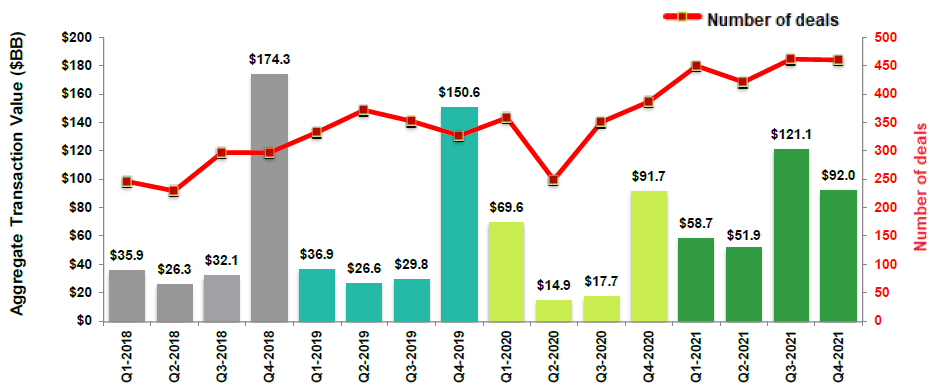

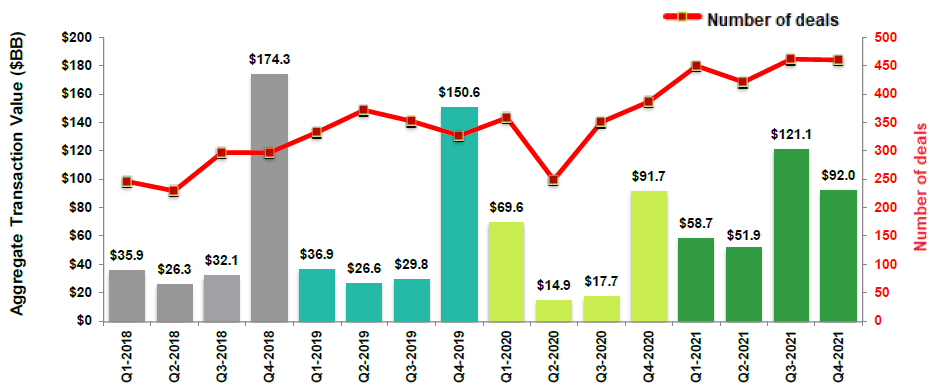

Quarterly U.S. healthcare M&A activity for transactions closed.

Aggregate transaction value and number of deals.

Source: S&P Capital IQ

32 revenue multiples reported in both Q3 2021 and Q4 2021

The escalating need for healthcare workers

U.S. hospitals, which are facing growing challenges in retaining employees, have been forced to increase salaries and offer signing bonuses to attract nursing applicants. In a study backed by the American Hospital Association (AHA), hospital labor expenses have increased 12% through November 2021 as compared to pre-pandemic levels.

The Biden administration announced in November 2021 it will invest $1.5 billion toward national health providers to address workforce shortages and healthcare disparities across the United States. The industry is projected to face a shortage of almost 60,000 primary care doctors, dentists and psychiatrists over the next 10 years.

U.S. healthcare employees migrated from their employers primarily due to:

- Burnout from long and intense working hours brought on by COVID

- Lucrative employment alternatives from competing providers and staffing agencies.

AMN Healthcare Services, Inc. anticipates demand for nurses and clinical workers to remain above pre-pandemic levels. Hospitals and healthcare providers will likely remain dependent on healthcare staffing agencies, as recent trends in employee migration and flexible working conditions have become the new norm.

Get the pulse of the industry

Download your free copy of the Healthcare M&A update H2 2021 for more information on:

- Financial performance of specific healthcare sectors

- Growing demand for labor

- Rise in travel nursing

- Potential pricing regulation

- Deals made in 2021