California regional M&A update: H1 2021

M&A activity in the California region accelerates steadily in 2021

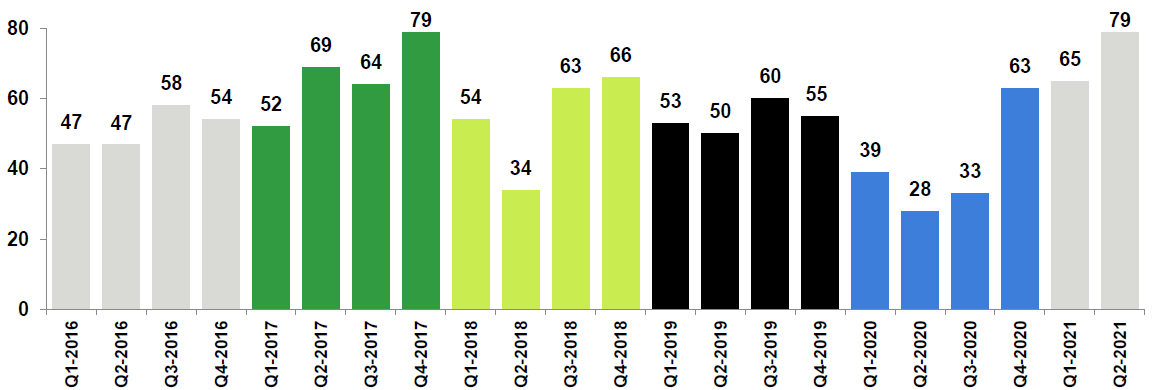

Up, up and away! M&A activity in California took off in the first half of 2021 as a result of corporations growing more comfortable in the new business environment caused by the continuing pandemic. While closed transactions only grew slightly from Q4 2020, the second quarter of H1 2021 experienced a meaningful increase.

- A total of 144 reported M&A transactions closed, up significantly from the 67 in H1 2020

- The aggregate disclosed value of M&A transactions totaled $32.4 billion during H1 2021

California middle market M&A transactions

Number of announced transactions (1)

Source: S&P Capital IQ

(1) Includes only transactions with disclosed enterprise value between $10 million and $1 billion.

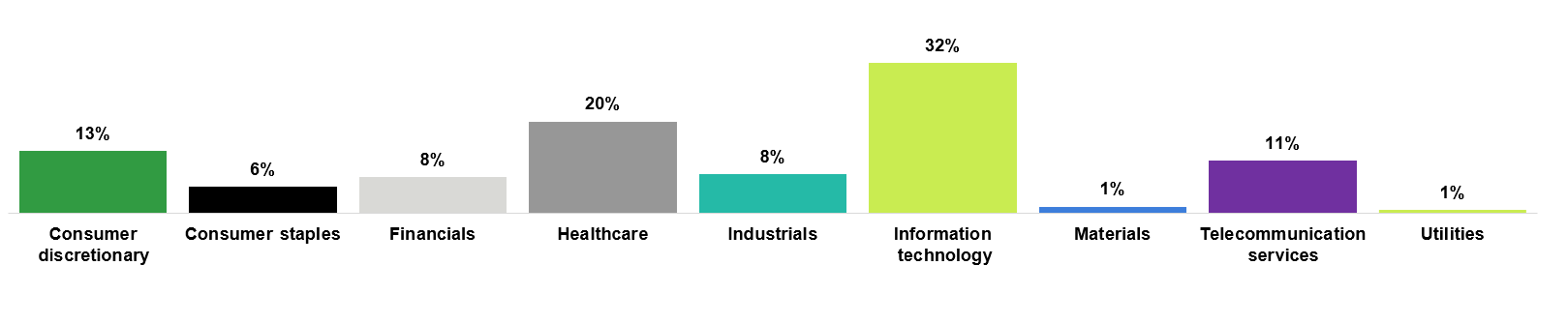

Technology sector drives M&A activity

Strategic buyers continued to be the most active buyer type in the first and second quarters of 2021 in the California region. During these quarters, strategic buyers represented 97% of closed transactions.

The information technology segment was the most active during the first half of 2021, accounting for 32% of M&A deals closed. The healthcare and consumer discretionary segments accounted for the second and third largest categories for the period with 20% and 13% of transaction volume, respectively.

H1 2021 California middle market M&A transactions

Number of transactions by industry sector (1) (2)

Source: S&P Capital IQ

(1) Includes only transactions with disclosed enterprise value between $10 million and $1 billion.

(2) Percentages may not total 100% due to rounding.