Data, analytics and the difficulty in determining a direct return on investment

With 92% of CFOs indicating that they plan to increase investment in information technology, organizations have begun investing in their data and analytics initiatives to aid in informed decision making as they strive to increase profits, save time and tailor their offerings to the right customers.

When investing in these initiatives, organizations often first look towards technology implementation, such as building a data warehouse or analytics dashboard. However, issues arise when stakeholders struggle to conceptualize the value of data as an asset and only focus on its direct return on investment (ROI).

Consider a manufacturing company investing in a new piece of machinery to increase their daily production. The cost of investing in the machinery can be easily evaluated against the increase in profits that will come as a result of increased daily production, resulting in a tangible ROI. But with data and analytics initiatives, the cost of a technology implementation is difficult to directly evaluate against the intangible benefits of having access to accurate, up-to-date data, as there is no direct way to correlate the implementation to a direct increase in profits.

For many organizations, this lack of a direct, tangible ROI continues to lead stakeholders away from investing in data and analytics initiatives, even though they may still desire the information it can provide into their key markets. Therefore, it’s important to understand how leveraging data and analytics initiatives as an asset can provide value to your business and allow you to continue competing effectively in your respective industry.

Data as a value-added asset

When investing in data and analytics initiatives, it’s important to view your data as an asset that creates value in multiple areas of your organization and not as an initial spend that will correlate to a direct monetary ROI. The value of these initiatives is found in having access to accurate, up-to-date information to allow your organization to make quicker, more informed business decisions.

Take cybersecurity initiatives as an example, companies invest in cybersecurity to protect their business assets even though they can’t correlate a direct ROI. The investment still adds business value through its ability to negate problems that could have potentially arose had you not invested in prior security. Similarly, data and analytics initiatives protect your business from potential future harm by creating insight into opportunities that allow your business to continue competing in your industry.

The more you get to know your customers, the more you can improve how you sell to them. And with better visibility into the trends in your key markets, you can also make decisions faster, decreasing the time needed to respond to customers or issues, allowing you to act quicker in the market and therefore compete more efficiently in your industry. For example, if you have data and analytics initiatives in place and begin to see a cost increase across your suppliers, you’ll be able to respond more quickly because you had better visibility into that area of your organization. You had to first invest in data and analytics initiatives before you saw the return from that investment through the visibility needed to negate this potential issue.

So, while it can be difficult to determine a direct ROI on your data and analytics initiatives, there is clear value in having access to these capabilities. To understand where this value is coming from, the following process outlined below guides the prioritization of implementation, concluding with visibility into which aspects of your data and analytics initiatives will provide the highest value to your business.

Understanding the value message

In order to understand the business added value data and analytics initiatives provide, you first need to understand your organizational priorities. The two main sets of organizational priorities to consider are those specific to your strategy and those that are critical to your organization’s overall mission.

1. Strategic priorities

Strategic priorities are the specific objectives your organization is planning to accomplish over a designated period of time. You can begin to develop a clear view of your organization’s strategic priorities by considering the following questions:

- Are we looking to improve our revenue?

- Are we trying to reduce our selling, general and administrative (SG&A) expenses?

- Are we hoping to capture a new market share?

2. Mission-critical priorities

Mission-critical priorities are those whose disruption would cause an entire operation to grind to a halt making them indispensable to continuing operations. They are often those most critical to the financial mission of your organization. You can begin to develop a clear view of your organization’s mission-critical priorities by considering the following questions:

- What is our direct cost of materials?

- What is the business impact of our pricing structure?

Once you have a clear outline of your organization’s strategic and mission-critical priorities, you can begin to align your data and analytic initiatives to them.

Assessing the business added value

Aligning your data and analytics initiatives to your organizational priorities will allow you to assess the value data capabilities will provide your organization. This will allow you to understand in a somewhat quantifiable way where the business value is found when investing in data and analytics initiatives. There are five business impact dimensions to consider when assessing value:

1. Weighted number of anticipated users

Consider the number of users you anticipate utilizing access to the information provided by your data and analytics initiatives. This number should be weighted to capture the assumption that some of your users may have more impact on the success of the business than others. If you have a high number of users utilizing access to the information and they have a significant impact on the success of your business, then your data and analytics initiatives will provide more value to your business.

2. Existing alternatives

Consider the availability of current infrastructure to report on a specific key performance indicator (KPI) at the necessary dimensional view. If the intersection of the KPI reported on and the optimal dimensional view is stored by your source system then you can quickly access accurate, up-to-date data with your current infrastructure, increasing your business value.

3. Achievement

Consider whether decisions made based on the information obtained from your data and analytics initiatives can positively impact your revenue or cut your costs. If your business users can make better decisions based on increased access to information, then your data and analytics initiatives increase your business value.

4. Strategic significance and organizational alignment

Consider whether the information obtained from your data and analytics initiatives provide a strategic advantage and align with your organizational priorities. If your data and analytics initiatives are directly related to the strategic health of your business and align directly with your organizational initiatives, then they provide increased business value.

5. Frequency of use

Consider how frequently the information obtained from your data and analytics initiatives is used for every day decision making throughout your organization. How often are people leveraging this information to make decisions? If the information is used in every day decision making and is directly aligned with your core sales processes, then it will have more impact on your daily processes and increase business value.

The value of data as an asset to your organization is found in how well your initiatives align with the five business impact dimensions listed above. The more your data and analytics initiatives align with these dimensions, the more data is being utilized to effectively run your business. And the more data is being utilized, the more business value is produced as the outcome of previously investing in these initiatives.

Once you align your initiatives with your organizational priorities, you can begin assigning a quantitative value to your data and analytics initiatives. From there, you want to consider any capability gaps your organization might have in implementing and running a data and analytics platform.

Assessing the technical feasibility

While it’s great to look holistically at a data and analytics initiatives as something that has a significant amount of business value, if your organization doesn’t have the capability to physically implement and run the platform tools, then these gaps will need to be addressed before you can begin to move forward. There are five dimensions to consider when assessing technical feasibility:

1. Data availability

How available is the data at your required level of detail? High technical feasibility would require your data to be readily available at your specified necessary level of detail.

2. Extract, transform, load (ETL) complexity

What level of effort is required to transform data from its source into a format useable for analysis? High technical feasibility would require little to no transformation.

3. Volume, velocity, variety

What level of architectural complexity is associated with building and maintaining your analytical capability? High technical feasibility would require having a low volume, velocity and variety.

4. Maintenance and support

What amount of manual work is required to maintain the data? High technical feasibility would require low manual maintenance and support to maintain the data.

5. Data quality

How much management is required to maintain high data quality standards? High technical feasibility would require little to no quality management to produce accurate and complete data.

Opportunity Matrix

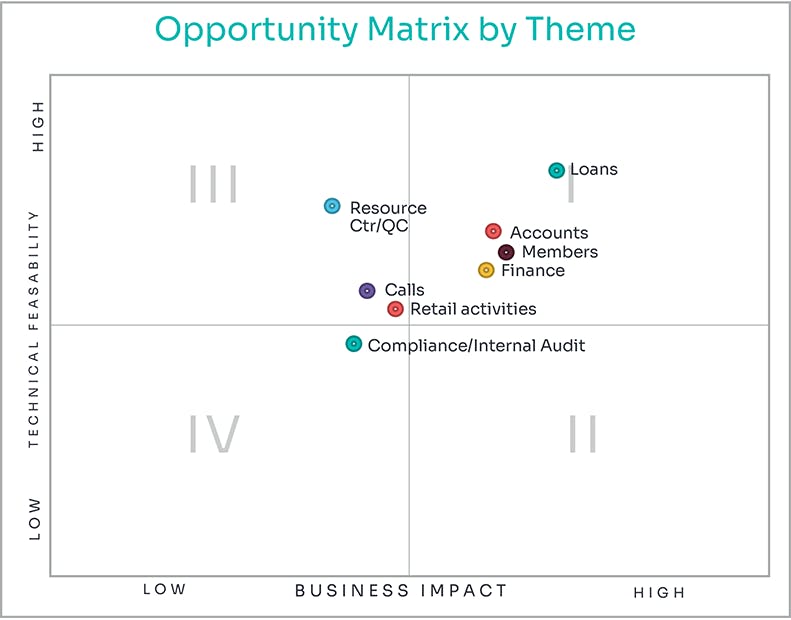

After assessing the business value and technical feasibility of your data and analytics initiatives, you can group related metrics into analytic themes to determine the overall business value and technical feasibility of incorporating them into a modern data platform. These themes are then plotted onto an opportunity matrix to identify initiatives that should be addressed before others when time and budget constraints are present. This works to maximize your business value while minimizing technical effort and investment.

The following graphic is an example of how analytic themes are plotted in the matrix. It is recommended that data and analytics initiatives that fall in Quadrant I be prioritized as they will provide the highest value to your organization with a relatively easy implementation.

Therefore, once you have completed your opportunity matrix, you will have a clear view of which data and analytics initiatives will provide your organization with the most business value without requiring massive amounts of technical overhaul. Through aligning your initiatives to your organizational priorities and plotting related metrics on an opportunity matrix are you able to visualize the value of data as an asset to your organization.

While an opportunity matrix doesn’t provide stakeholders with a direct ROI for your data and analytics initiatives, it does provide insight into the indirect added value to your business by having access to accurate, up-to-date data and how these initiatives can become integral tools to help your organization continue competing effectively in your industry.

Where do you go from here?

The process outlined above details a key component of what should be a larger data strategy plan constructed by your organization’s chief data and analytics officers (CDAOs). For many companies, determining what data can be used to generate revenue and creating actionable insights can be a challenge. To help alleviate some of these challenges, organizations can benefit from an outsourced CDAO.

Baker Tilly's digital team can assist your organization with data and analytics tool selection, implementation, maintenance and analysis. Our data strategy expertise can help your organization drive transformation beyond analytics, elevating data driven decision-making that propel you ahead of competitors. To learn more about how we can help your organization understand the business added value of implementing data and analytics initiatives, contact us today.

This article was derived from the Data as an asset webinar, watch the full recording below.