Includes only transactions with disclosed enterprise value between $10 million and $1 billion.

Strategic buyers continue to drive M&A activity

Based on the number of closed transactions, strategic buyers continued to be the most active buyer type in the first and second quarters of 2021. During these quarters, strategic buyers represented 100% of closed transactions.

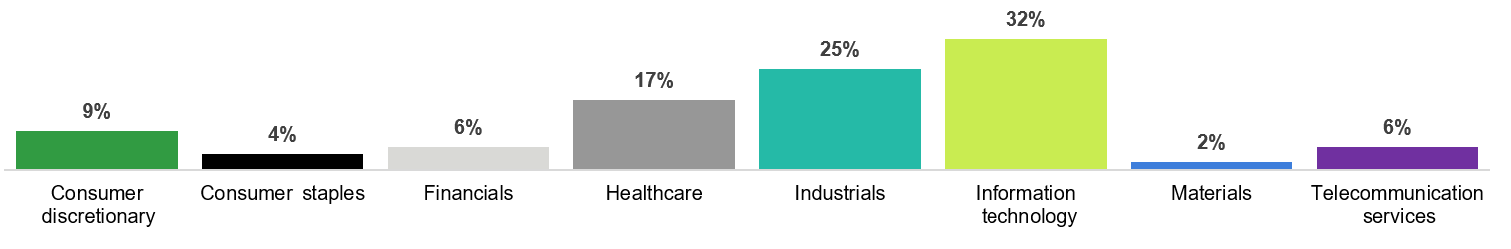

The information technology segment was the most active during the first half of 2021, accounting for 32% of M&A deals closed. The industrials and healthcare segments accounted for the second and third largest categories for the period with 25% and 17% of transaction volume, respectively.

H1 2021 Great Lakes middle market M&A transactions / Number of transactions by industry sector (1) (2)

Source: S&P Capital IQ

(1) Includes only transactions with disclosed enterprise value between $10 million and $1 billion.

(2) Percentages may not total 100% due to rounding.

Dig into our report

For an in-depth look at M&A activity in the Great Lakes region, download a free copy of the Great Lakes regional M&A update H1 2021. The report includes:

- Regional market activity

- M&A activity by market segment

- Transaction data for middle market M&A activity

- Buyers and targets by location

- Notable transactions closed during H1

More M&A H1 2021 reports

To view more on this topic or learn how Baker Tilly specialists can help, contact our team.