The road to recovery: tax strategies to increase your cash flow

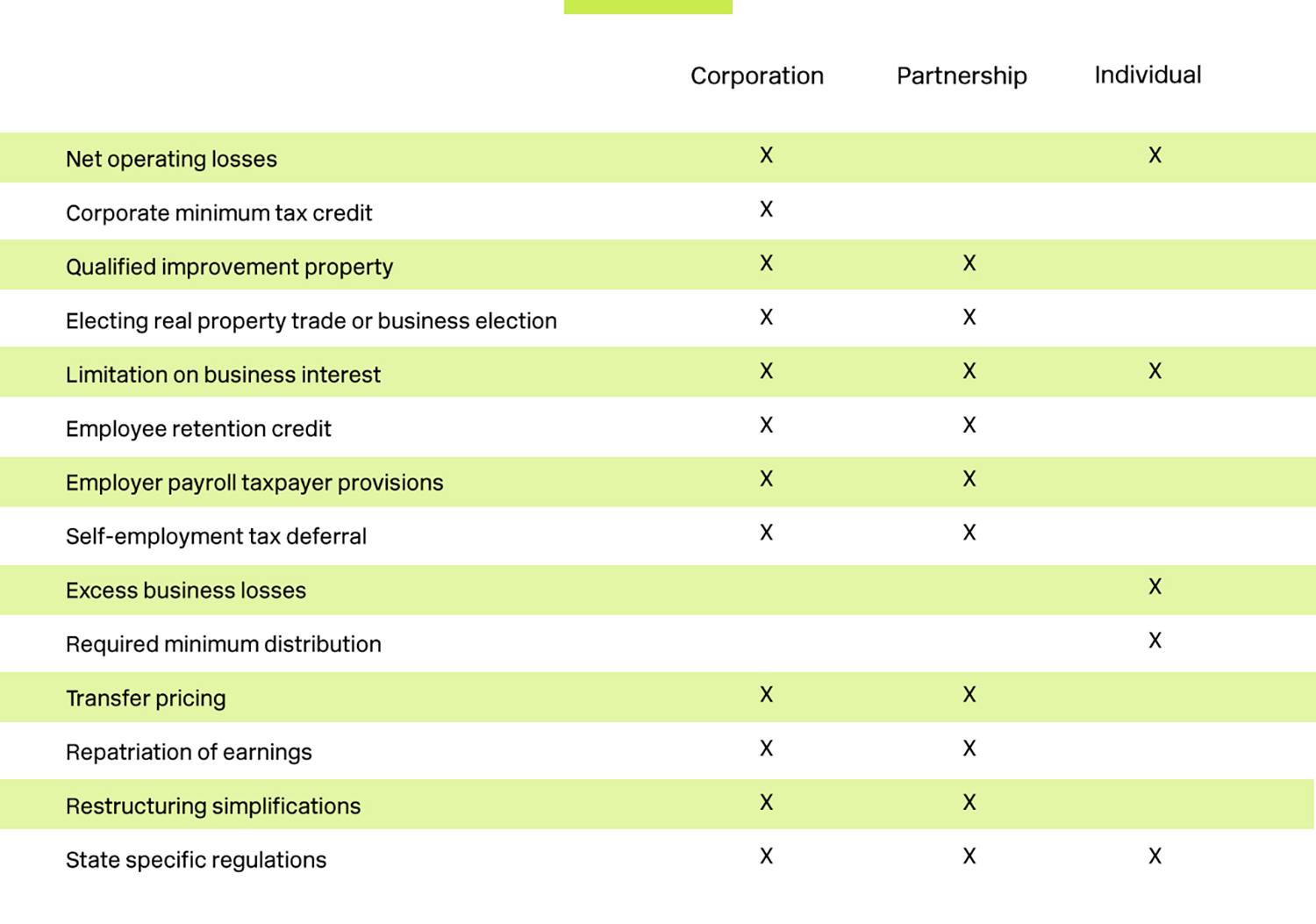

Corporations, partnerships and individuals are all learning how to use the changes in the CARES Act and other tax strategies to help boost their cash flow during this recovery phase of the COVID-19 pandemic. Baker Tilly has created this guide to help you understand what strategies may be applicable to you.

View larger table

Learn more about these strategies by contacting us or visiting the latest resources below:

Net operating losses

IRS provides guidance on the CARES Act five-year NOL carryback

Congress enacts CARES Act providing COVID-19 relief

Corporate minimum tax credit

Congress enacts CARES Act providing COVID-19 relief

Qualified improvement property

Planning to manage the QIP and business interest expense changes

IRS issues guidance on bonus depreciation for QIP

Bonus depreciation on qualified improvement property

Congress enacts CARES Act providing COVID-19 relief

Electing real property trade or business election

Congress enacts CARES Act providing COVID-19 relief

Limitation on business interest

Planning to manage the QIP and business interest expense changes

Congress enacts CARES Act providing COVID-19 relief

Employee retention credit

Federal coronavirus rescue programs

IRS significantly expands employee retention credit FAQ

IRS expands allocable healthcare expenses eligible for employee retention credit

Employer payroll taxpayer provisions

Congress enacts CARES Act providing COVID-19 relief

Self-employment tax deferral

Congress enacts CARES Act providing COVID-19 relief

Transfer pricing

International taxation relief provisions

Repatriation of earnings

International taxation relief provisions

Restructuring simplifications

State specific legislation and regulations

Qualified improvement property

Planning to manage the QIP and business interest expense changes

IRS issues guidance on bonus depreciation for QIP

Bonus depreciation on qualified improvement property

Congress enacts CARES Act providing COVID-19 relief

Electing real property trade or business election

Congress enacts CARES Act providing COVID-19 relief

Limitation on business interest

Planning to manage the QIP and business interest expense changes

Congress enacts CARES Act providing COVID-19 relief

Employee retention credit

Federal coronavirus rescue programs

IRS significantly expands employee retention credit FAQ

IRS expands allocable healthcare expenses eligible for employee retention credit

Employer payroll taxpayer provisions

Congress enacts CARES Act providing COVID-19 relief

Self-employment tax deferral

Congress enacts CARES Act providing COVID-19 relief

Transfer pricing

International taxation relief provisions

Repatriation of earnings

International taxation relief provisions

Restructuring simplifications

State specific legislation and regulations

Net operating losses

IRS provides guidance on the CARES Act five-year NOL carryback

Congress enacts CARES Act providing COVID-19 relief

Limitation on business interest

Planning to manage the QIP and business interest expense changes

Congress enacts CARES Act providing COVID-19 relief

Excess business losses

Congress enacts CARES Act providing COVID-19 relief

Required minimum distribution

Congress enacts CARES Act providing COVID-19 relief