Electronic filing for tax-exempt organizations – new rules under the Taxpayer First Act

Background

On July 1, 2019, the Taxpayer First Act (TFA) was enacted into law, granting taxpayers more rights and changing the Internal Revenue Service (IRS) administrative procedures to be more taxpayer-friendly. The IRS plans to meet the TFA requirements by developing comprehensive customer service, modernizing its technology and enhancing its cyber security. In addition, the TFA mandates electronic filing for certain tax-exempt organizations. With the electronic filing requirement, the intent of TFA is to expand access to Form 990 information.

Pre-TFA tax-exempt organization filing requirements

Prior to the effective date of the TFA, a tax-exempt organization was required to electronically file its Form 990 if it:

- Filed at least 250 returns of any type during the calendar year: including income tax, employment tax and information returns (e.g. Forms 1099 and W-2); or

- Had total assets of $10 million or more at the end of the tax year

In addition, organizations that qualified to file the Form 990-N (having average gross receipts under $50,000 and total assets under the Form 990 threshold) were also required to electronically file their Form 990-N postcard each year.

Any tax-exempt organization that did not meet the two criteria above had the option to file electronically or by mail. There were also exceptions that required paper filing, regardless of whether the two criteria above were met:

- Legal name change

- Short year/short period, except for short period final returns

- Returns from organizations not recognized as exempt

- Returns older than two prior years; a tax-exempt organization filing for the current year or two prior tax years can remit electronically

Conversely, all tax-exempt organizations filing Form 990-T were limited to paper filing since electronic filing of that form was not available.

TFA tax-exempt organization filing requirements

The TFA now mandates that all of the following forms be electronically filed as of the first taxable year beginning after July 1, 2019:

- Form 990, Return of Organization Exempt for Income Tax

- Form 990-PF, Return of Private Foundation or Section 4947(a)(1) Trust Treated as a Private Foundation

- Form 8872, Political Organization Report of Contributions and Expenditures

- Form 1065, U.S. Return of Partnership Income (if filed by a section 501(d) apostolic organization)

TFA tax-exempt organization filing requirements for Form 990-T and Form 4720

The TFA will also require electronic filing for Forms 990-T and 4720 in 2021 (for the tax year 2020) or once the IRS updates its system to enable e-filing of these forms. The IRS will continue to accept paper-filed forms until e-filing is available.

TFA small organization relief

The TFA provides a delay for small tax-exempt organizations, i.e., those filing Form 990-EZ who have gross receipts of less than $200,000 and gross assets of less than $500,000 at year-end. Form 990-EZ will need to be electronically filed for taxable years beginning after July 1, 2021.

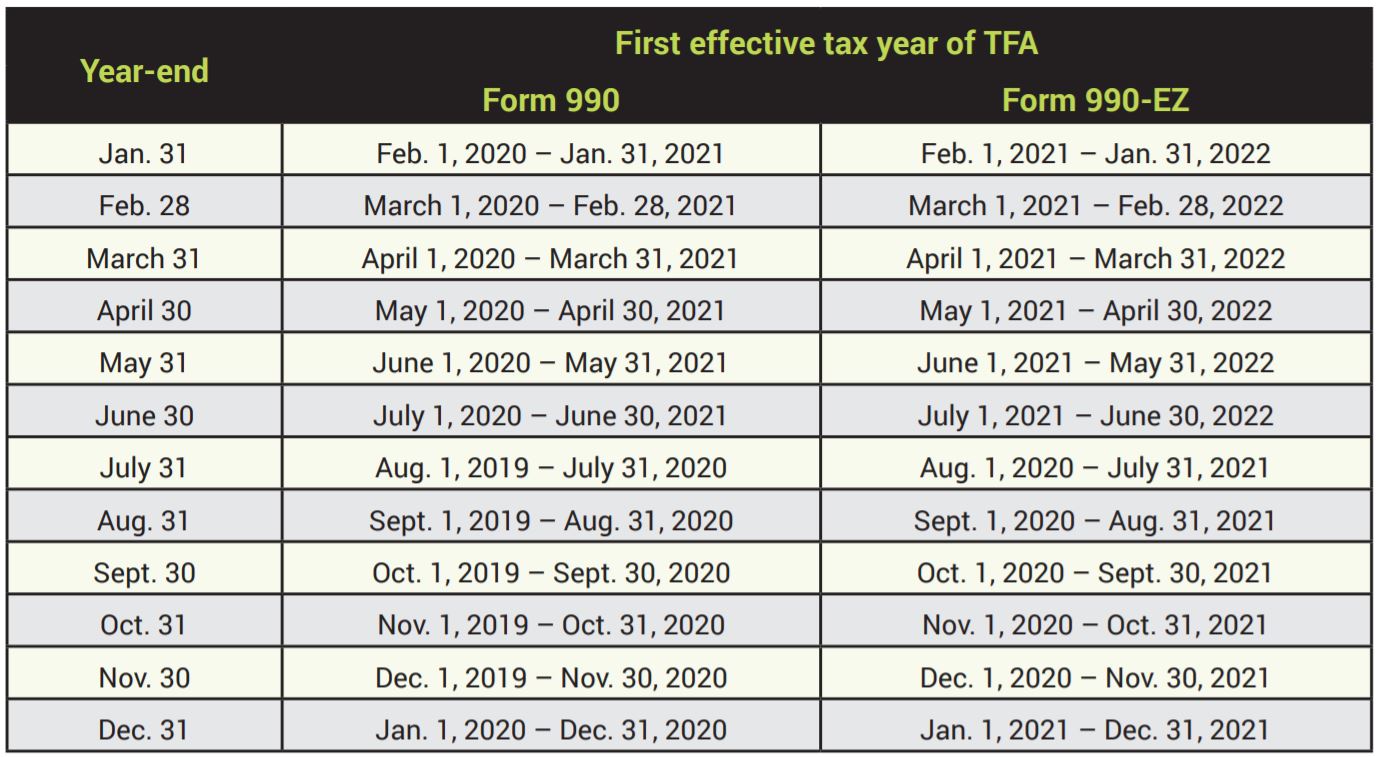

Year-end guide

The TFA mandates the following forms be electronically filed as of the first taxable year beginning after July 1, 2019, or July 1, 2021, for small organizations:

What should organizations do now?

The IRS is in the process of sending correspondence to tax-exempt organizations regarding the new electronic filing requirement. If you currently do not electronically file the Form 990 or 990-PF, we recommend the following:

- Evaluate the pre-TFA tax-exempt organization filing requirements to determine whether e-filing may have been required prior to the effective date of the TFA.

- Review the instructions for the Form 990 or Form 990-PF to ensure any required schedules and supplemental forms are completed and included. With the e-file mandate, it will be easier for the IRS to conduct data scans for missing or unusual items on the form.

- Consider engaging a third party to review or file your tax form if you haven’t in the past, to ensure your Form 990 or Form 990-PF is in compliance with the instructions and current reporting requirements.

For more information on this topic, or to learn how Baker Tilly specialist can help, contact our team.

There have been no changes made to the aforementioned TFA requirements under the Families First Coronavirus Response Act or IRS Notice 2020-18, but please check back regularly as we continue to monitor for any updates.

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.