GSA announces TDR pilot program to become eligible for expansion: what this means for federal contractors

On April 27, 2021, the General Services Administration (GSA) announced in a blog post that after favorable fiscal year 2020 pilot evaluation results, the Transactional Data Reporting (TDR) pilot program would be eligible for expansion – yet only after a clear expansion plan is developed. The TDR final rule was established by GSA on June 23, 2016, and requires participating vendors to report transaction data from orders placed against GSA’s Federal Supply Schedule (FSS) program. It has been nearly five years since the announcement of the pilot program, and it appears that GSA has been able to capture results supporting the implementation of the program over a larger scope than the original eight GSA schedule contracts chosen for the pilot.

When it was first unveiled, GSA hailed TDR as an essential tool in understanding governmentwide purchasing behavior and allowing agencies to make smarter acquisition decisions while decreasing the overall burden to contractors. After years of data issues that rendered key program metrics incomplete and resulted in uncertainty regarding the program’s future, it appears that after the 2020 evaluation, the TDR program will be expanding. Baker Tilly has reviewed the FY 20 evaluation report and the article that follows summarizes key findings and provides some perspective on important takeaways for the government contractor community.

FY 2020 pilot evaluation results

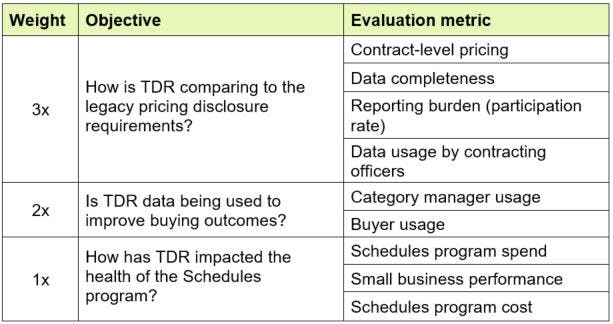

While GSA’s Federal Acquisition Service (FAS) has and continues to be responsible for the operation of the TDR pilot, GSA’s Office of Government-wide Policy (OGP) was tasked with conducting the evaluation of the program. Based on performance in FY 2020, the TDR pilot was found by OGP to be meeting or exceeding targets as established by the TDR pilot evaluation plan and metrics (version 2.0). Notably, from FY 2019 to FY 2020, pilot performance was found to be either maintained or improved under all nine evaluation metrics. Each evaluation metric was weighted (1x, 2x or 3x), rated as significantly under-performing, on track to meet targets or meeting or exceeding targets, and given a respective evaluation score of low, medium or high. Different weights were assigned based on the evaluation objective the metrics were designed to meet.

The weights and the corresponding evaluation metrics are depicted below:

The four metrics with the greatest collective weight fall under the evaluation objective that sets out to “determine if TDR can fulfill the Commercial Sales Practices (CSP) and Price Reductions Clause (PRC) function while lowering industry reporting burden.” Evaluation methodology, results and takeaways for these four metrics are outlined below:

Contract-level pricing (High)

The contract-level pricing metric measures the quantitative percentage change in pricing for identical products on the same contract, adjusted for inflation using the Consumer Price Index (CPI). After reviewing 66 million records for items that were on contract for a year, OGP found that “FY 20 TDR contract pricing increased by 0.54%, non-TDR increased by 0.79% (0.25% higher than TDR contractors). On a CPI-U inflation adjusted basis, TDR contract pricing decreased by 0.64% while non-TDR contractor pricing decreased by 0.39%.”

This is the third year in a row that contract-level pricing was found to be better when TDR was used as opposed to the Commercial Sales Practices construct (relying on a Most Favored Customer (MFC) pricing objective). As one of the highest weighted metrics, GSA views this evaluation as one of the key drivers of TDR’s success in reducing pricing for their federal partners.

Data completeness (High)

Data completeness measures the percentage of transactional data reports that include data for two fields: manufacturer name and manufacturer part number. OGP is reporting that TDR data is now 98.7% complete, an increase from 94.1% in FY 2019 and 73.6% in FY 2018. In addition to this high rate, FAS notes that they are in the process of completing additional user experience enhancements that will provide the industry with instructions that should further increase the completeness of data collected. With a near perfect data completeness rate, GSA can now make the case that TDR data is more actionable and that system validations put in place in FY 2019 have paid off.

Reporting burden (High)

GSA takes into consideration the participation rate of eligible contracts in the TDR pilot program and believes that an increase in the participation rate is indicative of contractors viewing TDR as a more economical and less burdensome pricing model than the CSP/PRC model. FY 2020 results reveal a participation rate of 61.3% (2,486 out of 4,053 eligible contracts), which exceeds the 60% target that was originally set. This rate is up from 56.7% in FY 2019 and 53.5% in FY 2018.

Data usage by contracting officers (Medium)

Of the four key metrics that are weighted the highest, data usage by contracting officers was the only metric to not exceed its target. This metric is measured by the qualitative evidence of FSS contracting officers using transactional data to negotiate contract-level pricing on TDR pilot contracts. Evaluation of this metric found that “all TDR pilot PCOs have access to data but are not making meaningful use of it,” resulting in a medium score (3 out of 6 points).

FAS notes that there have been a limited number of individual cases that reflect successful usage of TDR data and acknowledge that there is definite room for improvement. According to FAS, best practice training for individual FSS contracting officer usage will be made available in FY 21. Due to the qualitative nature of this evaluation, it isn’t possible to draw any definitive conclusions about how frequently contracting officers are truly using the transactional data. While this evaluation is an improvement from FY 2019, where contracting officers only had access to data after completing training and requesting access, it is clear that increasing the ability of FSS contracting officers to leverage TDR data will be an emphasis of the expansion plan to be published by GSA.

Summary

Collectively, GSA appears to be proud of the results of the FY 2020 evaluation and is touting the program as a less burdensome alternative to the CSP/PRC pricing construct. Their recent blog post makes it clear that they believe the pilot program has successfully demonstrated the value of TDR. From GSA’s perspective, the steady progress of the pilot program has proven the potential of TDR and provides support for continued investment in the program.

Future of TDR pilot program

GSA acknowledges that although FY 20 evaluation results are favorable, significant improvements are still needed in order to support an expansion of TDR. FAS identifies the need for contracting officers to leverage transactional data as its key area for improvement. To address this, FAS is expected to implement an aggressive training program that will inform contracting officers on the benefits of having access to the granular pricing information that is supplied by TDR. FAS will be publishing an expansion plan that should describe this effort in greater depth and will also address the following:

- The ability of FSS contracting officers to leverage transactional data for price negotiations in lieu of CSP and PRC disclosures

- The impact of an expanded data collection on FAS’s ability to leverage the data it currently collects

- Impacts on current and future GSA Schedule contractors

- Communication to industry partners ahead of changes

- Training and tools for category managers that are currently not impacted by TDR

- Potential impacts on other FAS initiatives, such as Multiple Award Schedules (MAS) consolidation and implementation of Section 876 of the FY 2019 National Defense Authorization Act

TDR will only become eligible for expansion once these expansion plan considerations are met. Given GSA’s stance in their blog post, it seems reasonable for contractors to expect this plan to be published and for TDR’s scope to expand.

What this means for contractors

TDR was established under the premise that it had the potential to centralize pricing decisions, reduce contract duplication and lower overall acquisition costs. Nearly five years since its inception, GSA believes the pilot program has been able to yield some of its desired results. While the expansion plan has yet to be published, FSS contractors should carefully consider the implications of GSA’s proposed expansion of the program.

1. Nature of scope expansion

Given that GSA has acknowledged TDR needs to address potential impacts of other FAS initiatives, it remains unclear how the new scope of TDR will be determined, or which additional MAS categories will be included in the program. Given that the evaluation metrics did not provide guidance on how TDR performed on FSS contracts for service providers, one would expect that the TDR program will continue to be focused on product offerings and related Special Item Numbers (SINs). Additionally, the current evaluation metrics do not provide guidance for how TDR should be assessed or applied when accounting for items with limited sales, complex bundled solutions, fixed price orders and differing terms of sale at the order level. These have always been challenges for the TDR construct and it remains to be seen if the expansion plan will seek to address these limitations.

2. Service offerings

Currently, the services offered under Professional Engineering Services SINs are the only professional services that are TDR-eligible. Since the evaluation metrics were silent on the effects of the program on service offerings, one could infer that GSA had issues gaining visibility into unit level hourly rates associated with TDR reported sales, given the federal government’s preference for purchasing services on a firm-fixed price basis. What this means for current TDR contractors under these SINs is unclear. This is somewhat concerning as the current version of the program may not provide a full pricing picture for these organizations going forward, potentially hampering contract negotiations. Whether or not the TDR expansion solves for this issue is an open question. From GSA’s perspective, the implementation of Section 876 from the FY 2019 National Defense Authorization Act may provide some answers for these organizations.

3. Contract-level pricing

Per GSA’s analysis, contract-level pricing under TDR has been more favorable for federal buyers for the past three years of the pilot program, which may be an indication that TDR vendors are feeling additional pricing pressure at the contract and/or order levels. However, one should note that no true correlation or causation may exist here. Per OGP’s evaluation, procurement contracting officers (PCOs) have not been effective in using the TDR data, so it seems difficult to conclude that the TDR data has had an impact on contract level pricing for TDR contracts. Additionally, it appears that this conclusion was based on a comparison of year-over-year pricing for GSA contracts and may not represent a measurement of which company/contract actually offered better pricing, or perhaps more important, more value.

As FAS category managers begin to rely on the TDR data and draw conclusions from the collected transactional information, contractors should expect that FSS contracting officers will begin to use this information in establishing negotiation objectives for new contract proposals, during option exercises, when other contract modifications are executed, or even at other times during the life of the contract. There is an alternate price reductions clause [1] in TDR contracts that allows the contracting officer to ask for, or the contractor to offer, price reductions at any time during the life of the contract).

4. Best value

Industry observers should closely consider the emphasis on the contract level pricing evaluation metric described in the report. Measurable reductions in negotiated contract prices are seen as a benefit of the program (with the highest weight). While this is understandable, industry observers should pay attention to how GSA will evaluate this metric relative to overall value achieved.

The concept of “best value” has long been a foundational tenet of the GSA Schedules program. Price is but one element, of many, in making a best value determination. Quality, desired performance level, total program cost and delivery speed are all examples of important considerations that often drive pricing decisions at the task order level. In our experience, GSA contracting officers have frequently had difficulty accepting the notion that many important terms and conditions specific to an individual sale can cause a contractor to offer pricing that it would not extend to other customers, under different terms and conditions. As GSA contracting officers begin to use transactional data to inform contract level pricing negotiations, contractors may find themselves in situations where they will have to articulate those unique terms and conditions.

Additionally, while many contractors will cheer the removal of the CSP disclosure requirement and the significant level of effort and risk associated with it (for good reason), a CSP did provide a means of communicating the value delivered by a specific company and its products, services and solutions. Without the support of a current, accurate and complete CSP disclosure, GSA contractors may be left with fewer options to demonstrate their unique value proposition.

5. Training

While training contracting officers on how to leverage TDR data effectively is a focal point for GSA, it is important that training on how to review and interpret CSP data is not forgotten, particularly while the CSP/PRC construct is still an option for contractors. For companies still relying on this construct, contracting officers will need to be able to recognize the specific value that each company brings to the table, evidenced by the prices they command in the free and competitive commercial markets. For companies that do continue to rely on a CSP, that data should be treated with a greater weight than data captured from other companies’ pricelists (horizontal or CALC comparisons) or transactional prices, as those other companies may not serve as a good or fair basis of comparison.

Conclusion

With FY 20 results in hand, GSA claims that, “The TDR pilot proved it is a more effective, less burdensome alternative to legacy pricing disclosure requirements. When TDR is used, government prices are lower, the reporting burden on contractors is reduced, and small businesses generate stronger sales growth.” It is clear that GSA values the TDR program, and that some level of expansion is likely on the horizon.

For more information on TDR, or to learn how Baker Tilly specialists can help – please contact us.

[1] 552.238-81 Price Reductions (May 2019) (Alternate I - April 2014) applies to contracts participating in the Transactional Data Reporting (TDR) pilot.