Food and beverage M&A update: Q4 2019

Major U.S. indexes

The fourth quarter of 2019 (Q4 2019) showed strong performance for the broader U.S. equity market, as the S&P, DJIA and NASDAQ closed up 8.5 percent, 6.0 percent and 12.2 percent, respectively, for the quarter. For the 12 months ending December 31, the S&P, DJIA and NASDAQ closed up 28.9 percent, 22.3 percent and 35.2 percent, respectively.

Food and beverage relative performance

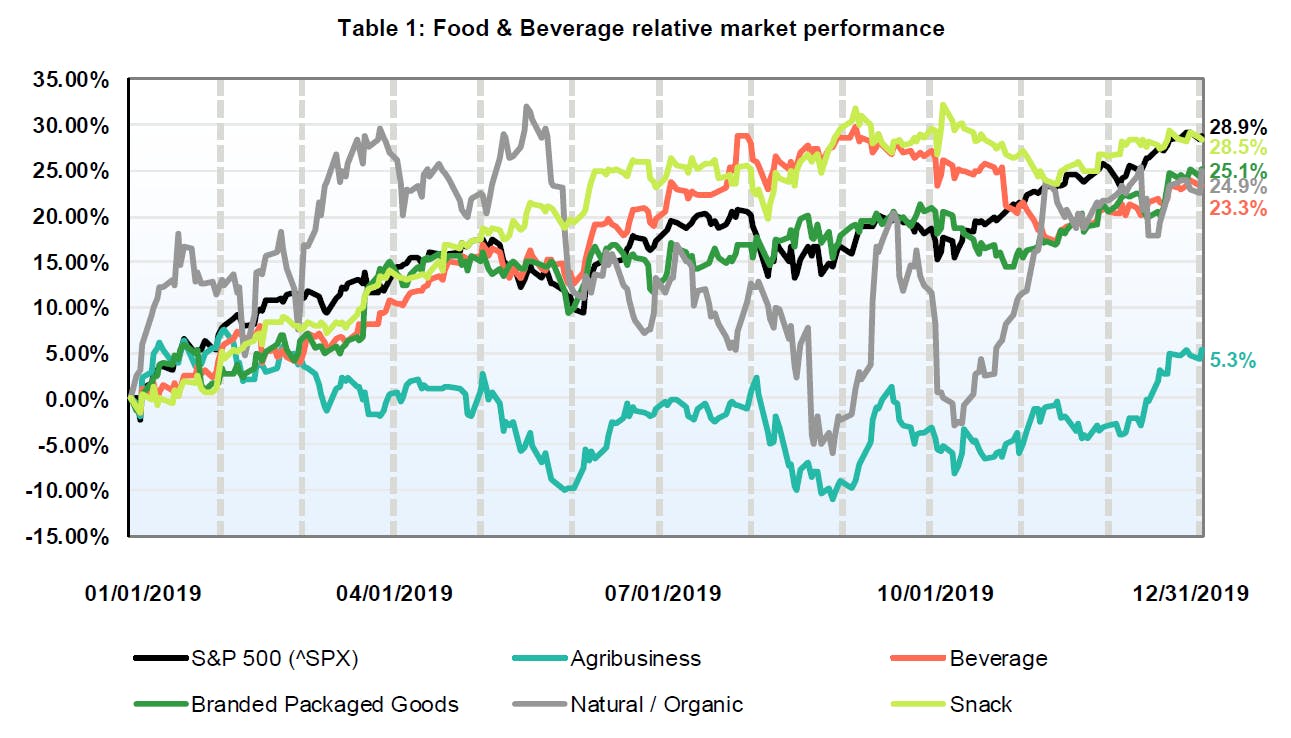

As of December 31, 2019, all of the five food & beverage segments exhibited increases on a trailing twelve months basis. As a whole, markets in 2019 experienced the best year in nearly two decades. Despite ongoing external threats to investors, the Federal Reserve cut interest rates, job growth continued, American consumer spending increased and the positive outlook of an early-stage deal with China in the trade war all drove markets to record-setting heights.

The stocks of the snack segment performed the best of the five food & beverage segments. This segment exhibited annual gains of 28.5 percent, trailing the performance of the S&P 500 index’s 28.9 percent increase during the observed period. Even the agribusiness segment, the worst performing of the five food & beverage segments, exhibited annual gains of 5.3 percent.

A key driver of the natural / organic segment’s turnaround was the performance of The Hain Celestial Group, Inc. (“Hain”). The company announced at its Investor Day in February that the immediate strategy was to simplify the organization by curtailing the portfolio of brands. Hain felt that the portfolio consisted of too many brands relative to the size of the company. To that point, Hain has successfully completed seven divestitures since February’s Investor Day. The divestitures included the non-core brands of Tilda, SunSpire, Arrowhead Mills, Plainville Farms, Empire Kosher, FreeBird and WestSoy. With the continuous goal of pursuing margin improvement opportunities, the company expressed its appetite to continue divesting brands that are less profitable or otherwise less of a strategic fit within Hain’s core portfolio in order to progress towards executing the strategy of simplifying the organization. For the year, the natural / organic segment increased 24.9 percent.

LTM as of December 31, 2019 | EV = Enterprise value

Source: S&P Capital IQ, The Hain Celestial Group, Inc. and Baker Tilly Capital research (January 2020)

For more information on this topic, or to learn how Baker Tilly specialists can help, contact our team.