At a glance

Making Tax Digital (MTD) is a government initiative aiming to simplify the way businesses record and report their income, expenditures and taxes.

MTD for value-added tax (VAT) requires VAT registered businesses with taxable turnover above the VAT registration threshold to keep records in digital form and file their VAT Returns using software.

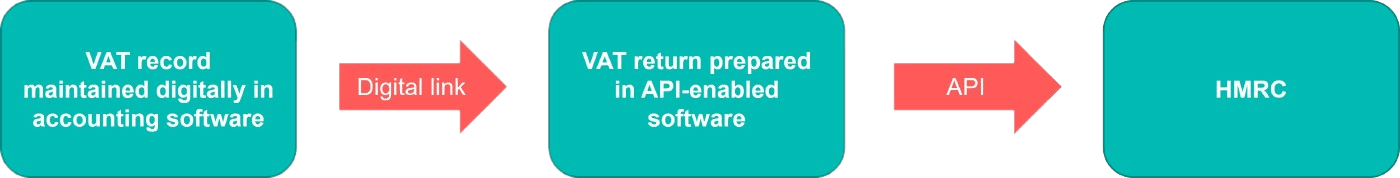

Baker Tilly Digital Making Tax Digital for IFS provides a digital link between IFS applications and HM Revenue & Customs (HMRC). This way, IFS will record all sales, purchases and expenses in a digital format and then transfer the totals for each of these to application programming interface (API)-enabled software which prepares the VAT Return.

The Baker Tilly Digital MTD for IFS is fully compliant with the relevant HMRC requirements, including the digital link to IFS and API submission to HMRC allowing you to use your IFS platform to submit all necessary information on your behalf.