U.S. markets cooled off during the first half of 2022

Declines are happening across all major indexes. This is driven by increased interest rates from the Federal Reserve to combat record inflation, as well as macroeconomic pressures brought on by the war in Ukraine and continued supply chain disruptions throughout multiple U.S. industries.

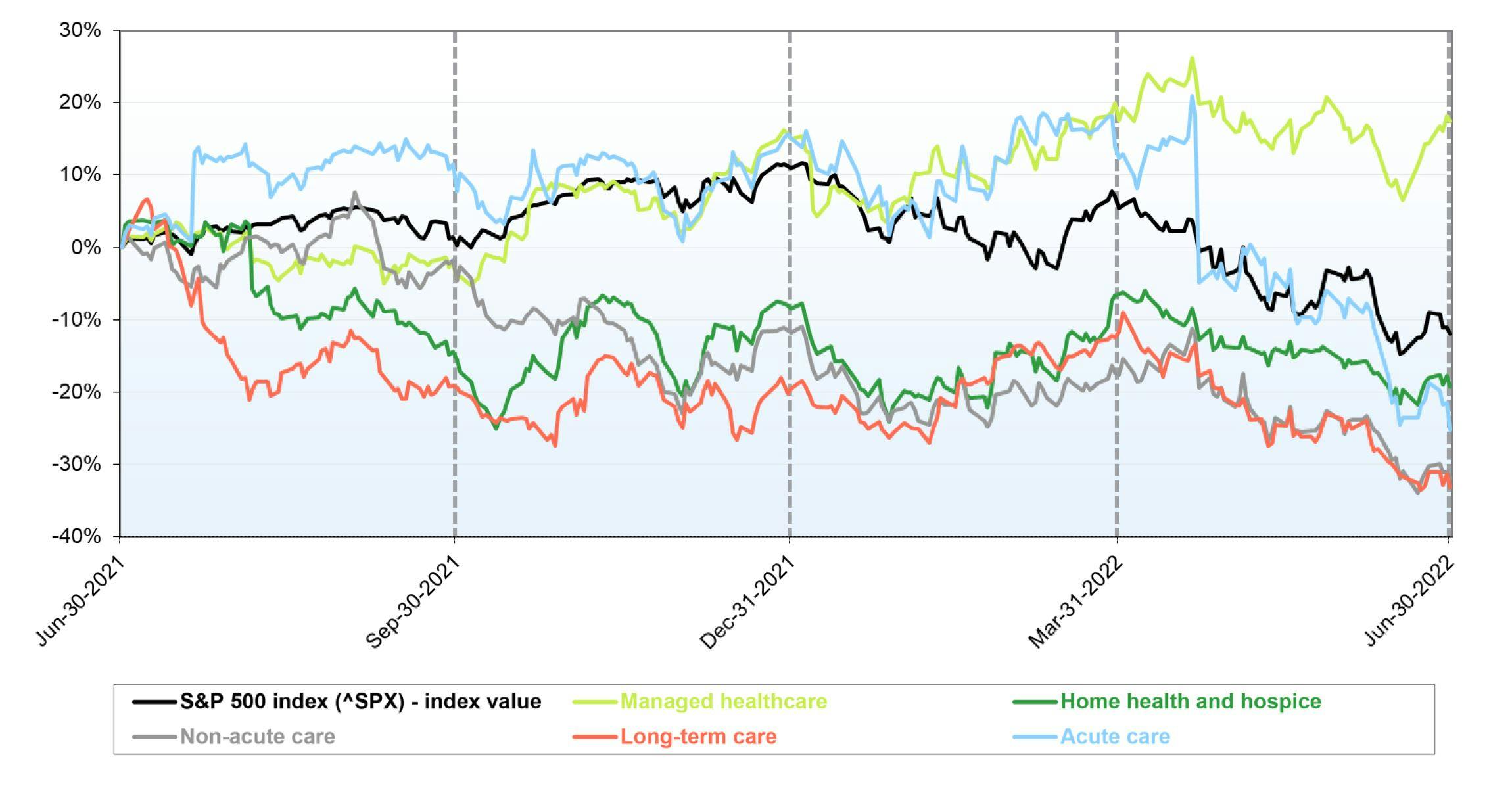

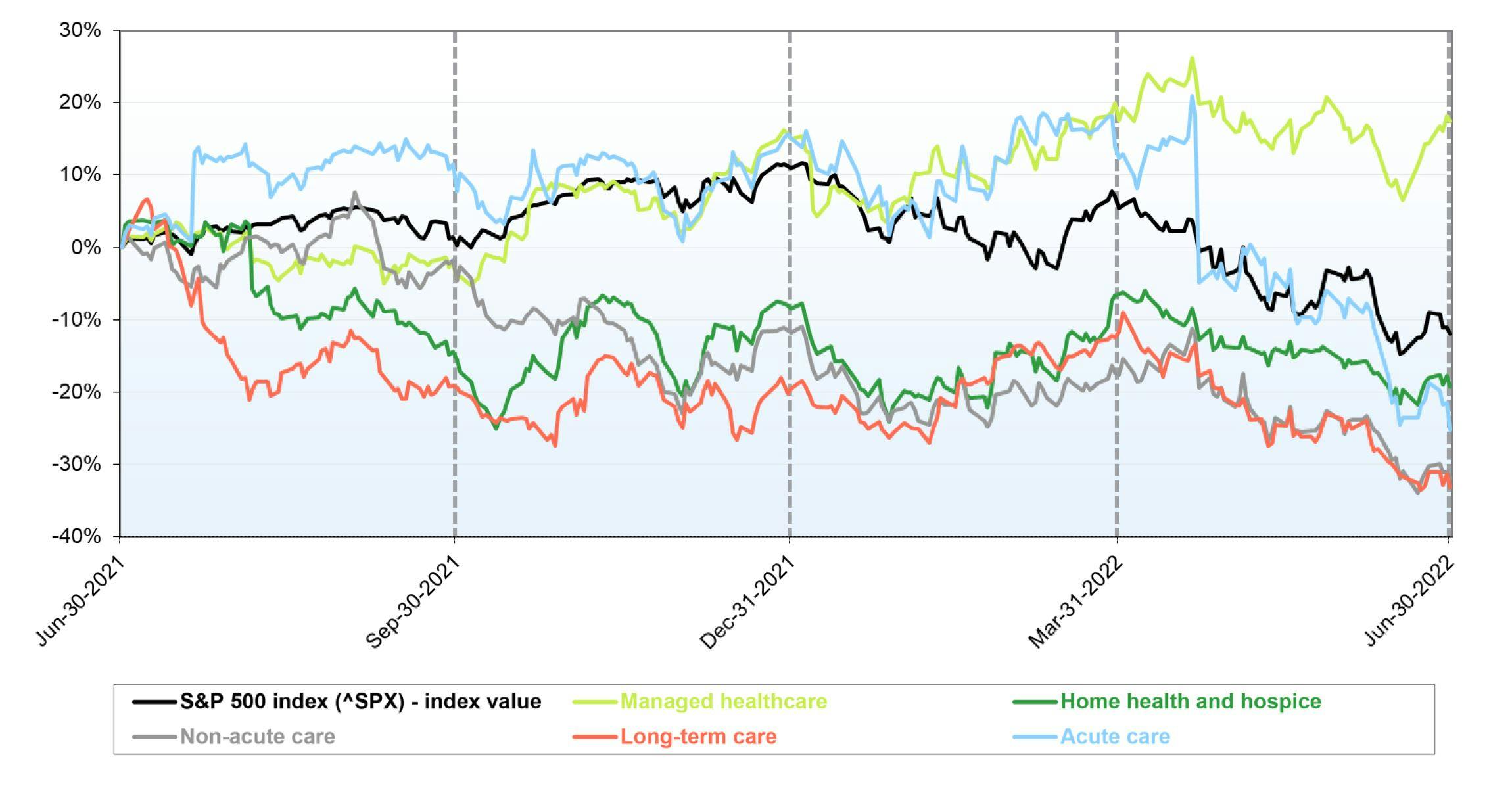

As most healthcare sectors shifted downward in the first half of 2022, managed healthcare outperformed the S&P 500, showing a positive return of 17% during the period. This is largely attributable to the ability of insurance policy providers to manage margins during inflationary periods by continually renegotiating contract pricing with policy holders.

Healthcare providers’ relative market performance

Source: S&P Capital IQ

LTM as of June 30, 2022

EV = Enterprise Value

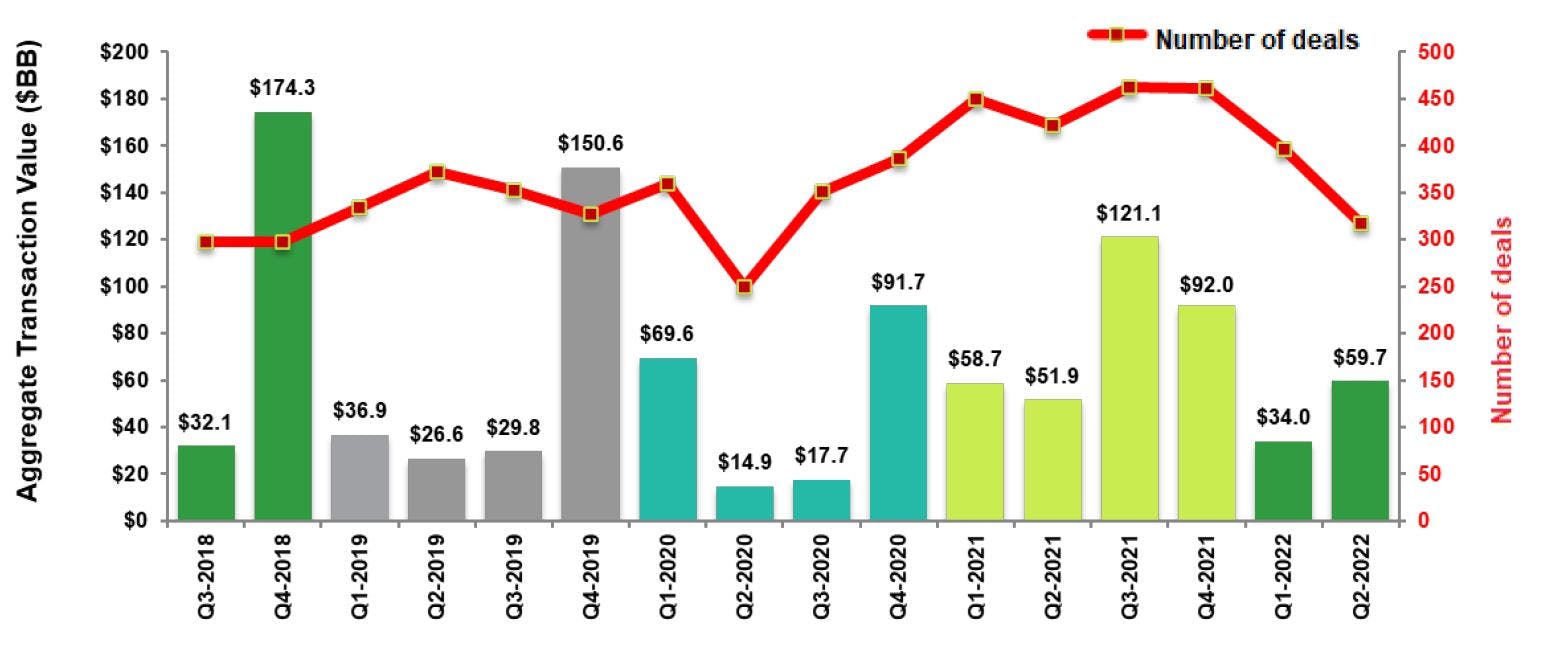

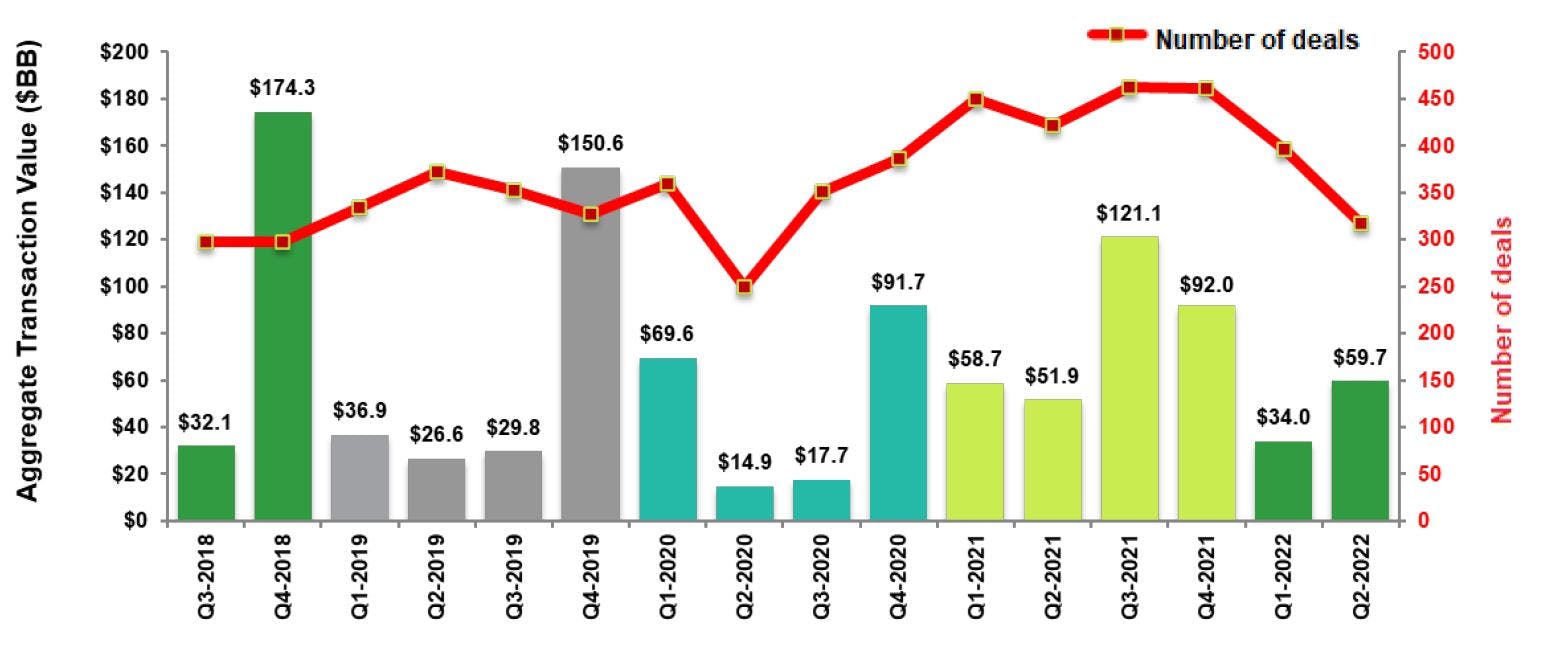

M&A overview

There were 713 reported M&A transactions that closed during H1 2022, down from the 923 transactions during H2 2021. Reported closed healthcare transactions in H1 2022 decreased 18% compared to 872 closed deals for the same period in 2021.

The aggregate value of M&A deals also decreased from $213.1 billion in H2 2021 to $93.7 billion in H1 2022. This was driven by:

- A decrease in both average deal size and deal volumes

- A significantly lower number of deals had reported transaction values during the period

However, we can note a largest acquisition in the first half of 2022: Cerner Corporation, Inc. bought for $30.2 billion by Oracle Corporations’.

Quarterly U.S. healthcare M&A activity for transactions closed

Aggregate transaction value and number of deals.

Source: S&P Capital IQ - 16 revenue multiples reported in 1Q 2022; 18 revenue multiples reported in 2Q 2022