The new Raytheon case: mental gymnastics defining “work” and policy “bright-lines"

By now, you have probably heard about the recent and now infamous Raytheon case: the United States Court of Appeals for the Federal Circuit Case No. 2021-2304, Secretary of Defense V. Raytheon Company, Raytheon Missile Systems 21-2304.OPINION.1-3-2023_2056385.pdf (uscourts.gov). If you are unfamiliar with this case, consider this your introduction to the maelstrom. This case has kicked off the new year with a bang—or at least a gavel strike—and stirred many in our industry to ask about the case, its challenges and the subsequent fallout in two key ways.

Time worked and recording it

When it comes to timekeeping, total time accounting—or ensuring all hours worked are recorded—is the preferred standard amongst government auditors and reviewers; but it is not always right for every company and has yet to become a regulatory requirement. However, the court’s decision in this case certainly advances the ball in making the case for total time accounting.

Other methods of timekeeping (e.g., proration, by exception, and others) ultimately hinge on achieving the same result: what work effort was compensated and how does it align it to the corresponding activities? Or more technically, how can contractors ensure all costs, such as compensation for time worked, are proportionally spread across all benefitting cost objectives, including segregation of allowable and unallowable activities. Generally speaking, anything other than total time accounting can introduce additional risk to a timekeeping system, magnifying the importance of how contractors define “work” and what they require of employees with respect to time entry.

The case

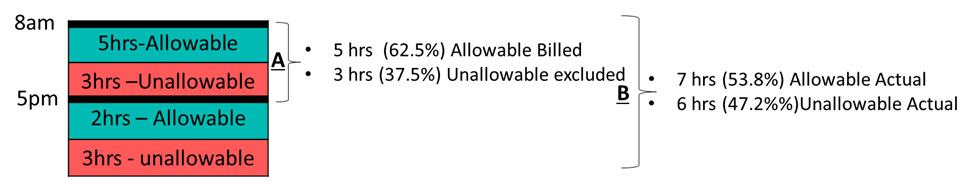

Raytheon’s Government Relations department and Corporate Development department policies instructed employees to record compensated time spent on unallowable activities while simultaneously stating that they need not report time spent on unallowable activities outside of their scheduled workday. The theoretical example in Figure 1 below illustrates what Raytheon recorded and billed (A) against what the courts determined the split of allowable and unallowable time should be (B).

Figure 1.

The court found that Raytheon’s practices caused the government to pay for unallowable time that employees were ultimately compensated for (item B in Figure 1 above) even though the additional time was not recorded. Raytheon’s compensation practices noted that all of an employee’s efforts and work should be a consideration for compensation decisions and not just the work performed during normal business hours. The court stated that salary, by definition, is compensation for all time worked regardless of an employee’s recorded time. The actual unallowable cost impact resulting from the court’s decision has yet to be calculated and even the court admitted that the calculation will certainly be a challenge for Raytheon.

Despite the scathing language used by the court regarding Raytheon’s timekeeping policies, it did not go so far as to mandate total time accounting but rather pointed to the Federal Acquisition Regulation (FAR) 31.201-6(e)(2) as a guide for when to consider time “compensated” referencing “employee’s regular duties.” However, it did not actually define what constitutes an employee’s regular duties. The court did hit on a key consideration when discussing regular duties referencing FAR 31.201-6(e)(2) “Time spent by employees outside the normal working hours should not be considered except when it is evident that an employee engages so frequently in company activities during periods outside normal working hours as to indicate that such activities are a part of the employee’s regular duties.” In other words, the time spent outside of normal working hours should be material.

The challenge

Defining “regular duties” can be a challenge these days given the new normal of in-person, hybrid and virtual work in many sectors. It may be difficult for many contractors to make these definitions clear for their workers. For example, if someone was thinking about how to advertise a company’s new product while taking a shower in the morning, is that time worked that they are compensated for and necessary to record as unallowable, proportionally offsetting other allowable labor costs? Does going “above and beyond” literally mean their effort was beyond expectations and was therefore not part of their compensation? While these may seem like government contracting nerd brain-teasers, this case makes them more relevant than ever before.

The fallout

Given the court’s decision, companies should actively review their timekeeping and labor charging procedures as well as their compensation policies to ensure that they are in sync and reflect what the company considers “work” and “regular duties” keeping in mind that time employees charge in practice should reflect these policies.

Policy “bright-lines”

Arguably, the success of a policy and procedure is governed by many things such as identified roles and responsibilities (the who), defined procedures (the how), timeframes (the when) and specificity (the what). Specificity keeps everyone on the same page and provides clarity. Often, these come in the form of a “bright-line,” or something defined in the procedure that serves as a clear threshold or boundary between one thing and another.

The case

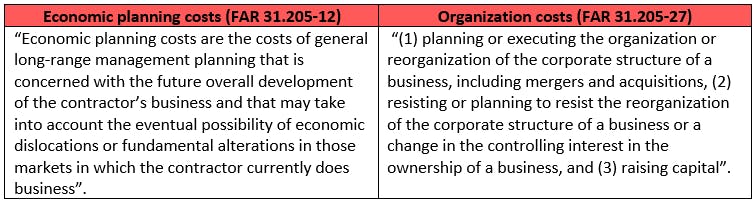

In Raytheon’s case, the company identified a “bright-line” as a submission of an indicative offer or the decision to go to market with offering materials between the allowable activities of FAR 31.205-12, “economic planning costs” and the unallowable activities of FAR 31.205-27, “organization costs.” Economic planning costs may include considerations to pursue merger and acquisition (M&A) activities or divestitures, while organization costs are the costs associated with specific M&A activity.

In Raytheon’s case, the court determined that the company’s “bright-line” of submission of an indicative offer was drawn too late in the process and led to the inclusion of other organization costs that would otherwise be unallowable under the “planning” portion of FAR 31.205-27. For better or worse, the court didn’t go far enough to define where that line should be drawn.

The challenge

This is going to lead many companies to review their own procedures and ask the question, “Where should this ‘bright-line’ be drawn?” For example:

- If a company’s long range economic planning includes analysis and determinations on whether or not a section of its business should be divested or a new market sector should be pursued through M&A, is that the point where activities then become unallowable?

- Is it the point where a company identifies a market sector or geographic region to specifically pursue through M&A that will govern the point at which activities become unallowable?

The fallout

As with many things, it depends, and there may not be a “right” answer that fits all situations. The court has reiterated that there is a clear distinction between economic planning and organization costs but lambasted Raytheon for where it drew its “bright-line.” As companies review their own “bright-lines,” whether related to the activities in this case or other potential circumstances, they should proactively document and defend their position to avoid the situation that Raytheon found itself in under this case.

Now what?

This Raytheon case has no doubt created activity on all sides of the government contracting fence for both contractors and government auditors/reviewers, as well as each other’s respective counsels. There will likely be more to come from this decision in the form of additional litigation, regulatory language and/or audit guidance. In the meantime, the decision has certainly given auditors and reviewers reason to examine such costs and practices with enhanced scrutiny. Contractors should be proactive in understanding their own timekeeping and compensation practices, as well as policy and procedure “bright-lines.” Still confused or struggling with where to begin? Contact us and we can help you navigate this ever-changing landscape.

For more information or to learn how Baker Tilly can help your organization, contact our team.