Top ESG reporting trends and their impact on private equity

Matt Mikulay and James Schoppe, two senior managers on Baker Tilly’s risk advisory team, recently hosted a webinar in collaboration with the Association for Corporate Growth (ACG). In the webinar, Matt and James discussed the basics of environmental, social and corporate governance (ESG), top ESG reporting trends and their impact on private equity.

Commonly referred to as corporate sustainability, ESG stands for environmental, social, and corporate governance and refers to the consideration of these three factors (alongside financial factors) in the investment decision-making process.

Environmental may apply to issues such as climate change, waste management and energy efficiency. Social can include human rights, supply chain labor standards and workplace health and safety. Governance may encompass rules and principles that define the rights, responsibilities and expectations of stakeholders throughout the company – or other companies.

In modern business, all of these elements need to be taken into consideration, along with financial factors. The days of key stakeholders being interested only in financials and profits are over, and entities must evaluate ESG risks and opportunities as part of their long-term value creation and strategy.

The pandemic has played a significant role in entities needing to revalue the risks and opportunities they are facing. In addition to COVID-19, factors such as climate change and social justice initiatives have forced investors and stakeholders to think about these factors as long-term considerations. Entities are facing increased pressure from regulators, investors and stakeholders (both internal and external) to prioritize ESG efforts. Focusing on the financial reports is no longer good enough.

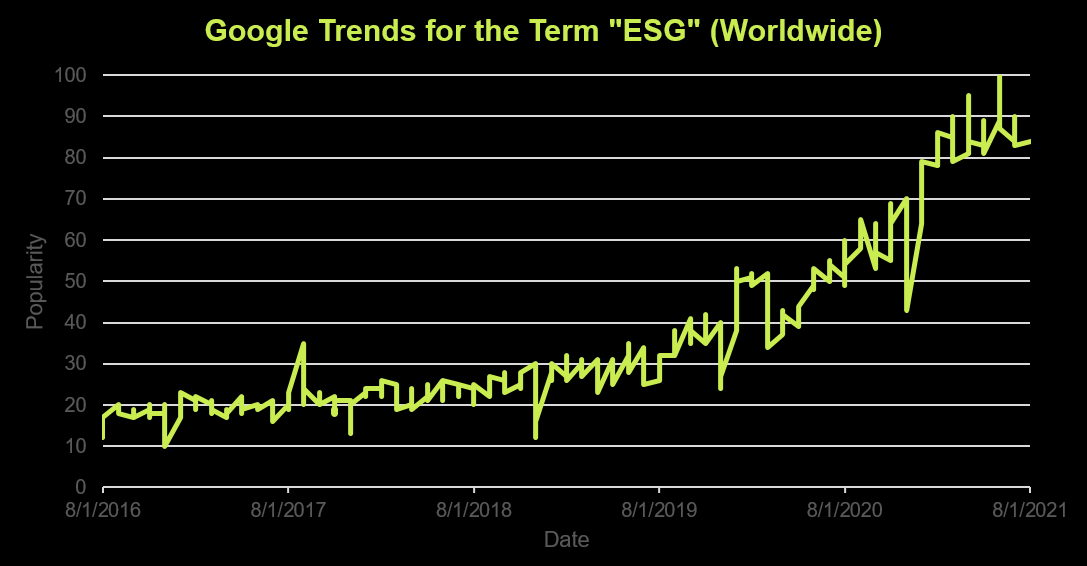

As evidence of the rising popularity of ESG, we can simply look at worldwide Google trends for the term “ESG.” As seen below, it is clear ESG is on the radar of the general population more than ever – and that trend does not seem as if it’ll disappear anytime soon – which is gaining attention from corporate executives.

As far as why we are in this current ESG landscape, the primary reasons can be broken down into four areas.

- Priority for investors and shareholders: Investors are urging companies to build ESG into their long-term strategy. Both individual and large institutional investors are demanding more ESG-related disclosures and reporting to help them make investment decisions. In fact, money invested in ESG funds more than doubled in 2020. Additionally, data shows the stocks of sustainable companies tend to outperform those in less sustainable companies.

- Regulatory: Ongoing initiatives to make sustainability a reporting and disclosure requirement are currently underway. While publicly traded companies are currently required to disclose material risks in their 10-Ks, there are no regulatory mandates for specific ESG reporting or disclosures at the moment. However, the SEC has created an ESG investing resource page on their website, and established a climate and ESG task force. Further, the SEC Investor Advisory Committee has indicated ESG will be a top priority in FY22, and recent remarks by SEC Chairman Gary Gensler support this increased focus. Regulatory bodies are becoming increasingly interested in this area, and we can expect that trend to continue.

- Key stakeholders in an entity’s business operations: Suppliers and customers are becoming more interested in partnering with and purchasing from companies that are focused on sustainability. They see a potential for decreased cost, increased revenue and better utilization of natural resources.

- Wealth transfer to younger generations: Organizations that are transparent in their ESG reporting are appealing to younger generations, who place a higher priority on sustainable reporting than older generations do. Younger generations also tend to be better advocates for ESG causes and thus are drawn to companies that share this value.

While ESG reporting remains largely voluntary, entities should be aware that ESG “raters” such as MSCI, Sustainalytics, and the CDP (formerly the Carbon Disclosure Project) are actively rating companies on ESG and sustainability reporting. Additionally, the CDP, Climate Disclosures Board, Sustainability Accounting Standards Board (SASB), International Integrated Reporting Council (IIRC) and the Global Reporting Initiative (GRI) released a joint statement in September 2020 to outline their commitment to establishing global sustainability standards. This would facilitate the transition to develop a universal set of standards and consolidate the different ESG frameworks to provide increased industry-wide transparency. The end goal is to create one system of reporting with universal transparency, and eliminate certain aspects of confusion and uncertainty regarding which ESG reporting framework or set of standards entities should use.

In addition to impacting public, private and not-for-profit organizations all over the world, ESG continues to have a profound impact on the private equity space. As for why private equity investors feel so strongly about this matter, we have highlighted four key reasons:

- Investment decisions: Many private equity investors are demanding companies have a sustainability mindset as part of their core values. In turn, companies are taking this seriously, because both positive and negative public opinion surrounding ESG can have an impact on a company’s value.

- Due diligence: In any investment strategy where ESG is being prioritized, the information needs to be verified and incorporated into a value assessment. Investors are still learning what information they need and how to acquire it – this is all part of the due diligence process.

- Internal firm values and ESG principles: It’s clear positive ESG ratings (which are derived in part from values and principles) are important to private equity investors, who are looking for credibility in this field.

- Portfolio company ESG information gathering: Private equity firms have influence, both before and after a transaction, in terms of keeping a portfolio company in line – in many regards. As it pertains to ESG, the PE firm’s desires will have a direct impact on operations.

ESG-focused strategies are not the only path for private equity firms to follow. However, there are benefits to integrating ESG elements into investing. The primary benefits, as we see them, are broken down as follows:

- Increased demand: The market – vendors, suppliers and investors – is demanding an ESG focus. It is becoming increasingly more common for companies to be more inquisitive around other organizations ESG strategies prior to agreeing to do business with them. Companies of every size are looking for guidance and assistance with ESG strategies, so at the very least it’s critical to start a dialogue around the topic. Organizations will always be exposed to ESG risk, so it is important to demonstrate awareness and develop mitigation strategies to manage the risks.

- Cost savings: If a company is truly concerned with ESG and has factored sustainability into its risk model, then long-term solutions are valued over short-term results.

- Legal and regulatory mitigation: Being proactive about legal and regulatory risks should limit litigation costs, strengthen compliance and attract investors. The end result could improve a company’s reputation and create customer loyalty.

- Increase productivity: New entrants to the workforce want to work somewhere that they believe in a company’s mission. And of course if an employee is happy, they tend to be more productive and stay at a company longer.

Private equity firms need to begin considering and responding to ESG now, if they aren’t already. Some initial steps private equity firms and their portfolio companies can begin to take include:

- Develop a point of view on ESG for your firm or company

- Establish internal “policy” or governance documents

- Define how ESG will impact your investment decisions

- Begin to develop procedures for gathering ESG information in the due diligence process

- Understand your stakeholders and what ESG information they might need

- Monitor the ESG landscape, and changes in frameworks/standards/regulation

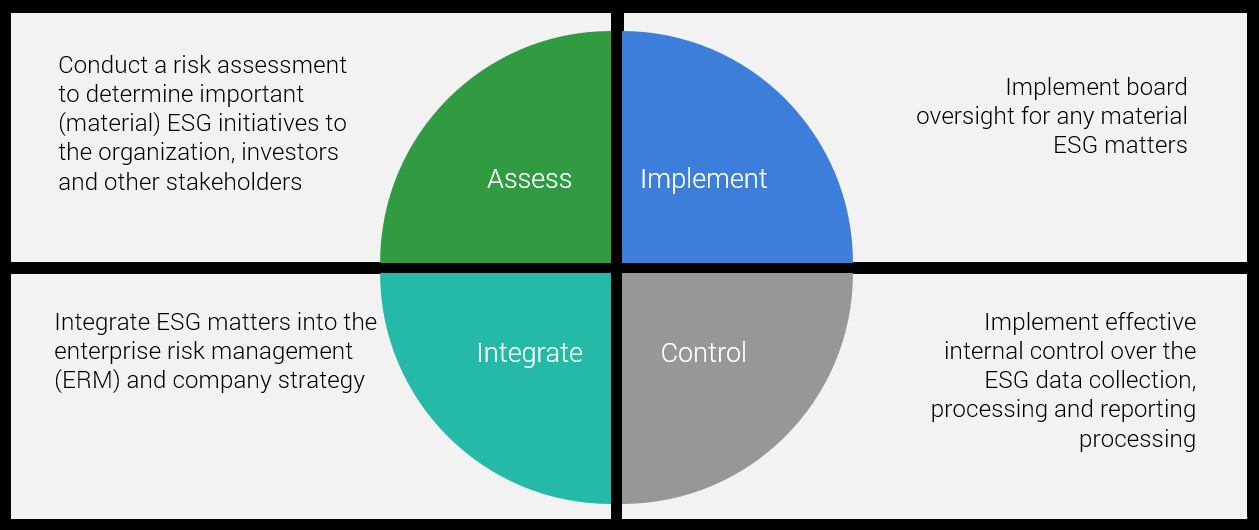

In all, we’re talking about proactive compliance – and operationalizing it. As depicted below, entities need to proactively and intelligently assess, implement, integrate and control their ESG-related risks and opportunities, in order to respond to changing stakeholder demands.

For more information about this topic, or to learn how Baker Tilly’s Value Architects™ can help, contact our team.