Main Street Lending Program officially expands to include not-for-profit organizations exempt under sections 501(c)(3) and 501(c)(19)

Title IV of the Coronavirus Aid, Relief and Economic Security (CARES) Act enacted on March 27, 2020, included a subtitle provision called the Coronavirus Economic Stabilization Act of 2020, which provides additional emergency relief to certain businesses that may not have been eligible for other funding under the CARES Act.

Shortly thereafter, the Federal Reserve announced the establishment of the Main Street Lending Program (the Program) to help facilitate roughly $600 billion in financing to small and midsize businesses in relation to Title IV. The Federal Reserve subsequently released term sheets about the programs, which defined criteria and restrictions for eligible lenders and eligible borrowers.

At the time, an eligible borrower did not include not-for-profit (NFP) organizations.

On June 15, 2020, the Federal Reserve Board released a proposal to expand the Program to provide credit to small and midsize eligible NFP organizations. The week-long comment period provide feedback on the proposed loan terms and conditions

Finally on July 17, 2020, the Federal Reserve modified the Program to include not-for-profit organizations exempt under sections 501(c)(3) and 501(c)(19) to provide these organizations with greater access to credit.

Baker Tilly’s specialists compiled a list of frequently asked questions to help guide you through the provisions for NFP organizations to determine potential eligibility for your organization.

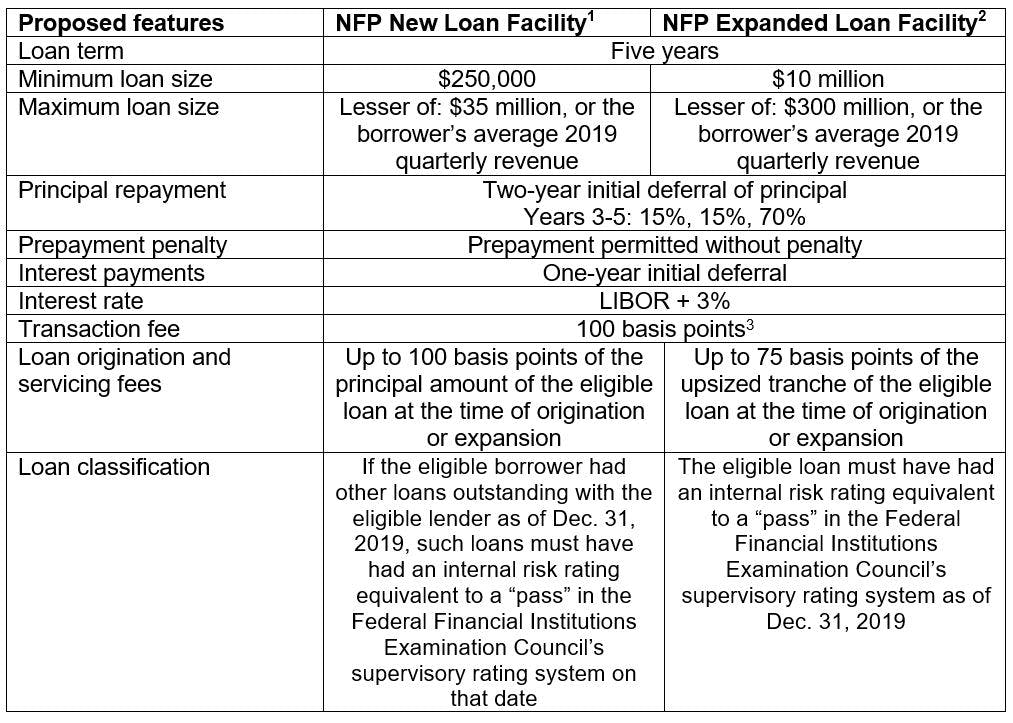

What are the available programs under the proposed Program for NFP organizations?

The Program’s NFP loans will be made available under two facilities: the Nonprofit Organization New Loan Facility (NONLF) and the Nonprofit Organization Expanded Loan Facility (NOELF). The NONLF will allow eligible lenders to originate loans for eligible NFP organizations, and the NOELF will allow for additional credit on loans previously entered into by eligible NFP organizations via an upsized tranche. Eligible NFP organizations should have been in “sound financial condition before the coronavirus pandemic.”

What type of NFP organizations would be eligible for the Program?

Only NFP organizations described in sections 501(c)(3) and 501(c)(19) of the Internal Revenue Code are considered eligible organizations under the Program. The Federal Reserve may open up the Program to other types of NFP organizations at a later date.

When is the Program expected to be available for NFP organizations?

Forms and agreements have now been modified to reflect the expansion of the Program to not-for-profit organizations, but the Program is still not accepting the submission of loans under either not-for-profit program. We will stay on top of updates and feature another alert once these forms and agreements are revised and are available.

If I applied for or received a loan under the Paycheck Protection Program (PPP), can I apply for a loan through the Program?

Yes. NFP organizations that received PPP loans are permitted to borrow under the Program, provided they meet the eligible borrower criteria as outlined below.

Is the loan eligible for debt forgiveness?

At this point, any loan under the Program will not be eligible for partial or full forgiveness.

What are the features of an eligible loan under the Program?

What criteria does an eligible borrower NFP organization need to meet?

An eligible borrower is an NFP organization that:

- has been in continuous operation since, Jan. 1, 2015;

- Is not an Ineligible Business as listed in 13 CFR 120.110(b)-(j) and (m)-(s), as modified by regulations implementing the PPP (see next FAQ for a more defined description);

- meets at least one of the following two conditions: (i) has 15,000 employees or fewer, or (ii) had 2019 annual revenues of $5 billion or less;

- has at least 10 employees;

- has an endowment of less than $3 billion;

- has total non-donation revenues (gross revenues minus donations) equal to or greater than 60% of expenses(4) for the period from 2017 through 2019(5)

- has a ratio of adjusted 2019 earnings before interest, depreciation, and amortization (EBIDA) to unrestricted 2019 operating revenue,(6) greater than or equal to 2%;

- has a ratio (expressed as a number of days) of (i) liquid assets(7) at the time of loan origination or origination of the upsized tranche to (ii) average daily expenses over the previous year, equal to or greater than 60 days;

- at the time of loan origination or origination of the upsized tranche, has a ratio of (i) unrestricted cash and investments to (ii) existing outstanding and undrawn available debt, plus the amount of any loan under the applicable Facility, plus the amount of any Center for Medicare & Medicaid Services accelerated and Advance Payments, that is greater than 55%;

- is created or organized in the United States or under the laws of the United States with significant operations in and a majority of its employees based in the United States;

- does not also participate in any of the other facilities available under the Program, the Primary Market Corporate Credit Facility,(8) or the Municipal Liquidity Facility(9); and

- has not received specific support pursuant to the Coronavirus Economic Stabilization Act of 2020 (Subtitle A(10) of Title IV of the CARES Act).

What is an Ineligible Business under 13 CFR 120.110(b)-(j) and (m)-(s)?

An Ineligible Business includes: financial businesses primarily engaged in the business of lending; passive businesses owned by developers and landlords that do not actively use or occupy the assets acquired or improved with the loan proceeds; life insurance companies; businesses located in a foreign country; private clubs and businesses which limit the number of memberships for reasons other than capacity; government-owned entities (except for businesses owned or controlled by a Native American tribe); and loan packagers earning more than one third of their gross annual revenue from packaging SBA loans. See the SBA website for the full list of ineligible businesses.

What certifications and covenants will an eligible borrower need to make under the Program?

- Will make reasonable efforts to maintain its payroll and retain its employees during the time the loan under the Program is outstanding

- Will not repay the principal balance or interest on any debt until the loan or upsized tranche of the eligible loan under the Program is repaid in full, unless the debt or interest payment is mandatory or due

- Commit that it will not seek to cancel or reduce any of its committed lines of credit with the eligible lender or any other lender

- Certify it has a reasonable basis to believe that, as of the date of origination or upsizing of the eligible loan, that it has the ability to meet its financial obligations for at least the next 90 days and does not expect to file for bankruptcy during that time period

- Will not repurchase an equity security that is listed on a national securities exchange of the eligible borrower (or its parent company) within 12 months after the eligible loan is repaid. Refer to H.R. 748-192, Sec. 4003(c)(3)(A)(ii)(I).

- Will not pay dividends or make other capital distributions with respect to the common stock of the eligible borrower within 12 months after the eligible loan is repaid. Refer to H.R. 748-192, Sec. 4003(c)(3)(A)(ii)(II)

- During the 12-month period beginning on the date the loan agreement is executed:

-No officer or employee(11) of the eligible borrower whose total compensation(12) exceeded $425,000 in calendar year 2019 will receive total compensation greater than the amount received in 2019 (refer to H.R. 748-192, Sec. 4004(a)(1)(A)); or

-No officer or employee of the eligible borrower will receive severance pay or other benefits upon termination of employment that exceeds twice the compensation received in 2019 (refer to H.R. 748-192, Sec. 4004(a)(1)(B)); and

-No officer or employee of the eligible borrower whose total compensation exceeded $3 million in calendar year 2019 may receive greater than $3 million plus 50% of the excess over $3 million received in calendar year 2019. Refer to H.R. 748-192, Sec. 4004(a)(2).

What is the period of time the loans will be available?

All facilities under the Program have been extended to December 31, 2020.

For more information on this topic or to learn how Baker Tilly specialists can help, contact our team.

(1)See Federal Reserve term sheet at

https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200717a2.pdf

(2)See Federal Reserve term sheet at

https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200717a1.pdf

(3)The eligible lender will be assessed a 100 basis point transaction fee, and can choose to pass down to the EB.

(4)Expenses equal total expenses minus depreciation, depletion and amortization.

(5)"Donations” include proceeds from fundraising events, federated campaigns, gifts, donor-advised funds, and funds from similar sources, but exclude (i) government grants, (ii) revenues from a supporting organization, (iii) grants from private foundations that are disbursed over the course of more than one calendar year, and (iv) any contributions of property other than money, stocks, bonds, and other securities (noncash contributions), provided that such noncash contribution is not sold by the organization in a transaction unrelated to the organization’s tax-exempt purpose.

(6)The methodology used by the eligible lender to calculate adjusted 2019 EBIDA must be the methodology it has previously used for adjusting EBIDA when extending credit to the eligible borrower or similarly situated borrowers on or before June 15, 2020. The eligible lender should calculate operating revenue as unrestricted operating revenue, excluding funds committed to be spent on capital, and including a proxy for endowment income in place of unrestricted investment gains or losses. The methodology used by the eligible lender to calculate the proxy for endowment income must be the methodology it has used for the eligible borrower or similarly situated borrowers on or before June 15, 2020.

(7)For purposes of this requirement, “liquid assets” is defined as unrestricted cash and investments that can be accessed and monetized within 30 days. An organization may include in “liquid assets” the amount of cash receipts it reasonably estimates to receive within 60 days related to the provision of services, facilities, or products, or any other program service that exceed its reasonably estimated cash outflows payable within the same 60-day period.

(8)The Primary Market Corporate Credit Facility was also established as a result of the CARES Act and will support credit to employers through new bond and loan issuance.

(9)The Municipal Liquidity Facility was established to help state and local governments through the purchase of short-term notes directly from U.S. states and certain U.S. counties and U.S. cities.

(10)Other emergency relief support under Subtitle A included loans, loan guarantees and other investments made for passenger air carriers, cargo air carriers and businesses critical to maintaining national security.

(11)The exception is an employee whose compensation is determined through an existing collective bargaining agreement entered into prior to March 1, 2020.

(12)Compensation is defined in Sec. 4004(b) as “salary, bonuses, awards of stock and other financial benefits.”