Healthcare M&A update: Q2 2019

Sector spotlight: Revenue cycle management outsourcing

Revenue Cycle Management (RCM) involves the control of payments as they flow through the healthcare ecosystem, amongst patients, providers, facilities and suppliers. Activities falling under the RCM umbrella include billing, collections, coding, data analytics and compliance. Providers and healthcare organizations often manage their revenue cycle in-house, with the application of software developed by healthcare IT firms, or they may choose to outsource a portion or all of their RCM activities. With more stringent reimbursement policies, growing emphasis on detailed reporting and an industry-wide shift towards value-based care, providers are turning towards RCM outsourcing to optimize revenue, to recognize cost efficiencies and to focus on providing care.

The RCM outsourcing industry is in a period of strong growth, with the industry projected to grow from $11.7 billion in 2017 to a valuation of $23 billion by 2023. According to a 2018 Black Book survey, 18% of hospitals implemented a full RCM outsourcing project in 2018, up from 11% in 2015. Increasing demand is being driven by a twofold benefit to providers from RCM outsourcing:

- In today’s environment of falling reimbursements, the importance of revenue capture is growing- in a 2018 Crowe study conducted on approximately 950 hospitals, RCM outsourcing was found to generate a 3% increase in POS cash collections and a 2% increase in self-pay after insurance collection. Outsourcing some or all of RCM activities can decrease bad debt, cash collections and decrease AR balance.

- Hospitals’ expenses have been growing faster than revenues, with margins dropping to a record low of 1.6% in 2017. Finding cost savings will be crucial to providers moving forward, and outsourcing RCM activities is one way to save on administrative costs of staffing and costly technology implementations that may not be optimally suited for an organization.

Crowe’s study did indicate that RCM outsourcing had its pitfalls for the 950 surveyed hospitals- it resulted in a lengthier collection cycle and resulted in 1% higher denial and write-off rates. However, healthcare industry variables such as reimbursement models, coding standards, reporting requirements and compliance are most likely to challenge providers’ top and bottom-lines. In this environment, greater revenue capture, lower cost structures, analytics-based insight and the ability to scale operations without significant integration hurdles are all benefits which are driving demand for RCM outsourcing. Industry trends that could continue the growth of RCM outsourcing firms, as well as the attractiveness of investing in or acquiring them, include:

- Fragmented Market: According to a 2018 Black Book survey, the top-rated end-to-end RCM outsourcing vendors varied greatly by segment (hospital systems & integrated delivery networks, small, medium and large hospitals, and physician practices & groups), as well as for specific RCM services including claims solutions and outsourced coding. While larger players such as Optum, R1 RCM and Navigant have a strong presence across all segments, the remaining market is broken up into multiple smaller players. This represents further opportunity for industry consolidation, and with many providers expressing dissatisfaction with services from their big-name vendors such as Cerner and Parallon, newer players have a chance to establish a foothold in a space which is highly relationship focused.

- Technological Advancements and Requisite Staffing: Emerging technologies such as AI and automation are being implemented by RCM vendors to enhance their products and the valuable analytical data given to clients. Benefits may include accurate prediction of a patient’s likelihood to pay or visualization of value-based care metrics for optimal reimbursement. According to a 2019 Black Book CFO survey, 83% of financial leaders rate advanced analytics as the biggest potential disrupter to current operations. Organizations, especially smaller clinics and practices may turn to outsourcing their revenue-cycle activities to be able to benefit from these trends, while not having to pay specialized staff to keep up with it.

- Specialty RCM: As providers are looking to optimize billing and coding, and to comply with CMS-mandated policies to avoid reimbursement penalties, specialty-focused RCM services should see growth. Complex ICD-10 coding and CMS reporting requirements for specialty departments means that optimizing financial performance for specialties such as urgent care, emergency medicine, physical therapy and home health is growing more difficult. This has led to 7 acquisitions of specialty RCM outsourcing firms since 2018.

- Patient Consumerism: Patients in the healthcare system are increasingly willing to shop around for the best experience, with considerations having moved past simply quality care. Creating a seamless patient experience through an integrated RCM system with features such as price estimates, convenient scheduling and real-time payment, could be a big step in preventing patient attrition. The market perspective and technical expertise of an RCM outsourcing firm could be highly valuable to providers, as they analyze the benefits and methods of implementing and managing a patient-centric RCM system.

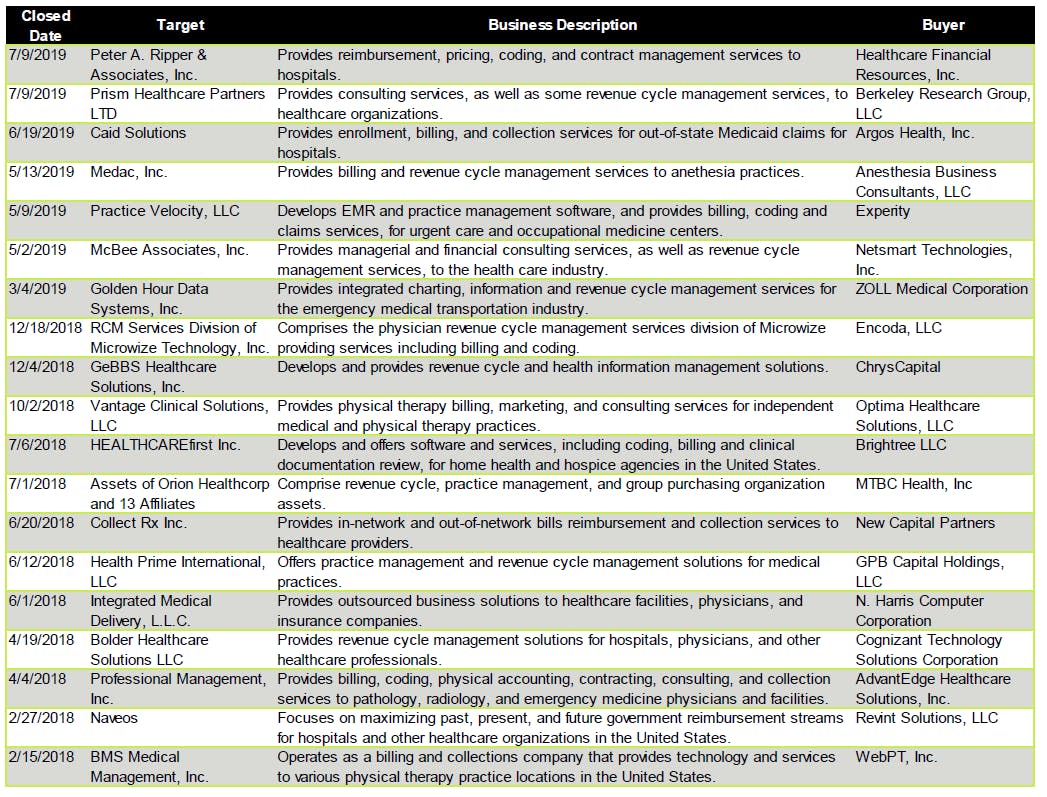

Table 1: Recent Revenue cycle management outsourcing transactions

Sources: Healthcare Business Management Association; RevCycle Intelligence; Healthcare Finance News; Crowe RCA; Black Book Market Research; The Advisory Board; S&P Capital IQ

Read the full update

For more information on this topic, or to learn how Baker Tilly specialists can help, contact our team.