Texas M&A update: Q2 2019

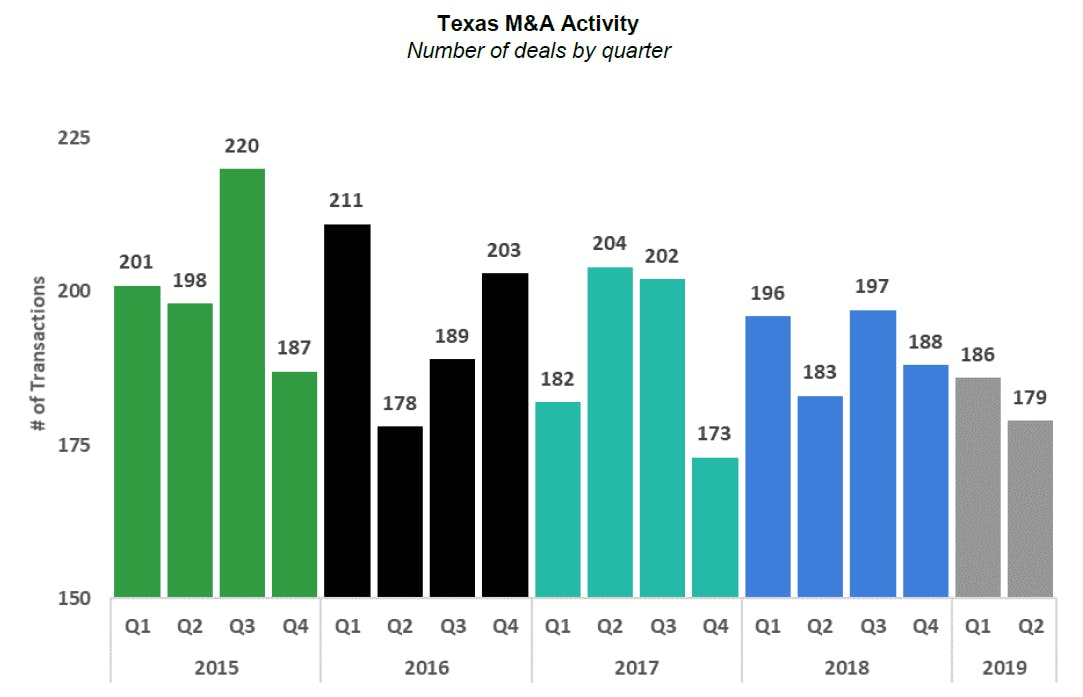

Baker Tilly Capital, LLC’s Texas M&A update provides a recap of transactions where the target is located in Texas. M&A transaction volume in Texas totaled 179 deals in Q2 2019 and declined slightly from both Q2 2018 (183 deals) and from Q1 2019 (186 deals). The greatest activity (27% of all transactions for the quarter) occurred within the Industrials sector and a majority of deals (87.2%) were completed by strategic buyers.

For purposes of this newsletter, “middle-market” is defined as transactions with enterprise value between $10 and $200 million.

Middle-market M&A activity in Texas declined to a five-year low in volume as well as aggregate transaction value in the first half of 2019. The second quarter had eight less deals than Q2 2018 and three less than Q1 2019. Aggregate transaction values for middle-market deals reported during Q2 2019 was $567 million.

Source: Capital IQ and Baker Tilly Capital, LLC Insights

Read the full update

For more information on this topic, or to learn how Baker Tilly specialists can help, contact our team.