GSA OIG report takes aim at TDR evaluation plan

Snapshot

In the summer of 2016 the General Services Administration (GSA) unveiled the Transactional Data Reporting (TDR) Pilot Program as an alternative to the traditional compliance paradigm under Federal Supply Schedule (FSS) contracts. Those vendors willing to report transactional prices paid data on a monthly basis would no longer be subject to the FSS program’s Price Reductions Clause (PRC) and its “tracking customer” requirement, nor would they be required to submit Commercial Sales Practice format (or CSP-1) disclosures. At the time, GSA hailed TDR as an essential tool in understanding government-wide purchasing behavior and allowing agencies to make smarter acquisition decisions. GSA also maintained that the three year pilot program would be evaluated based on various metrics related to pricing competitiveness, sales volume, FSS utilization, small business participation, and other measures valuable to category management.

On July 25, 2018, GSA’s Office of Inspector General (GSA OIG) issued an audit report finding that GSA’s evaluation plan for TDR is inadequate. The report titled, “Audit of Transactional Data Reporting Pilot Evaluation Plan and Metrics”, finds that GSA failed to establish defined performance targets tied to clear pilot performance objectives, and that TDR data has not been made available to allow for an evaluation against the metrics established by GSA.

Beyond the headline

It is apparent that GSA OIG is skeptical that the TDR rule is the right path for the Schedules program. OIG has previously been critical of the rule, stating in 2013 that, “while obtaining and using transactional data can benefit GSA and its customer agencies, we are concerned that the approach presented in the notice leaves the government subjected to unnecessary risk.” In the July 2018 audit report, OIG communicated that the current evaluation criteria are vague and that they will not enable GSA to objectively measure or evaluate whether the TDR pilot is improving the value of the Multiple Award Schedules Program. GSA responded to this finding by elaborating on their quantitative metrics and reiterating their belief that these criteria will work and only need time to prove the TDR concept.

Also noted in the recently released report is that the roughly 500 million rows of TDR data amassed by GSA has yet to be used to evaluate the TDR program. While it is available to an internal FAS analytics team and some category managers, these individuals do not bear the responsibility of measuring the program’s effectiveness. Due to the proprietary nature of the data, GSA is still working on a solution to ensure its security before distributing to a broader audience. This broader distribution to contracting officers would seem necessary to achieve the desired effect of promoting category management, reducing prices, and achieving a number of additional goals.

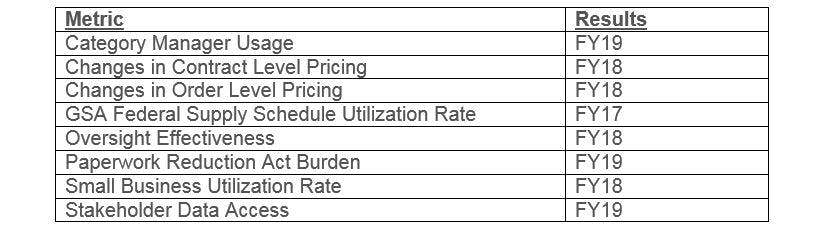

In GSA’s response to the OIG findings, they identified the following target timeframes for establishing a quantitative baseline from which measureable performance targets related to the pilot can be established:

While GSA has stated that there has been progress in evaluating the TDR program against its current measures, industry should continue to maintain a watchful eye on the steps that are taken to further assess the program during the final year of what was originally intended to be a three-year pilot.

Additionally, in GSA’s response to the OIG audit they noted that they were planning for GSA FSS Contracting Officers to begin using transactional data to negotiate contract level prices in late FY2017. Our understanding is that a limited number of contractors may have experienced this, but that widespread use of the transactional data to support contract level price negotiations may not be happening with much frequency. At industry meetings when the TDR rule was being proposed and ultimately rolled out, GSA officials stated on a number of occasions that the data would not be used to facilitate a race to the bottom on prices, and when and how the data would ultimately be used by contracting officers at GSA and ordering agencies was uncertain. It will be interesting to see how and where transactional data is deployed and relied upon by the government to negotiate better contract-level prices, and whether they will take into account the unique factors that can lead to lower prices on a specific order where volume and other requirements that can influence pricing are understood.

Key Takeaways

TDR was established under the premise that it had the potential to centralize pricing decisions, reduce contract duplication, and lower acquisition costs. After nearly two years it appears that an evaluation of the pilot is still in its infancy, which could put pressure on the program to yield meaningful results quickly. While there are a number of open questions, FSS contractors should carefully consider the implications of the OIG’s findings:

- Given that GSA has yet to use the data and that performance targets are still in question, it remains to be seen whether TDR will be expanded to other schedules, or whether the schedules currently included in the pilot will continue to include TDR as an option.

- While GSA has continued to stress that a reduction in prices is but one aspect of how TDR will be evaluated, there is some potential for TDR vendors to feel additional pricing pressure (at both the contract level and the order level) if GSA pushes to achieve positive value metrics and expands access to the transactional data.

- GSA agrees that it should validate if the TDR data is “complete, accurate, and reliable” before using it to make decisions. Contractors should be careful to ensure that their TDR data is being reported accurately. Periodic reviews of pricing and other information included in the data, as well as the process and systems relied upon to produce the data are steps to consider.

- The current evaluation metrics do not provide guidance on how TDR should be assessed when accounting for items with limited sales, complex bundled solutions, fixed price orders, and differing terms of sale at the order level. If you are a contractor who has accepted TDR and you sell products or services with these kinds of issues, be aware that you may need to provide additional data to support pricing.

For more information on this topic or to learn how Baker Tilly specialists can help, contact our team.