Shaping your capital funding strategies for 2024 and beyond

As the 2024 budget season approaches, it is important for municipalities and school corporations to shift their focus toward capital funding strategies for the coming years.

The opportunity: Leveraging property tax debt

In recent years, a growing number of school corporations, cities, towns and counties have turned to property tax debt as a strategic tool used to manage tax rates and to fund essential capital projects. There are two advantages to this approach:

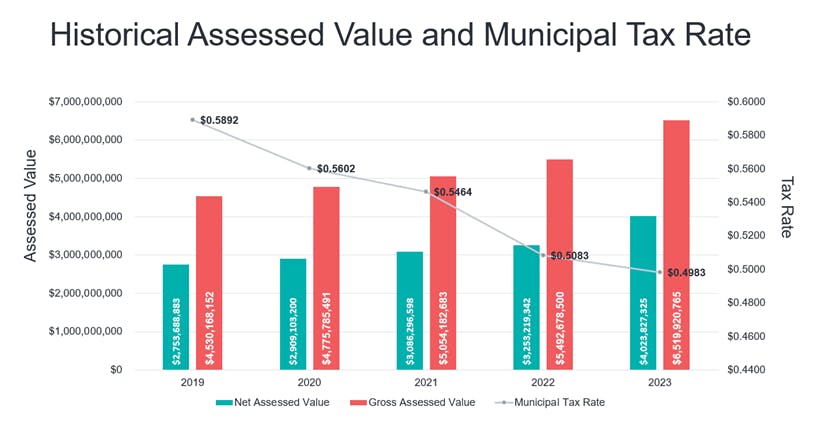

1. Tax rate management: Based on Department of Local Government Finance (DLGF) Certificate of Net Assessed Value data, from 2022 to 2023 statewide net assessed values increased by approximately 14.8%, and the growth from 2023 to 2024 is approximately 5.9%. Growth in assessed value that outpaces growth in property tax levies places downward pressure on property tax rates (see graphic below illustrating the relationship).

2. Funding capital projects: By strategically utilizing property tax debt, taxing units can generate funds for capital projects, relieving pressure on funds that may be needed for operations.

Source: DLGF Budget Orders and County Abstract Reports for the Town of Zionsville, Ind. and Boone County, Ind.

Things to consider:

While property tax debt offers an attractive solution, it's essential to be mindful of various factors that can impact your community's financial health and taxpayer satisfaction:

- The financial decisions of one taxing unit can have consequences for the entire community. It’s important to understand what all of the taxing units within your community are doing and how their actions affect your unit’s budget.

- Tax rate management alone does not address the assessed value component of the property tax bills. Increasing assessed values with level tax rates can lead to higher tax bills for taxpayers. It is important to develop a full picture of your community’s assessed value and tax rate dynamics, and to accurately communicate that information to community stakeholders and taxpayers.

- Capital funding should address the immediate needs of the community, while also building a sustainable and resilient future for its constituents.

- Property tax debt is just one tool available for financing capital projects. Successful communities explore various resources to meet their financial needs.

- Capital project funding decisions should be undertaken within the context of a larger strategic financial plan that accounts for the capital and operational needs of your community.

- Strategic capital decisions can create opportunities for collaboration with public and private partners. Explore the collaborative possibilities with your projects, which may allow your community to unlock efficiencies that may not be achievable otherwise.

The end of the budget process is a perfect time to begin planning activities for long-term financial and capital planning. Working with fresh budget information and year-end data positions your community for success in the new year.

Chart your community’s path with Baker Tilly specialists who can assist your community with comprehensive long-term financial and capital planning and bring together professionals who impact the financial decisions across local taxing units.