Using foreign business development to drive market expansion

Your product has international appeal, and you have identified potential new markets to explore. The next step is to consider the human element in generating leads and closing new business. Hiring a business development leader abroad can be a powerful and efficient way to test and enter new markets. In addition, it can also be a smart first step toward diversifying your revenue base and assimilating new business models.

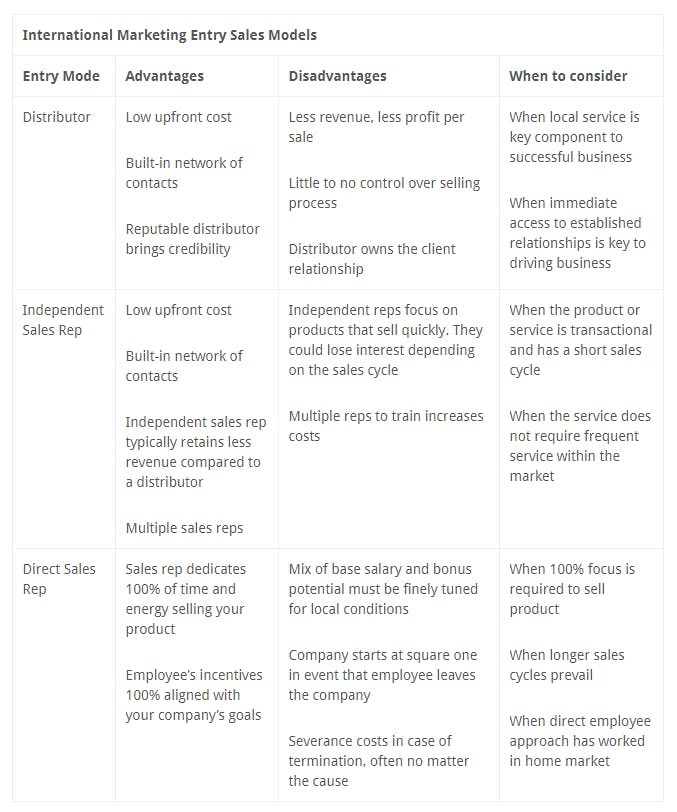

For most countries outside the United States, the art of conducting business places a greater emphasis on developing in-person relationships within a high context culture. With that in mind, three main entry sales models are available:

- Partner with a local distributor in the foreign market

- Partner with an independent sales representative who sells your product and other competing or non-competing products at the same time

- Hire a direct sales representative who focuses solely on selling your product

Each of these options has benefits and disadvantages. Baker Tilly International Growth Specialists detail some of the pros and cons below, as well as when you might consider each option. Regardless of which market entry approach you choose, focusing on the human element is critical in order to effectively bridge cultural gaps and build rapport with the local customer base. And aside from the main goal of increased revenue and new market share, over time a gradual knowledge share could provide your organization with an even more regionalized approach to your ongoing global strategy.

To achieve superior results with less risk in shorter timeframes, we recommend that you seek the expertise of an international business advisor who can help your organization uncover and harvest near- and long-term growth opportunities.

For more information or any questions you might have on this topic, please contact your Baker Tilly Valued Business Advisor or contact one of our International Growth Services Specialists.

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.