The danger to valuation of eliminating corporate interest deductibility

“The road to hell is paved with good intentions,” as the saying goes. Will the same be said of eliminating the tax deductibility of corporate interest expense? The need for corporate tax reform is broadly accepted and the debate includes a focus on revisions to the tax code relating to corporate interest expense. However, the discussion should be tempered with a careful examination of the broader impact of a change to this part of the tax code and the implications for corporate value.

The 2016 presidential election is bringing a flurry of issues to the attention of the American public as candidates develop and refine their positions and proposals on resonant issues, such as tax reform. A key feature in the discussion of tax reform is the future of corporate interest deductibility. This debate should be tempered with education, understanding and a full examination of the greater economic implications of changing the tax code.

Tax Reform Debates — The Search for Symmetry

The discussion of corporate interest deductibility in the tax code is not limited to a single candidate or party but encompasses a wide-reaching debate that crosses party lines, and it could have a significant impact on the future of many American companies.

The debate over changing corporate taxation tends to center on two issues: 1) treating taxation of equity and debt investments equally; and 2) achieving revenue neutrality in a politically polarized landscape.

How it Works

In the middle market, the first line of financing for many companies is bank debt, as equity financing can be expensive or hard to access. For more than a century, the interest on corporate debt has been viewed as a business expense and therefore fully deductible under the tax code. The ability to deduct interest expense makes bank debt an obvious option for businesses to finance operations and capital investments.

Proponents claim that the deductibility of interest promotes the sustainability of corporate growth by making funding options attractive to companies. Detractors assert that interest deductibility provides a perverse tax incentive to incur debt to fund growth, which could lead to companies becoming overleveraged and risking bankruptcy.

The Impact on Valuation

What is missing in the current debate is recognition of the great impact that changing the tax code will have on corporations. Beyond a revenue neutral change and shift to symmetry in how investments are treated, the reduction or elimination of interest expense deductibility will affect more than just a company’s cash flow.

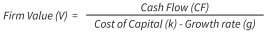

Let’s bring it back to basic financial principles. The value of a company is a function of three elements: cash flow, growth rate and cost of capital. Perhaps this formula is familiar:

This foundational relationship should be a rallying point for education in the debate over the deductibility of interest expense. Corporate interest deductibility impacts not only the available cash flow or a company—because it affects earnings—but also the cost of capital and likely the growth rate as well.

Many of the presidential candidates use reassuring phrases like “revenue neutral” to describe their proposals; however, the impact could be more far-reaching with long-term implications for corporate valuation and the U.S. economy. As such, any discussion about changes to the tax deductibility of interest expense cannot stop at whether such changes are revenue neutral at the corporate or personal levels because that only addresses the cash flow aspect of the impact to companies.

What also must be addressed is whether such proposals will affect the cost of capital for middle-market companies or their ability to generate growth. Both of these factors play an incredibly important role in corporate valuation, and in many instances a more important role than a company’s earnings.

A comprehensive study is underway to identify the likely effects of the change in interest deductibility on middle-market companies. The goal of the study is to promote a fully informed discussion around the issue and the potential impact on business valuation.

Watch for the forthcoming results of the study, conducted by ACG and RGL.

As appeared in Middle Market Growth, January/February 2016.

For more information on this topic, or to learn how Baker Tilly specialists can help, contact our team.

*Effective December 2018, RGL Forensics joined Baker Tilly US, LLP. This article was published while we were RGL Forensics. The author(s) or team member(s) quoted from RGL are now employees of Baker Tilly.