White House framework on digital assets points to importance of continuous monitoring by companies, investors

Cryptocurrencies, a digital asset, have been free from financial regulation for some time. As the use of cryptocurrency increases, new risks emerge for consumers, investors, and organizations.

The ecosystem of digital assets – cryptocurrencies, blockchain, nonfungible tokens (NFTs), decentralized finance (DeFi), decentralized autonomous organizations (DAOs), and more – is young and volatile. In November 2021, non‑state issued digital assets reached a combined market capitalization of $3 trillion, up from approximately $14 billion in early November 2016. However, the value of one type of digital asset – cryptocurrencies – dropped significantly between November 2021 and September 2022. According to the FBI, reported monetary losses from digital asset scams were nearly 600% higher in 2021 than the year before.

More recently, in May 2022, the collapse of TerraUSD, one of the most popular U.S. dollar-pegged stablecoin projects, cost investors tens of billions of dollars as they pulled out in a panic that some compared to a bank run. Widespread buy-in bolstered by supportive reporting from respected financial institutions lent credibility to Terra, further driving the narrative that stablecoins were a legitimate and safe investing vehicle.

New framework

To address the impact of the risks on consumers, investors, and businesses, the White House on September 16 issued a framework for responsible development of digital assets. The framework builds on the Executive Order issued by President Biden in March 2022. To date, nine federal agencies have issued reports focusing on the following areas:

- protecting consumers, investors, and businesses

- promoting access to safe, affordable financial services

- fostering financial stability

- advancing responsible innovation

- reinforcing global financial leadership and competitiveness

- fighting illicit finance

- exploring a U.S. Central Bank Digital Currency (CBDC)

The framework points to the direction federal agencies will take to issue future regulations or guidance to establish stability in the digital assets space and help make them safe and affordable financial options.

The White House framework attempts to both promote innovation in the digital assets space as well as mitigate the downside risks. Financial institutions and investors need to be aware of and prepare for the benefits of digital assets innovation while protecting themselves from potential risk. Over the next several months, Baker Tilly will provide specific guidance and tips as we monitor the next steps taken by the federal agencies who have contributed to the framework. Some of the things our practitioners are paying close attention to include:

- emerging risks, including national risk assessments for decentralized finance (DeFi) and NFTs

- domestic and global regulation and enforcement related to AML and combatting financial terrorism (AML/CFT)

- updated BSA regulations

- U.S. attempts to remain a leader in financial payments and technology

- Accurate validation of cryptocurrency

Fraud and Anti-Money Laundering (AML)

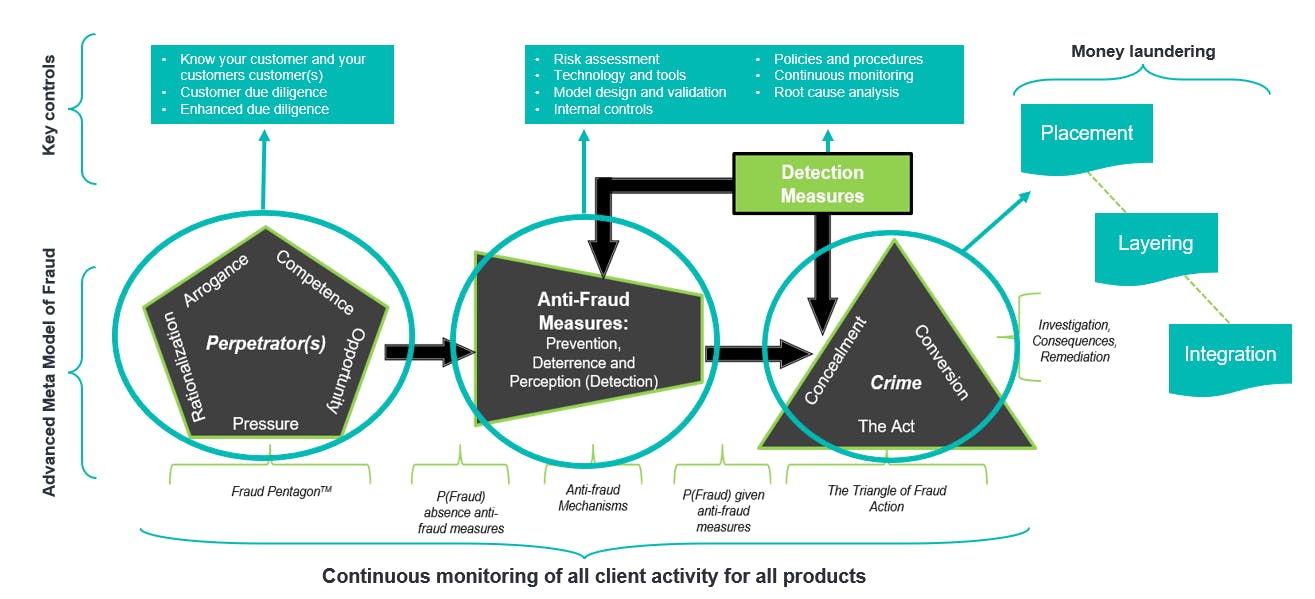

Cryptocurrencies can make it easier for fraudsters to obscure the source of criminal proceeds and are increasingly becoming the preferred currency of cyber criminals. Understanding the relationship between fraudsters and the ecosystem of digital assets is crucial because it can be a haven for the financial transactions of criminals and terrorists. It also helps direct resources to combat money laundering and other illicit activity, which is strongly advised and consistent with the regulators’ expectations. Organizations need to focus on and continuously monitor the human element of potential perpetrators and the activities or alleged crimes. So, understanding the relationship between fraudsters and the ecosystem of digital assets is crucial. We have synthesized our understanding into a concept or model we call the Fraud and Anti-Money Laundering Landscape (FRAML).

FRAML™ - Fraud and Anti-Money Laundering Landscape

FRAML connects the “why-based” fraud pentagon with the “what-based” triangle of fraud action to accentuate the importance of the human element and anti-fraud measures. After all, it is humans that commit crimes and execute money laundering tactics, not books and records. The FRAML model includes several key anti-fraud measures that must be considered, including knowing your customer, which is an attempt to ensure you don’t do business with bad actors.

The triangle of fraud action focuses on the specific elements of the fraud or financial crime, including the act, the concealment, and the conversion of benefits that accrue to the perpetrator.

FRAML highlights the critical role of anti-fraud efforts: Between the perpetrator and the criminal act are anti-fraud interventions designed to reduce the incidence and impact of fraud. The profession has identified these activities as prevention, deterrence and the perception of detection.

Regulators have emphasized that monitoring and evaluation of a compliance program should be data-driven and continuous. This, along with feedback from internal audits, external audits, investigations, employee surveys, and the like, will help ensure the compliance program is evolving and risk-based.

To learn more about Baker Tilly's digital assets services, visit our homepage or connect with our specialists.