Key finance and accounting performance indicators for craft breweries

Reprinted courtesy of Beverage Master. Read the full issue.

Do you have real-time visibility into your financial information? If so, are you confident you’re monitoring the right type of data to achieve your business goals? We plan to explore these questions and more as we dive into the issues breweries often face when it comes to financial reporting. We will also take a look at industry best practices and technologies brewers are leveraging in order to spot opportunities, identify risks, set goals, measure progress and adjust their strategy.

Cash is king.

Every business, large or small, depends on cash. However, for many breweries, the focus tends to be more on sales growth than anything else. While sales growth is fundamental to your business, it is equally as important to monitor your cash flow.

Cash flow is the movement and timing of money into, through and out of your business. In other words, it provides a clear picture of your company’s financial health. A cash flow projection estimates the timing and amounts of cash inflows and outflows over a specific period, usually one year.

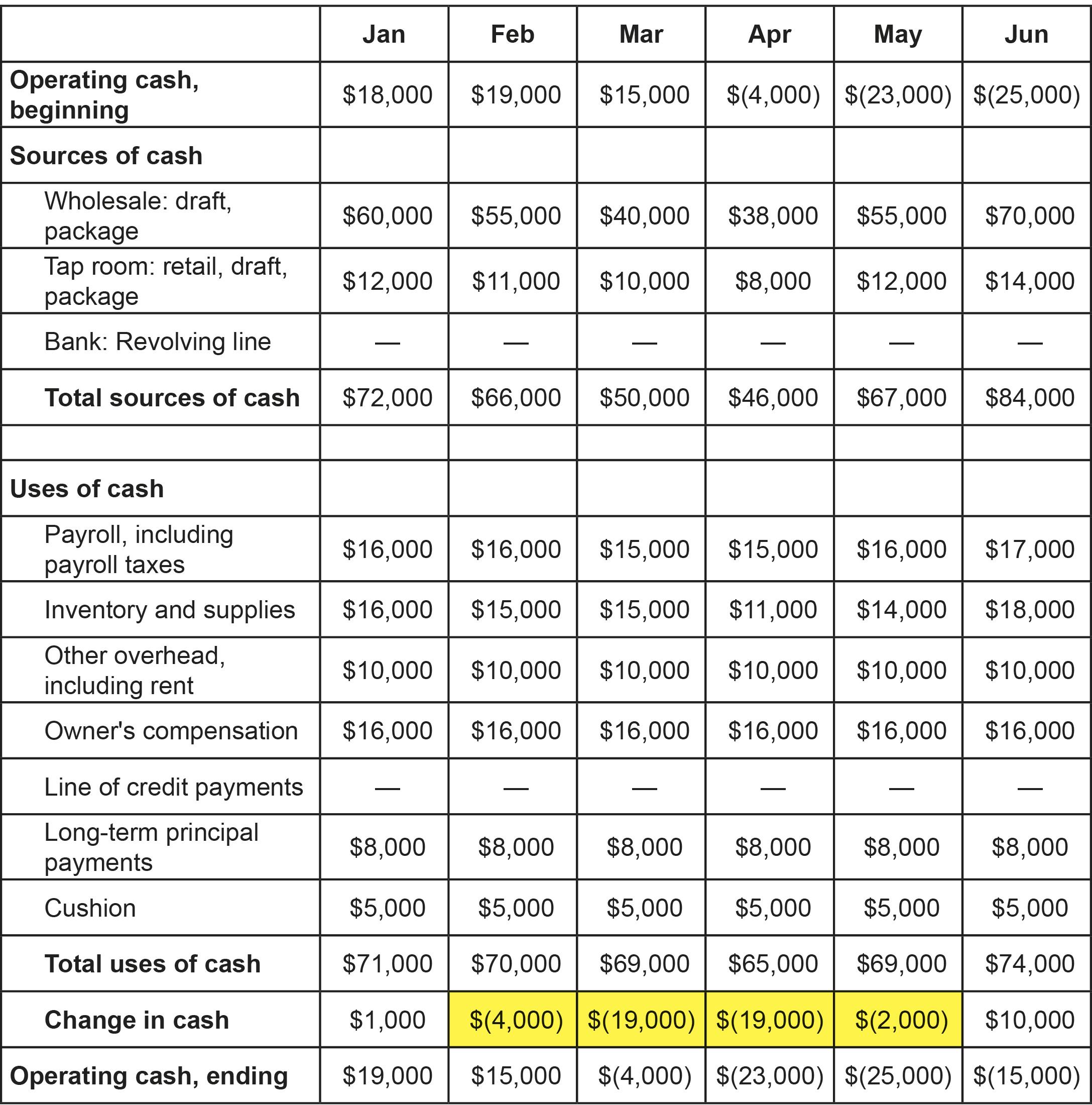

Let’s take a look at some high-level benefits of a cash flow projection:

The first step to creating a cash flow projection is to define your approach and assumptions. For example, you may want to evaluate the financial impact of adding a new seasonal brew. Two key questions to ask are:

How much will I expect my revenue and expenses to increase? Will I need to tap into my line of credit or find additional financing as I start up?

Next you will need to:

- Obtain historical revenues, expenses and cash flow for last two to three years

- Develop a template to forecast one year into the future

- Review historical growth and forecast growth based on discussions with management

Prepare a formal report outlining the significant assumptions and the forecast results including:

- Key assumptions

- Increase operating revenue

- Increase operating expenses

- Capital additions: production or brewing equipment, delivery trucks

- Debt service/borrowings

- Cash reserves

To make sure your projection stays accurate throughout the year, consider these variable expenses:

- Months with three payrolls

- Months when insurance premiums are due

- Increased estimated taxes due to increased sales

A good rule of thumb is to designate an amount equal to 10% of revenues for “other expenses” under uses of cash — so you’ll have some cushion when unforeseen costs arise.

To keep your projections on track, create a rolling 12-month plan that you update at the end of each month. If you add a new month to the end every time a month is completed, you’ll always have a long-term grasp of your business’s financial health. However, don’t try to project more than 12 months into the future or you’ll end up spending a lot of time trying to predict something with too many variables (prime rate could shoot up, sales could go down dramatically, etc.).

Cash flow projection example

After you define your assumptions and approaches and create your 12-month cash flow, you notice a net cash loss in the first half of the year as highlighted below (shown as six months).

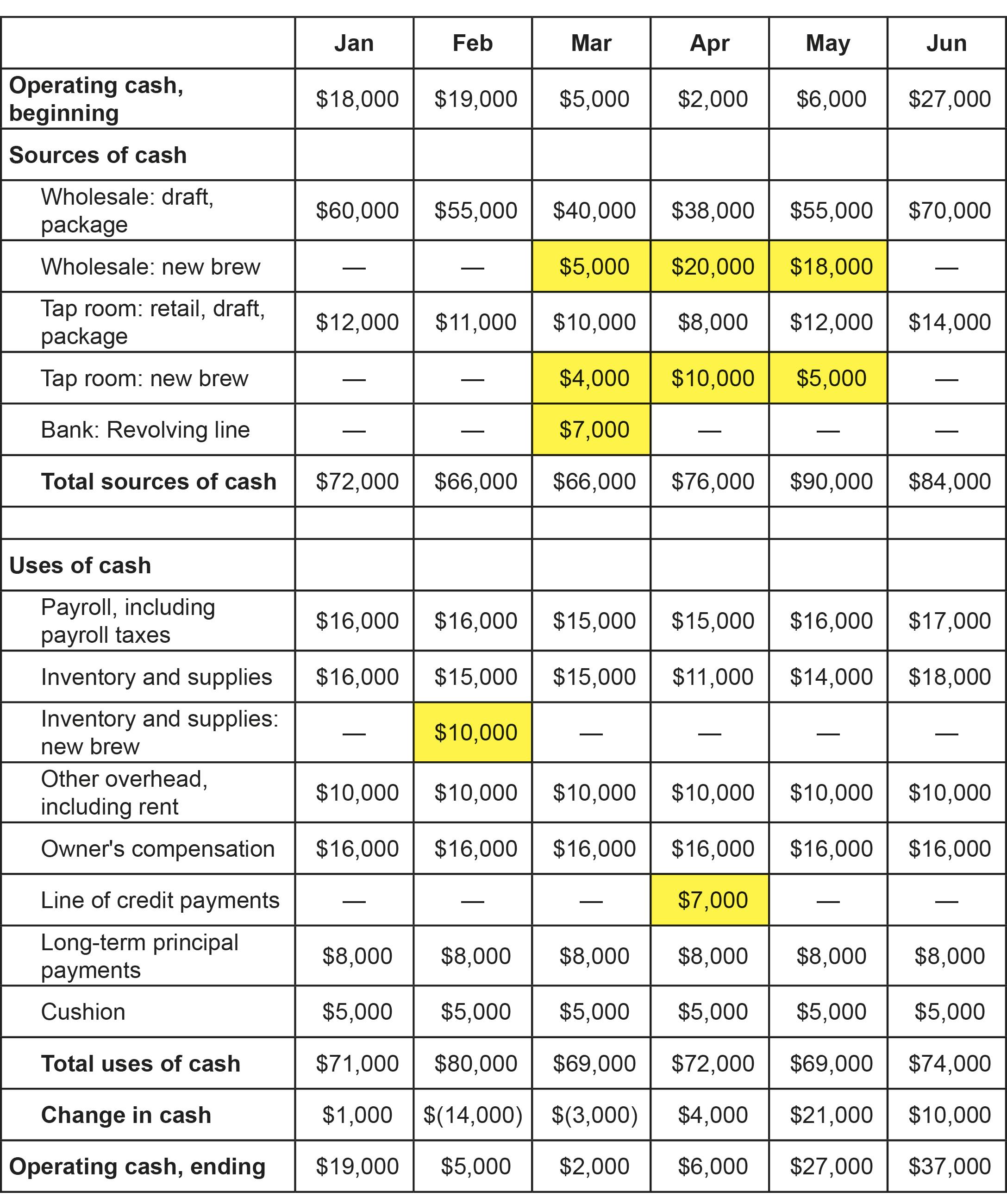

You decide the next step to minimizing your negative cash flow in the first half of the year is to evaluate the impact of producing a new seasonal brew as seen in the projection below:

Using cash flow projections is a cyclical activity. As months pass, you can compare your monthly cash flow statements to your projections for each month and the numbers should be close. You can get away with a 5% variance but if you start to see large differences from month to month, you should revisit your key assumptions to check for flaws in your logic.

Once you’ve gotten into the habit of using a cash flow projection, it should give you added control over your cash flow and a better understanding of your brewery’s financial position.

Beyond cash flow, it is important to understand and consider all of your financials when determining your strategy and planning for the future of your brewery.

By transforming your finance and accounting data into key performance indicators (KPIs), you become equipped to make intelligent, informed business decisions. Below are examples of relevant KPIs for craft brewers along with items to take into consideration during analysis.

1. Revenue trends

Monthly comparisons year over year and month over month, actual to budget comparisons, revenue by category and/or style, revenue by package type, etc.

Are sales meeting expectations? Are any seasonal brands selling well enough to go year round? Are there any year round brands that could become seasonal? Are there brands that should be discontinued? Are certain package types selling more than others?

2. Cost of goods sold (COGS)/gross margins

Monthly comparisons in total, by brand, by category/style, by package type, actual to budget, etc. – report both in dollars and as a percentage of revenue.

How are margins trending to expectations? Are there styles that are cost effective to produce with a higher perceived value in the market? Are costs increasing/decreasing due to raw material cost changes? Are there items that may need a price increase? Are there potential efficiencies that can help reduce costs in the brewing process? Should you brew larger batches for better yield? Are your COGS fully loaded with labor, overhead allocations, excise taxes, utilities, insurance, etc.?

3. Distributor/customer performance:

Revenue, gross margin, rebate/discount tracking month to month by distributor/customer, actuals vs projections, etc.

How is each distributor performing compared to projections? Are their margins sufficient to cover rebates, discounts, samples, shared mark-downs, etc.? Are certain geographical regions performing better than others? Where should your inside sales team focus their efforts? Consider additional reporting options that provide visibility of distributor sales to retailer including: on vs off premise sales, sell through turns, etc.

4. Operating expenses:

Monthly comparisons year over year and month over month, actual to budget comparisons, etc. - report both in dollars and as a percentage of revenue

Investigate areas where expenses are increasing (either in total or as a percentage of sales). Identify areas where there are cost savings opportunities. Variable expenses should fluctuate with sales levels, including staffing costs.

5. Tasting room and restaurant metrics:

Revenues and margins tracked by month year over year, food cost as a percentage of food sales, staffing costs as a percentage of tasting room revenue, daily sales trends, etc.

Evaluate seasonality trends to determine staffing needs and consider training time needed when hiring new staff for busy season. Monitor food costs to determine if menu price increases are needed. Assess daily sales trends for potential promotions on slower days of the week in order to increase business.

6. Capacity/efficiency:

Production volumes as a percentage of full capacity month over month, direct labor costs as a percentage of revenue, etc.

Are you at capacity and losing orders? Is it time to increase capacity? Are you consistently under capacity? Possibly consider contract brewing or other ways to fill capacity. Evaluate labor costs to ensure efficient production staffing levels.

So, now we know what type of data successful brewers are tracking but what technology is needed in order to access that data?

Introducing new technology to any business is commonly viewed as complicated, timely and costly. However with the rapid expansion of cloud-based technology, there are now a number of applications tailored to meet the needs of small and midsized businesses in any industry.

Most of us are familiar with the phrase “moving to the cloud” but, what does that really mean? In its most simple form, cloud computing is the use of a shared resource on the internet to store, manage and process data. Unlike the historical way of hosting a technology platform on your own server, cloud-based technology allows unique users to access the same software application from any device, anywhere, at any time. Information is easily updated and shared between team members without the need to manually input reports or be in the same physical location. Cloud applications are also being built with an open-interface approach which allows for more seamless integration amongst individual solutions.

Business processes that are commonly handled in the cloud include:

- Accounting and general ledger management | Such as: Sage Intacct, QuickBooks Online

- Accounts payable | Such as: Bill.com

- Expense management | Such as: Expensify, Nexonia

- Inventory management | Such as: Ekos, OrchastratedBEER

How leveraging those tools can provide data-driven insights while saving you time and money:

Real-time data and reporting:

Because cloud-based technology can be accessed from anytime, anywhere, the data really is “at your fingertips.” This accessibility is becoming increasingly important as the competitive landscape continues to intensify in the craft beverage space. The ability to integrate your existing applications with multiple cloud solutions allows for a comprehensive view of your data (i.e. sales, operations and finance) and thus, enables you to make timely intelligent business decisions. Plus, you can use these tools to create tailored management dashboards with customized reporting capabilities – so you see what you want to see on a regular basis.

Taking it one step further, the ability for craft brewers to access data in real time also makes that data more useful in identifying trends, comparing results to industry benchmarks, monitoring key performance indicators and, ultimately, being a better business partner to your distributors and retailers.

Automation and scalability:

Most growing craft breweries tend to run lean and have limited personnel resources. In these cases, leveraging innovative technology to streamline finance and accounting functions and reduce the need for manual processes can be very beneficial. For example, cloud-based accounting software typically automates processes by importing transaction data on a real-time basis. The cloud computing model empowers team members to collaborate and share information beyond traditional communication methods - allowing multiple facilities and/or taprooms to co-manage production, raw materials, packaging levels and distribution scheduling.

Successful craft brewers are growing at an unprecedented rate and the ability to scale on an as-needed basis is one of the biggest advantages of cloud technology. Accelerated business growth typically leads to growing pains and missed opportunities resulting from the mismanagement of more data, infrastructure and customers. The right cloud solution will grow alongside your business to meet market demands and accommodate growth as technology shifts, revenues grow and your business needs evolve.

Brewers face many challenges in an industry that is becoming less predictable with fewer loyal consumers. Staying a step ahead of your peers in this rapidly changing environment is critical to maintain a competitive advantage and realize long term success. Having real-time visibility into your cash flow, sales and operational data is a key part of that success. This will allow you to determine KPIs that align with your business goals and track them so you can plan for the future. Take advantage of the many cloud-based tools that can help you transform your data and streamline processes so you can get back to what really matters, running your brewery.

For more information on this topic, or to learn how Baker Tilly specialists can help, contact our team.