2024 Tax Strategy Playbook

Download the Tax Strategy Playbook for tax insights and opportunities that could impact your organization in 2024.

Baker Tilly’s inaugural Tax Strategy Playbook discusses the outlook for the new year’s tax policy landscape, outlines how current tax policy impacts your business and discusses opportunities for tax planning and mitigating inherent risks. We delve into various areas within federal, global and state and local tax as well as detail federal clean energy incentives.

The Baker Tilly Tax Strategy Playbook covers significant federal tax updates, such as how to maximize energy credits, leverage IRA incentives and navigate the Inflation Reduction Act's benefits. Discover key strategies in our Tax Strategy Playbook.

Domestic sourcing is impacting the energy, technology and infrastructure sectors in the U.S., creating new demand for U.S. manufactured products. The most significant pieces of tax legislation we’ve seen over the last several years have all included incentives for domestic manufacturing investment, sourcing, and production:

This activity reflects the recent broader trend of congressional attempts to bring manufacturing and supply chain activity back to the U.S. Each bill has specific domestic content investment and documentation requirements that must be adhered to. Furthermore, the domestic incentives do not offer a reduced benefit for partial compliance. Consequently, significant capital investment may be made and without proper documentation could lead to forfeited tax benefit.

Early indications show a positive domestic economic impact; in June 2023 the Department of the Treasury reported a surge in construction spending for manufacturing, with spending doubling since 2021. The increase is primarily driven by construction in the computer, electronic and electrical sectors.

We’ll continue watching economic data, as well as future legislative negotiations, to determine the impact and possible trend of incentivizing the onshoring of manufacturing activity.

As businesses expand and build new facilities, investment in energy infrastructure is often needed. Evaluating the best source of energy for new initiatives is complex and involves a myriad of factors.

The Inflation Reduction Act (IRA), the largest climate investment in U.S. history, provides several considerable incentives for development and production of clean energy. The IRA builds on the energy initiatives included in the American Reinvestment Recovery Act of 2009, providing significant federal incentives, available to both taxpayers and nontaxpayers, for clean energy projects. The IRA includes more than 70 investment, production and excise tax credits designed to facilitate the transition to cleaner energy production, promote advanced manufacturing, encourage the adoption of clean vehicles (CVs) and reduce greenhouse gas emissions through the use of alternative fuels and energy efficient technologies. These incentives are focused on clean/renewable electricity and renewable fuels and provide tax credits to the owners of these clean energy facilities.

The incentives provided by the IRA are significant — they can provide benefits of up to and in some cases exceed 50% of the capital cost of the qualifying energy project, changing the economics of funding such an activity. At the same time, these incentives have significant eligibility and compliance requirements that must be evaluated and managed; failure to do so properly will jeopardize the incentives and may trigger recapture by the IRS.

Taxpayers should consult their tax advisors and carefully consider any new projects that involve energy production. However, IRA benefits aren’t solely limited to taxpayers investing in or building new energy facilities; the IRA made an important change by allowing direct pay and transferability of certain tax credits. This creates additional planning opportunities, particularly for C corporations with significant liabilities and other taxpayers with passive income tax liabilities.

Prior to the Inflation Reduction Act (IRA), federal tax credits claimed by an entity had to be used by that entity or, in the case of a partnership or S corporation, allocated to partners or shareholders of that entity. The IRA introduced the ability for taxpayers to transfer all or a portion of certain clean energy tax credits to a third party (transferability), or for some entities, to receive payments from the IRS in the amount of the credit (direct pay). These provisions allow companies to monetize credits they’ve earned but cannot currently use.

Taxpayers who wish to take advantage of direct pay or transferability are required to follow a federal registration process.

Applicable credits have significant flexibility; many IRA clean energy credits can be carried back three years to offset prior year tax liabilities or carried forward for 20 years to offset tax in future years.

The application of these provisions changes the economics of investment in clean energy for many taxpayers, particularly those who are not subject to tax or do not have a current tax liability. Likewise, this presents an opportunity for taxpayers with substantial tax liabilities to purchase credits at a discount while utilizing the credits full value against taxes. The implementation of transferability and direct pay creates tax planning opportunities for taxpayers.

The Inflation Reduction Act (IRA) created numerous incentives on clean energy and climate change. Among these is the investment tax credit (ITC), which incentivizes renewable energy generation. Leveraging and maximizing the ITC significantly improves the economics of qualifying projects for owners and investors.

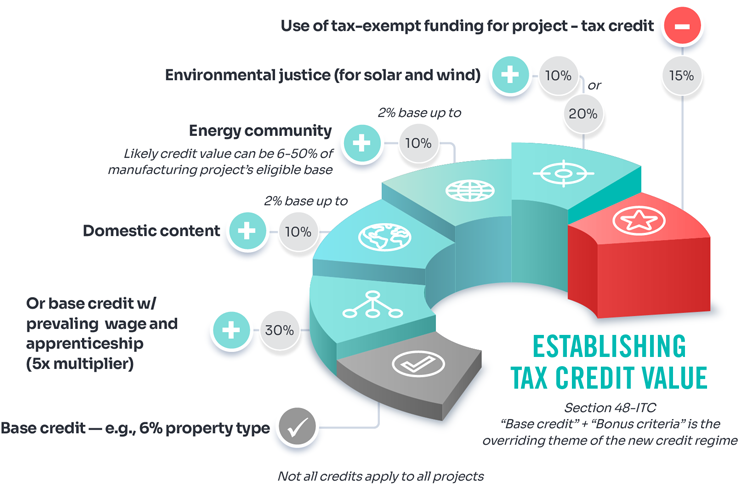

The ultimate benefits available from the new credit can vary widely depending on several factors, including:

Careful planning should be taken to maximize the credit percentage for a qualifying project. Credits can range anywhere from 6% to well over 50%. Baker Tilly is your partner in the initial determination of whether a project qualifies, to maximizing, documenting and filing for your ITC credit.

Taxpayers who have the desire to further environmental, social and governance (ESG) goals, while also reducing their effective tax liability, may be able to do so through the use of federal tax credits. The Inflation Reduction Act (IRA) revamped the Investment Tax Credit (ITC) and Production Tax Credit (PTC), which provide federal tax credits for the development of renewable energy products and production of renewable energy, respectively. These credits can provide a federal tax credit that can be utilized to offset federal income tax liability while also supporting a company’s ESG goals by investing in renewable energy.

To promote sustainable energy and the utilization of the ITCs and PTCs, the IRA allows these credits to be transferred to third parties, a concept we explain in greater detail more in “Transferability and Direct Pay of the Inflation Reduction Act Credits.”

For PTCs, the credit is earned each applicable year for up to ten years; each year of credits can be transferred to a third party. For ITCs, the credit is earned in the year in which the project is placed into service and is based on the capital costs required to construct the project. The transferability of these credits allows third parties to buy the credits, generally at a slight discount, without becoming a member/partner of the entity earning the credits and helps simplify the ability to transfer the credits. These tax credits allow the tax credit investor to reduce their effective tax payments while also achieving some of the organization’s ESG goals without the cost of direct investment.

Some taxpayers are better suited for the purchase of IRA credits, particularly as a purchased credit is currently considered passive in nature. Companies who are interested in purchasing credits should consult with their tax advisor on their ability to utilize the credit and discuss whether their provider can substantiate the value of the credit.

The Inflation Reduction Act (IRA) includes a wide range of credits designed to facilitate the transition to cleaner energy production, promote advanced manufacturing, facilitate the adoption of clean vehicles and reduce greenhouse gas emissions by encouraging the use of alternative fuels and energy efficient technologies.

Can tax credits be specially allocated in a partnership? This question is coming up more frequently since the enactment of the IRA. The answer is, as with many partnership questions, “it depends.”

There is some flexibility in the rules for allocating investment tax credits (ITCs). If the partnership agreement contains special allocation provisions, and the allocations meet certain requirements, credits can be allocated consistent with the special allocations. Careful planning and structuring are necessary to make this work, starting with a review of the partnership agreement to make sure that it matches the intent of the parties, achieves the desired result and will be respected under the regulations.

Other credits generally must be allocated according to the “partner’s interest in the partnership,” which means the partner’s economic interest in the deal. Credit allocations that diverge from this concept — such as allocating 100 percent of a credit to a single partner, regardless of the overall economics — will not be respected under the regulations.

With the expansion and extension of credits by the IRA, understanding the credit allocation rules is an important component of partnership tax planning.

The Tax Cuts and Jobs Act (TCJA) of 2017 made substantial changes to the deduction for research and experimental (R&D) activities effective for the 2022 tax year. These expenses are often referred to as “Section 174 expenditures.”

Previously, taxpayers had the option to deduct R&D expenses as they were paid or incurred, unless they made an election to amortize over five years. However, effective for the 2022 tax year and beyond, taxpayers can no longer take current deductions for R&D expenditures and must now amortize them over the following timeframes:

This change will impact taxpayers by delaying expenses to subsequent tax years, which is likely to increase a taxpayer’s current year tax liability. Forcing amortization puts many companies investing in R&D in a position where they have an actual cash outflow but only a small fraction of the corresponding deduction. Accordingly, taxpayers who utilized the R&D deduction and operated in a loss position could become profitable under the new rules. For example, start-up companies with minimal revenue could find themselves with an income tax liability.

The changes to the tax treatment for R&D expenditures have not been well-received by taxpayers, particularly innovative and research-intensive businesses who have seen material increases in their tax liabilities. There is growing bipartisan support on Capitol Hill for reverting to current expensing of section 174 expenditures. We’ll continue to monitor legislative negotiations for developments in this area, as a change could provide taxpayers with new planning opportunities.

Taxpayers planning to claim the Internal Revenue Code (IRC) 41, Credit for Increasing Research Activities (R&D tax credit) are likely to face increased reporting requirements beginning with the 2024 tax year. The R&D tax credit allows taxpayers who meet the eligibility requirements to claim a credit that offsets either their income tax or payroll tax liabilities.

Starting with the 2024 tax year (which will be filed in 2025) taxpayers will have to provide significantly more information to claim the credit, including:

The implementation of these new requirements will require additional diligence by taxpayers. This will undoubtedly elevate the cost of claiming the credit, with taxpayers facing not only additional filing costs, but also the need for substantially increased tracking and analyzing of research activities.

The IRS is currently evaluating industry feedback requested on the proposed changes. We’ll continue to monitor developments in this area.

Download the Tax Strategy Playbook for tax insights and opportunities that could impact your organization in 2024.

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments. Baker Tilly Advisory Group, LP does not practice law, nor does it give legal advice, and makes no representations regarding questions of legal interpretation.