Introduction to charitable remainder trusts

Beyond making contributions directly to charity or utilizing donor-advised funds or a private foundation, other options to benefit charity involve the use of so-called split-interest charitable gifts. One version of such a gift is the CRT. Working with your attorney, you create a trust for the ultimate benefit of one or more charities of your choosing. As the donor, you contribute assets to the trust and retain the right to receive a stream of payments, typically for a number of years. You also receive a charitable income tax deduction for the year in which you make the contribution. This is based upon the present value of the remainder interest that will pass to the charitable beneficiaries. The factors used in computing the present interest are the following:

- The value of the asset contributed to the trust;

- The term of the trust (how long the payments to you, the donor or other beneficiaries of your choosing);

- The stated rate of the payout;

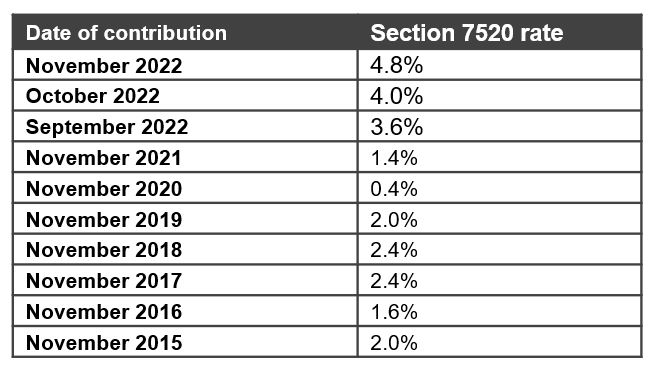

- The section 7520 rate (the interest rate for predicting the growth of the assets); and

- The timing or frequency of the payments to you (e.g., annually, quarterly, etc.)

During the period that you have the right to payments from the trust, the trustee is obligated to make those payments to you, typically from income generated by whatever assets the trust owns. This is where the decision of which assets to give to the trust is important. Among other factors to consider are the asset’s liquidity (because often the asset is sold by the CRT), ease of valuation, freedom from encumbrance, and income taxation.

Example of how a CRT works

Susan, age 60, establishes a CRT in November 2022 and makes a contribution of $1 million of publicly traded securities. The Section 7520 rate for November 2022 is 4.8% (higher than either of the prior two months). The CRT pays her $75,000 annually for 10 years. The present value of Susan’s annuity stream is $584,797.50. The present value of the charity’s interest (and Susan’s income tax charitable deduction) is $415,202.50 ($1 million less $584,797.50).