Revenue recognition: what to know about uninstalled materials

Published in Construction Financial Management Association's January/February 2022 issue of Building Profits magazine.

When the Financial Accounting Standards Board (FASB) issued Revenue from Contracts with Customers (Topic 606), some of the accounting practices commonly used by contractors under ASC 605-35, which codified the previous guidance known as SOP 81-1, were no longer allowed. One such item of interest was the accounting for materials purchased or allocated to a project that was not yet installed — commonly referred to as uninstalled materials.

What qualifies as uninstalled materials?

Since contractors can, for the most part, recognize revenue under Topic 606 in a manner that is largely consistent with the percentage-of-completion method (PCM) of accounting under Topic 605 (reporting contract revenues based upon the ratio of the cost incurred on the project to the total estimated cost), some of the changes to revenue recognition addressed by Topic 606 have been occasionally overlooked. One of those changes relates to materials that have been purchased for a specific project but have not yet been installed. When examining the intricacies of Topic 606, it is easy to see how there can be a lack of understanding among construction contractors regarding what specifically qualifies as uninstalled materials.

One reason some contractors may not view uninstalled materials as a pertinent issue is because they typically buy materials as they use them. So when they apply the concepts of Topic 606, the amount of time it takes to install the material after it is received is so limited that the risk of a significant amount of uninstalled materials included in the cost-to-cost method is low. Also, most small- to mid-sized construction companies or independent contractors buy materials on a project-by-project basis and may view the uninstalled material guidelines as something that does not have a meaningful effect on their business since they already incurred the cost of the material.

However, in ASC 606-10-55-21, FASB specifically noted that a shortcoming of the PCM of accounting was that there may not be a direct relationship between the entity’s inputs (cost incurred) and the transfer of the good or service to the customer (satisfaction of the performance obligation). Certain types of contractors are more prone to this shortcoming than others.

A GC that subcontracts all the tasks in a project probably didn’t lose a lot of sleep thinking about Topic 606 and how to apply uninstalled materials in the PCM calculation; however, the contractor hired to build the elevator system probably did. While the purchasing agent who was able to get a deal on all the drywall isn’t thinking about the accounting ramifications, the financial manager should be thinking about whether the procurement of the drywall is:

- Cost incurred, which under Topic 606 is considered progress toward satisfying the performance obligation;

- Cost incurred but uninstalled materials to exclude from the PCM calculation; or

- Inventory to be used on future backlog and not yet a cost of the contract.

Therefore, it is important to thoroughly understand the details surrounding the material used to complete any construction project. When assessing how to account for this material, the financial manager should understand the specifications — not in an engineering sense — of the contract. No one is expecting the financial manager to run the project; however, the financial manager should know whether the contract is unique and how this uniqueness can affect the timing of the revenue recognition.

The financial manager and project manager should be able to answer where the material is located and who owns it. The material may be earmarked for a certain job, but if it’s sitting in a warehouse (or even on the jobsite), then who technically owns the material and is responsible for it at that point in time? Has the customer already paid for the material and taken control? Is the material being used on the job highly specialized, of a higher cost, or have any other unique specifications that can change how revenue may be recognized?

Sometimes the project’s contract clarifies these details, but many times it does not. In fact, it’s possible to have the same exact material and amounts on two different jobsites, yet the material needs to be handled differently for each scenario.

Uninstalled materials: who is affected?

Any contractor that needs to purchase substantial materials for projects could potentially be affected by the intricacies of Topic 606 relating to uninstalled materials. Subcontractors may especially be affected due to the amount of materials they have on hand to assist contactors on jobs.

Consider the case of an electrical contractor that buys a significant amount of wire or a mason who purchases a large volume of bricks. Contractors that purchase more material than they need at the moment could potentially have to make adjustments to the cost-to-cost calculations due to having uninstalled materials. Those contractors that purchase limited quantities of materials for a specific, short-term project are less likely to be impacted.

The intricacies of uninstalled materials: how revenue changes

Previously, when determining revenue recognition under Topic 605, a contractor would use all the costs incurred on the project, which ran through its job cost records and made progress to the extent the contract was complete. The uninstalled materials are not part of this cost and therefore excluded in revenue. However, under Topic 606, more information must be considered to determine how much progress has been made toward completion. In other words, how much of the contract value can be recognized as revenue? Sometimes the calculation is not as easy as it used to be.

Recognizing uninstalled materials in calculations

In order to calculate revenue under ASC 606-10-55-189 and 190, you must first understand that the amount of revenue to recognize is a combination of the progress completed and the uninstalled material. First, the contractor must identify the costs incurred but not yet installed and carve out the amount of uninstalled materials from the cost-to-date amount to determine costs incurred for the portion of revenue to recognize based upon the measurement of progress toward completion. Second, the cost of the uninstalled materials is added to determine the total amount of revenue recognized. Therefore, revenue recognized on uninstalled materials is recognized at a zero margin.

For a contractor with a significant amount of uninstalled materials, its work-in-progress (WIP) schedule can present job-to-date gross profit percentages that do not match the final estimated profit amount; this may take some getting used to. Some contractors may look at how to present their WIP schedules in a way that easily depicts the effects of uninstalled materials. Work with your accountant on the best way to present uninstalled materials on the WIP schedule.

A presentation that allows the users to recalculate the revenues earned on each project is recommended. Surety and banking relationships may have input on the presentation as well. And, overall, it is better to be upfront with the users than to explain at the last hour.

Example

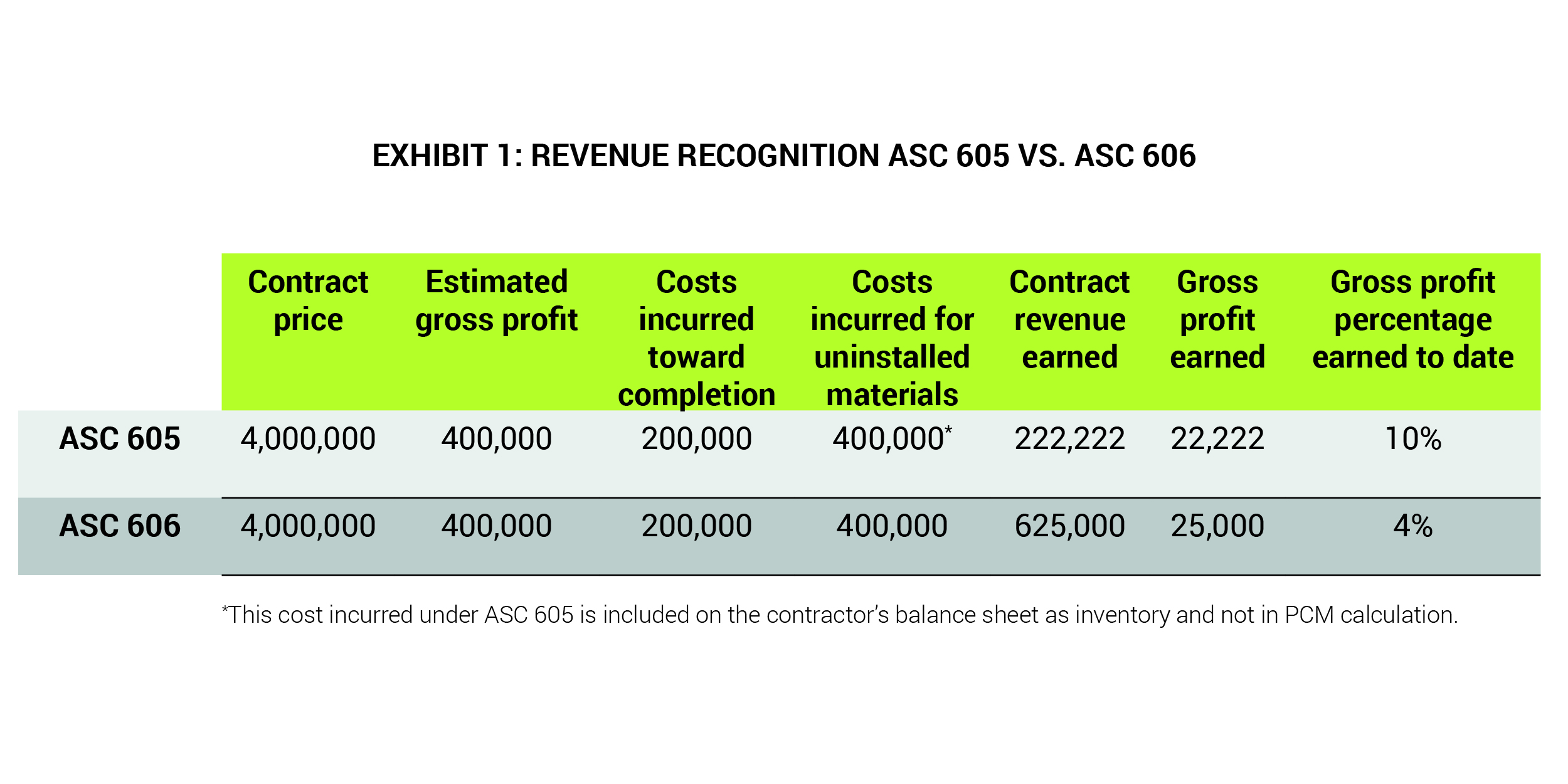

To consider exactly how revenue and gross profit timing will change under Topic 606, consider a contractor that has a job with a final estimated 10% gross profit. Previously under ASC 605-35, the contractor would exclude the uninstalled materials from the cost-to-date to determine the percentage of total estimated cost complete and, consequently, the percentage of the total contract to recognize as revenue. Now, under ASC 606-10-55-189 and 190, uninstalled material is also excluded from the measurement of the portion of revenues recognized based upon the progress toward completion, but the cost is added to the revenue calculated without any margin. As such, a job with a 10% total gross profit may end up reporting a job-to-date gross profit of only 4%.

The example in Exhibit 1 demonstrates this scenario and how the changes can occur if uninstalled materials are present on a contract.

In that example, this job had $200,000 in costs incurred to date before uninstalled materials and a gross profit of $22,222 (see the Topic 605 row). However, not included in the cost is an additional $400,000 related to material acquired, which does not increase the amount of progress made toward job completion. As such, this cost is included on the balance sheet as inventory and is not run through the contract’s profitability.

Under Topic 606, these same costs were incurred, but the treatment of the $400,000 of uninstalled materials is different. This cost is added to revenue without a margin after the measurement of progress toward completion. In this case, the amount of revenue and cost are increased by the amount of uninstalled materials and the gross profit recognized changes. Acknowledging uninstalled materials leaves the total job profit unchanged, but it changes the revenue and profit recognition process.

Four criteria of Topic 606 for progress toward completion

The intent of Topic 606 is to eliminate the recognition of gross profit on costs incurred, which do not advance progress toward completion. Just because the material was obtained doesn’t mean the project is closer to completion. FASB developed four criteria (included in ASC 606-10-55-21) to determine when costs incurred are not proportionate to the entity’s progress toward completion.

Using the previous example, here is a review of these four criteria and how they would apply in practice.

- The good is not distinct

When looking at the example in Exhibit 1, the $400,000 of material is not distinct from the rest of the contract. Assuming the contractor in this example is an electrician, the material is necessary to complete the performance obligation. The material is part of an integrated set of activities to complete the electrical aspects of the contract. - The customer is expected to obtain control of the good significantly before receiving services related to the good

When exactly does the customer control the materials? The contractor needs to make this determination. For example, the contractor acquires the goods needed for the specific project and has billed the customer for this cost. In this situation, it would appear that the customer controls the material, but what if the contractor can receive a discount by buying goods in bulk and having the materials delivered to the project site? Judgment needs to be made on whether the customer controls the goods. If the contractor can move goods to another job due to a schedule change, then the customer probably doesn’t control the goods. In a case like this, it would appear that the costs qualify as inventoriable items under Topic 330, Inventory. - The cost of the transferred good is significantly relative to the total expected costs to completely satisfy the performance obligation

In Exhibit 1, $400,000 of the $600,000 in costs incurred to date under the contract are related to uninstalled materials. Having a ratio of 67% materials to total job costs appears to not be proportionate to the progress of the project toward completion. A good practice to use in analyzing jobs is to monitor the components of the cost on a completed job. If the contractor sees a trend where material on similar contracts is a consistent percentage of the job cost, then any job where the material cost percentage exceeds this trend is a good candidate to review for uninstalled material issues. - The entity procures the good from a third party and is not significantly involved in designing and manufacturing the good

A contractor that obtains parts for their customers for a project is probably not involved in the manufacturing. The contractor understands the specifications for the job and orders the materials; however, all the contractor did was order the material. They did not have a significant role in designing or manufacturing the materials.

There are certain contractors that have a manufacturing component to their operations, and they often incur significant material cost prior to the delivery and installation. As noted in Step 5 of Topic 606 regarding the contract process, revenue is recognized when (or as) the entity satisfies a performance obligation. In this situation, when does this type of contractor satisfy the performance obligation? How do they account for all of the material made for the project?

As previously noted in ASC 606-10-55-21(b), the fourth criteria indicates that the cost of materials is considered uninstalled materials based on whether the entity procures the goods from a third party and is not significantly designing and manufacturing the goods. A contractor that fabricates goods as part of a construction contract usually has both the engineering and manufacturing components. As such, these contractors are typically involved in the design and manufacturing of the materials to be installed as part of their performance obligation under the contract.

Therefore, all costs incurred to date that have gone through the manufacturing process are considered progress toward satisfying the performance obligation. Revenue recognition has become a hot topic in analyzing a company’s performance. To start, everyone usually looks to grow their business. For example, a contractor was able to double its revenue by simply changing its contracts. Previously, this contractor only contracted with the project owners to manage their projects. When looking at the job sites, this contractor was clearly managing the projects. Each of the trades working on the job contracted directly with the project owners as well. In this situation the contractor is only recognizing a fee to manage the job. The value of all of the subcontracts are not part of the contractor’s financial statements. Later, this contractor began to directly contract with the trades. This changes the entire value of the contract being recognized in the contractor’s financial statements. Now, all of the value of the subcontractors’ work is recognized on the contractor’s financial statements.

What was once an “agent-like” construction management contract became an “at-risk” construction contract, where the contractor was now acting as a principal in the arrangement. You can look at the jobsite under either of these scenarios and it will look the same. However, a simple change to the nature of the contract can substantially change the company’s revenue. This is one such example of how a contract can change the amount and timing of revenue recognition. A significant change in procurement practices can have an effect on the timing of revenue recognition for a contractor that is material intensive.

It is imperative to understand whether the cost of material that meets the requirements of ASC 606-10-55-21(b) should be excluded when determining progress toward completion. By not doing this, a contractor can misstate revenue if these costs happen to be significant.

Tax considerations

Although this article is focused on the issue of uninstalled materials and their application to recognition of revenue under Topic 606, there may also be some unintended tax consequences. Accelerating revenue recognition can increase taxable income, and a contractor can create an unplanned tax burden by trying to support the material cost as progress toward completion. A good practice that all contractors should follow is to review any changes to revenue recognition with their tax accountants. Not all U.S. GAAP changes are automatically applied to the Internal Revenue Code; it is better to know how these changes may affect your company rather than be surprised with an unexpected tax bill the day before your payment is due.

What should contractors do to monitor uninstalled materials?

Contractors should continually monitor their contracts and have a thorough understanding of what is considered truly uninstalled materials. Each type of contractor has different issues to consider, and to take it even further, each contract may have unique considerations. A GC that subcontracts most of its work probably does not have a significant risk of misstating revenue. However, the subcontractor that has material-intensive work should develop processes and procedures to quantify the effect of potential uninstalled material issues.

Contractors must consider if they are misstating profits on the job by choosing to leave uninstalled materials in their calculations. The reported profit needs to be in line with the contractor’s progress toward satisfying the performance obligation.

While performing financial statement audits since the adoption of Topic 606, Baker Tilly noted that uninstalled materials were an issue that required some attention. Although we did not see many material adjustments for uninstalled materials, the contractors that self-performed their work and were material intensive had to consider this issue. These contractors were able to support the nature of the work being done, and the materials purchased for jobs were installed so quickly following their arrival on the jobsite that any issues that may have existed were not material.

In some cases, it was noted that costs on specific projects seemed too high and not in line with expectations, but further analysis revealed the costs incurred were of such specialized material that the material portion of the cost structure was higher for those contracts. Essentially, these contractors did not blindly assume there were no issues to consider. Rather, they developed processes and procedures and were able to support their positions.

Some of the red flags that may help a contractor identify the existence of uninstalled materials are comparing the percentage of job cost for materials to the history of the type of contract and identifying large underbilled amounts on contracts.

Conclusion

No one wants to have a conversation regarding an inaccurate revenue amount. Whatever type of work is done by the contractor, the financial manager should work with their outside accountant to develop specific tools and processes to help mitigate the risk of improper revenue recognition.

Revenue recognition issues are different for each type of contractor; however, there are simple checks that financial professionals should put in place to ensure uninstalled materials are properly included in revenue recognition. These checks and balances are necessary to monitor for potential uninstalled materials and should not be an arduous task.. Remember, an ounce of prevention is worth a pound of cure.