Strategic discussions can help manufacturers maximize the benefits of R&D tax credits

Research and development (R&D) tax credits, available at both the federal and state levels, provide companies with a dollar-for-dollar reduction in income and payroll taxes for qualifying expenses. Manufacturers can take advantage of the credits to support the assessment and implementation of emerging technologies that are relevant for business growth. On average, R&D tax credits equate 7% to 9% of eligible activity costs, such as wages, supplies, cloud service provider costs, or contract research costs, as described below.

Speaking at the virtual PowerPlex 2020 conference in May, Baker Tilly Director Ryan Holzhueter emphasized that while companies are well aware of R&D tax credits since they’ve been around for almost 40 years, they may not be aware of how quickly new technologies that are eligible for a tax credit come onto the market. Growth strategy conversations at a manufacturing company have to include every level of operations – from the C suite to supply chain to procurement to shipping – because every function will have different views of what technology is available and what it enables.

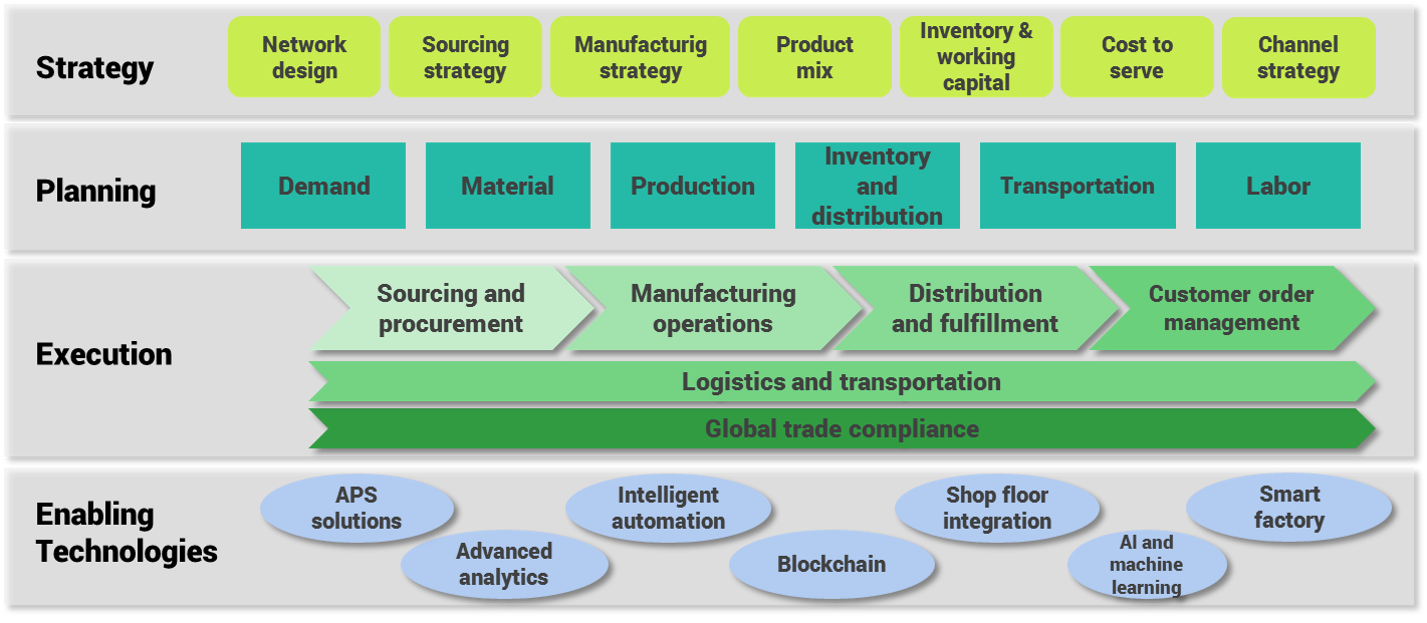

Manufacturers can take advantage of tax credits that allow them to adapt technologies that will support the strategy, planning and execution of new initiatives. Qualifying technologies include things like enterprise resource planning (ERP) solutions, blockchain, 3D printing and smart factories.

Contextualizing a manufacturing enterprise...

Eligible activities for credit

Activities must meet four IRS criteria for eligible costs to qualify for the R&D tax credit:

- Technological in nature: Activities must rely on engineering or scientific principles (e.g., mechanical engineering, electrical engineering, computer science)

- Permitted purpose: Activities must be aimed at developing a new or improved product or process

- Technical uncertainty: Activities must involve technical uncertainty as it relates to capability, method or design for achieving the desired result

- Process of experimentation: Activities must involve a systematic or iterative process of evaluating one or more design alternatives to achieve the desired result

Companies should also note the activities need only be evolutionary to the organization itself, not to the industry as a whole in order to qualify.

For a manufacturer, R&D tax credits can be used for new product or process development, process optimization or cost reduction, or determining technical and functional specifications. For a food and beverage company, the credits can be used for incorporating new or sustainable ingredients in a formula, improving machinery/equipment to ensure safety for handling food, or increasing energy efficiency of water, fuel and utilities through the introduction of new technologies.

There are also a number of activities that do not qualify for the credits, such as general and administrative activities; sales, marketing and business development activities; repair and maintenance; or research done outside the U.S.

To qualify for the credit, a company has to identify eligible projects, quantify R&D expenses, and document qualifying projects.

ERP implementation

Implementing an ERP solution is one way a company can benefit from this tax credit. Components of complex ERP implementation and optimization projects that may qualify for the R&D credit include:

- Designing new or improved custom functionalities and models

- New add-ons and features, i.e., “apps”

- Integrating legacy and other systems and interfaces

- Processing, managing, modeling and analyzing large amounts of data

- Scaling multiple data sources and users

- Managing processing, response and reporting speed

Real-life examples

Holzhueter highlighted some real-life examples of how companies supported new projects with the help of R&D tax credits

- Medical device company that commercialized a collection of catheter-based tools used to treat atrial fibrillation ($150,000 credit)

- Boat manufacturer that uses handcrafted molds and hand-laid woven fiberglass ($500,000 credit)

- Technology company that provides a security workflow solution for professional teams, enabling security teams to audit and verify compliance in real time ($96,000 credit)

“In the world of smart manufacturing it’s not one and done,” Holzhueter said. “You have to continue to iterate and think about your processes for both existing operations but also in the spirit of growth.”

Download the presentation

For more information on this topic or to learn how Baker Tilly specialists can help, contact our team.