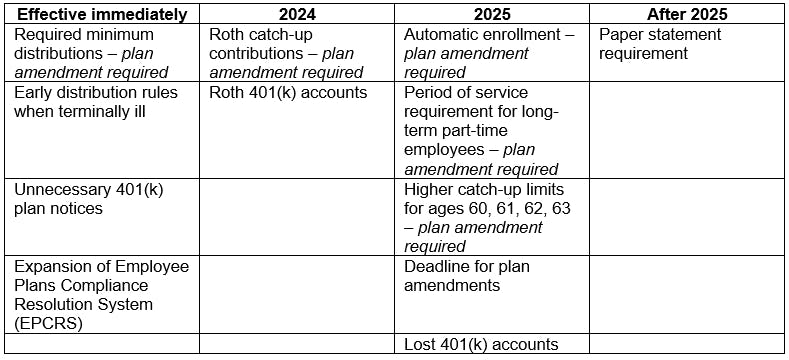

SECURE 2.0: Mandatory changes for 401(k) plans

Summary of required provisions

Explanation of required provisions

1. Provisions effective immediately

Required minimum distributions

Generally, former employees and retirees will withdraw their vested account balances in a 401(k) plan or transfer it to another qualified plan or an IRA. For these individuals, employers do not need to be concerned with required minimum distributions (RMDs).

If, however, an employer has former employees in their early 70s with vested account balances in the 401(k) plan, this change will be important for employers to consider as the former employees will need to begin taking RMDs. SECURE 2.0 increased the RMD age to age 73 for individuals who attain age 72 in 2023 or later. For example, an individual who attains age 72 in 2023 does not have an RMD requirement until the individual turns age 73 in 2024. In addition, the individual has until April 1, 2025, to take the first RMD. The RMD age will increase to age 75 for individuals who attain age 74 on or after Jan. 1, 2033. In this case, an individual who is 74 years old in 2033 has until April 1, 2035, to take the first RMD. This provision requires a plan amendment.

The “still working” exception continues to apply to the RMD rules. An individual still employed and does not own more than 5% of the company may delay taking the RMD until actual retirement.

Early distribution rules when terminally ill

A distribution from a 401(k) plan to a participant prior to age 59 ½ is subject to a 10% early withdrawal penalty unless an exception applies. Pursuant to SECURE 2.0, distributions to a terminally ill participant made after Dec. 29, 2022, are not subject to the 10% penalty. A physician’s certification as to the participant having a terminal illness is required. Since this is not a distributable event in many 401(k) plans, IRS guidance is anticipated.

Unnecessary 401(k) plan notices

For plan years beginning after Dec. 31, 2022, SECURE 2.0 eliminates the requirement to provide 401(k) plan notices to employees who elect not to participate in the 401(k) plan, referred to as “unenrolled participants.” Notices that do not have to be provided include fee and investment disclosure and summary annual reports. However, unenrolled participants must receive an annual notice that reminds them of their eligibility to participate and provides relevant deadlines to elect to participate in the plan.

Expansion of the EPCRS

The purpose of EPCRS as provided in Rev. Proc. 2021-30 is to permit employer-sponsored retirement plans to correct failures to maintain the plan’s tax-qualified status. SECURE 2.0 makes plan corrections easier by expanding self-correction and eliminating the deadline to make the correction. One area where self-correction will be beneficial is with plan loans that do not satisfy the requirements as to amount and payment terms. Employers should review plan loans to participants and self-correct any that are not compliant. Treasury is required to revise Rev. Proc. 2021-30 to take into account the changes made by SECURE 2.0 no later than Dec. 29, 2024.

2. Provisions effective in 2024

Roth catch-up contributions

SECURE 2.0 eliminates pretax catch-up contributions for employees with compensation greater than $145,000. Instead, SECURE 2.0 requires catch-up contributions to employer-sponsored qualified retirement plans to be designated Roth contributions. This change requires a plan amendment.

Roth 401(k) accounts

Some 401(k) plans have regular tax-deferred 401(k) accounts and Roth 401(k) accounts where the employee contribution is taxed currently rather than deferred. Prior to SECURE 2.0, a plan participant was required to take an RMD from a Roth 401(k) account, although an RMD was not required from a Roth IRA. SECURE 2.0 eliminates the RMD requirement from a Roth 401(k) account. A plan amendment is not required.

3. Provisions effective in 2025

Automatic enrollment

Automatic enrollment in 401(k) plans was first introduced in 1998 and has significantly increased participation in 401(k) plans, particularly among younger, lower-paid employees, allowing them to save for retirement. SECURE 2.0 requires new 401(k) plans adopted on or after the date of enactment, Dec. 29, 2022, to automatically enroll participants in the plan at an initial deferral rate of between 3% and 10% of compensation once they satisfy the plan’s eligibility requirements. After the initial year, the rate of deferral automatically increases by 1% until it reaches at least 10% but not more than 15%. This provision of SECURE 2.0 does not apply to 401(k) plans enacted prior to Dec. 29, 2022; small businesses with 10 or fewer employees; new businesses in existence for fewer than three years; church plans; and governmental plans. This provision requires a plan amendment.

Period of service requirement for long-term part-time employees

The SECURE Act expanded eligibility for contributing to an employer’s 401(k) plan to include long-term part-time workers who complete three consecutive years of service with at least 500 hours of service each year. SECURE 2.0 reduces the service requirement to two years. This provision requires a plan amendment.

Higher catch-up limits for ages 60, 61, 62 and 63

Current law permits employees who have attained age 50 to make catch-up contributions to a retirement plan in excess of certain limits. Under SECURE 2.0, the catch-up limit for individuals who have attained ages 60, 61, 62 and 63 during the taxable year is increased to the greater of $10,000, or 150% of the regular catch-up amount in effect for the taxable year. The increased catch-up limit would be indexed. This provision requires a plan amendment.

Deadline for plan amendments

The timing for retirement plan amendments made pursuant to SECURE 2.0 is on or before the last day of the first plan year beginning on or after Jan. 1, 2025; governmental plans have until 2027. Although the deadline for plan amendments is not for two years, plans must be operationally compliant with required provisions and any optional provisions that are implemented.

Lost 401(k) accounts

SECURE 2.0 enables the creation of a searchable database to help former plan participants to find retirement accounts of which they have lost track. The retirement savings “lost and found” will be housed at the Department of Labor (DOL) and be created within the next two years. The DOL is required to implement safeguards to protect individual privacy and security.

4. Provisions effective after 2025

Paper statement requirement

SECURE 2.0 requires 401(k) plans to provide one paper statement per year to plan participants.

To learn more about SECURE 2.0 and how these mandatory changes to 401(k) plans may affect you, please contact your Baker Tilly advisor.

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.