Tax Evolution & Automation

Tax Evolution & Automation

Michele Donohue

Principal

John Bennecke

Principal

James Hedderman

CPA

Principal

Josh Din

CPA

Principal

With increasingly complex and demanding digital compliance requirements, traditional tax operations are no longer enough. Our transformation specialists help clients build and operate new tax technology that helps reduce risk, accelerate results, and helps their business stay ahead of the curve.

What is tax evolution and automation?

Between outdated technology, multiple source systems, lack of system integration and time-consuming manual consolidation, tax professionals face many challenges. Add on top of that the sheer amount of data tax professionals need to utilize on a daily basis and you quickly reach a point where the traditional way of working no longer works. The only way to keep up is to look to advanced technologies to help manage your tax data. Tax evolution and automation is the process by which large amounts of unmanageable data become manageable through tools like robotic process automation (RPA), artificial intelligence (AI) bots and the implementation of software solutions.

Tax system automation is typically used to help companies organize data surrounding:

- Sales and use tax

- State and local tax

- Indirect tax

- Value-added tax

- Transfer pricing

- Federal tax compliance

- State tax compliance

- Tax provision

This automation eliminates the potential for human error, provides more accurate calculations and saves tax professionals countless hours of doing manual work.

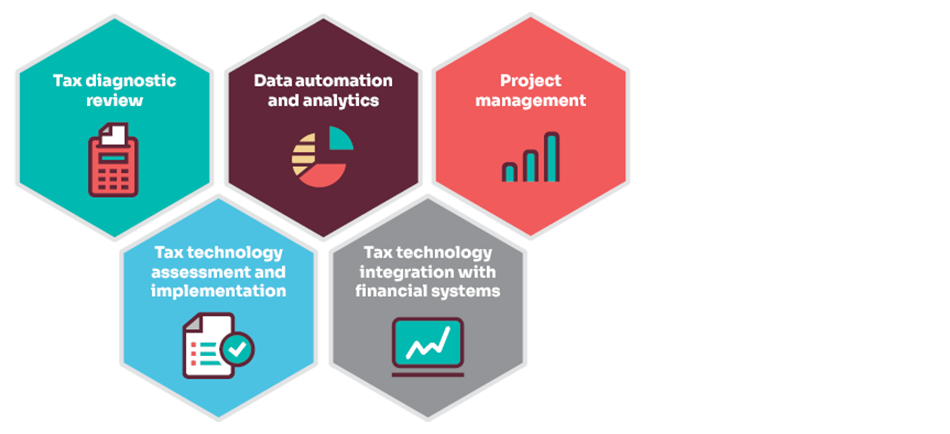

However, the process of understanding what needs to be done, how it should be done, and executing the project requires a specialized set of knowledge of both advanced digital techniques and up-to-the minute understanding of tax legislation and regulations. Baker Tilly can help by providing insights and best practices in the tax transformation journey.

- Gather data and document current state of tax department including information around people, process and technology

- Identify gaps and pain points, then provide recommendations and a technology roadmap based on benefits, budget and resources

- Tax technology “software” and process review, redesign and enhancements leveraging investments already made

- Develop functional and technical specifications for process and technology functionality, including documentation for future step processes

- Tax compliance and provision software implementation (e.g., ONESOURCE, Corptax, Oracle Tax, Longview)

- Indirect tax determination and compliance tax technology implementation (e.g., ONESOURCE, Vertex, Avalara)

- RPA to complement and integrate with existing process/technology

- Review existing process to identify gaps and pain points in manually intensive processes for operational gains from process automation

- Gather and leverage data and business requirements to design future state, make informed decisions and identify opportunities

- Develop data visualizations that provide meaningful insights

- Sensitization of tax ledgers (federal, state, local) and legal entities

- Reporting of local, functional and reporting currencies and provide sufficient detail for tax apportionment data by state jurisdictions

- Identify transfer pricing accounts for future reporting needs

- Assist with integration of indirect tax transactions, including strategy across inter-company transactions, and consideration of third-party solutions (e.g., ONESOURCE, Vertex, Avalara, Sovos)

- Gather localization requirements like invoicing, enterprise resource planning (ERP) set up, and tax reporting

- Develop and manage client communications, master work-plan and timeline in order to keep milestones on track

- Document outcomes and coordinate the resolution of open items or follow-ups that qualify for potential improvements or have opportunities for enhancement

“Finance and tax professionals can spend more than 50% of their time gathering data that could otherwise be spent on value-added activities. As your guide in the tax transformation process, our job is to reduce your manual effort, improve processes and set you up for success.”– Josh Din, Partner, Tax evolution and automation

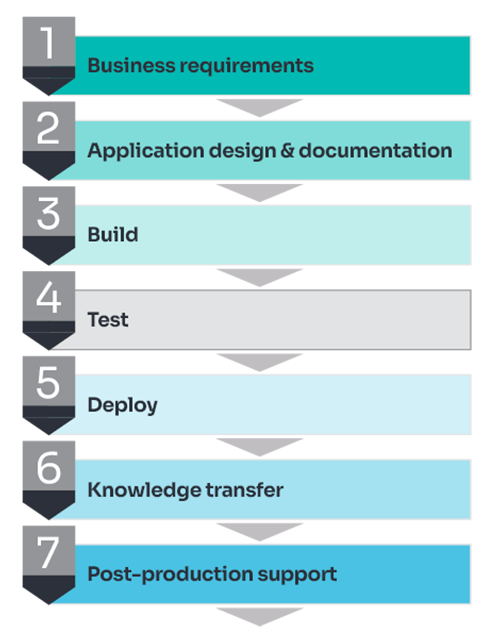

Our approach

We work with clients of all sizes to develop a detailed work plan for their tax technology transformation in alignment with their specific needs. Delivered using Baker Tilly’s transform framework, our work plan provides continuity, accelerated results and reduced risk.