Professional employer organizations (PEO) may lead workers compensation to InsurTech

The history of professional employer organizations’ (PEO) involvement in workers compensation has been fraught with bad actor scams1 and insurance company insolvencies2. Now, through the rise of technology and the prevalence of PEOs in the workers compensation market, companies may see truly useful transformation within traditional workers compensation models.

PEOs and workers compensation insurance regulation

Ever since the creation of workers compensation insurance more than 100 years ago, nearly every employee in the United States has been insured for workers compensation through a policy issued to the employer by a regulated insurance company; the amount charged for that coverage has also been regulated. Due to the perceived randomness and long-tail nature of workers compensation claims, as well as the small sample size of any individual employer, state mandated rates for each employer were based solely on the employer’s industry classification. The rigid assumption that the amount of claims incurred by an individual employer does not impact rates has become relaxed throughout the years due to the regulatory approval of experience rating, retrospective rating and large deductibles. Currently, there is much variation in regulated rates within employer classification codes, but the regulated rates still do not reflect all differences in expected losses. Through increased use of self-insurance (e.g., large deductibles), many employers are now able to retain more workers compensation risk than what was possible in the early years of workers compensation.

History of PEOs

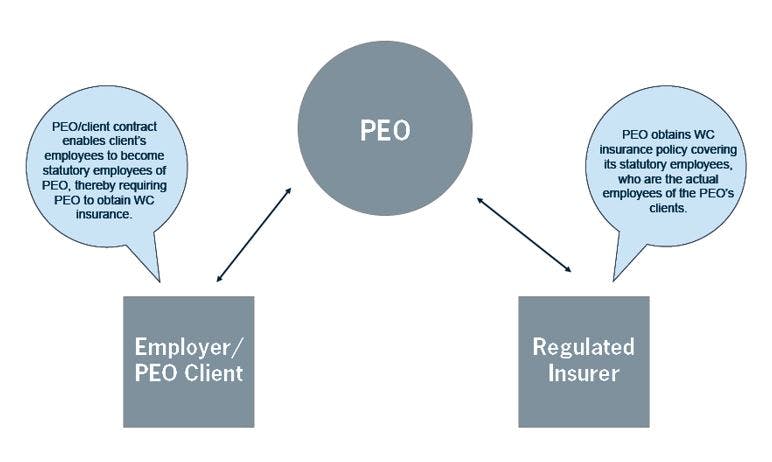

PEOs are organizations that assist their clients with human resources and employee benefits, including workers compensation insurance. These institutions assist with workers compensation by taking responsibility for their clients’ obligations to provide this type of insurance, essentially becoming the statutory employer (see chart below). The term PEO, however, did not always exist. Initially, staffing agencies realized they could buy workers compensation insurance based on the staffing agency employer classification code, even if their employees were staffed in an industry with higher risks. These so-called temporary staffing, or employee leasing agencies, sold their services on the basis of being able to pass through a much reduced workers compensation cost to their clients. Despite the lower rates the staffing agencies were continuing to pay, their policies were covering the operations of their new higher risk clients. As a result, the mandatory rates were inadequate and a regulated workers compensation insurer was footing the bill.

As these early PEOs flourished and grew, insurer insolvencies resulted. There were many loopholes in the rate regulation system, bad actors in the PEO industry and an overall resistance to being classified as something other than a standard temporary employment agency. All of these factors allowed this behavior to continue for many years before insurance regulation caught up.

Initially there was no consensus on what to call agencies that took responsibility for their client’s workers compensation risks. However, the term PEO began being used in 1994 when the National Staff Leasing Association changed its name to the National Association of Professional Employer Organizations. In most jurisdictions today, there is a consensus about which companies are PEOs and what workers compensation regulations apply to them.

Today’s PEOs retain workers compensation risk

In this day and age, insurance carriers are more cognizant of the dangers presented by PEOs. In addition, the underlying exposure of PEOs’ employees are subject to much greater shifts than a typical employer and there is no way in the regulated system for rates to adjust appropriately and quickly. As a result, these organizations have been forced to retain a large portion of the workers compensation risk themselves. Since workers compensation risk can be very material for a PEO, they must also be vigilant about underwriting, pricing and loss control in order to thrive.

Two types of PEO clients

When it comes to workers compensation, there are two distinct types of PEO clients that are broadly characterized as “white collar” and “blue collar”.

White collar clients are those with no risk of occupational accident other than office work. While large worker compensation claims can still occur (e.g., automobile, terrorism, ergonomics, natural catastrophes, vacation type activities, etc.), the costs of occupational accident risk is negligible compared to other employee benefits services provided by PEOs for these clients.

Blue collar clients, on the other hand, include restaurant, nursing home, manufacturing, logistics, construction and other types of industries where employees are subject to the risk of accident due to their occupation. For blue collar clients, workers compensation costs are a significant portion of total employee benefits costs. When referencing workers compensation in the PEO environment, blue collar PEO clients are primarily being discussed since workers compensation costs are material for blue collar clients.

InsurTech and PEOs

New technologies have transformed industries (e.g., Uber with the taxi industry, Airbnb with the hospitality industry, etc.) and are altering the insurance industry. Insurers have lagged other industries in this technological progress due to complicated regulations. While many insurance companies are investing heavily in InsurTech3, there is not as much investment in InsurTech4 for the workers compensation segment.

There are three possible reasons why InsurTech is more prevalent in personal and other commercial lines than workers compensation: the long-tail, the variety of industries and prior experience.

- Long-tail: It may take years to settle all claims and know the financial results of pricing and underwriting decisions. Due to ambiguous results early on, there is increased difficulty in confirming with data that InsurTech is improving underwriting and pricing.

- Variety of industries: There are a wide variety of workers compensation risks – from a truck driver to a coal miner to a carpenter to an architect. Personal automobile insurance, on the other hand, covers millions of people with very similar driving risks. The law of large numbers that works well in automobile insurance is difficult to apply in workers compensation.

- Prior experience: The history of new entrants into the workers compensation market is fraught with situations where a lack of expertise is perceived to have led to poor results. For example, in the 1990s, life insurers5 looking for investment returns had poor results when insuring a “carved out” portion of workers compensation which led to nearly $2 billion in potential losses. For the last several years, life insurers have had low investment returns and have been looking for new investments to, once again, improve their investment returns. However, life insurance investment in PEOs currently seems to have the potential to offset low investment returns.

By digging deeper, PEOs have the potential to transform workers compensation insurance and lead to improvements in three areas: risk control, underwriting and pricing. This transformation is possible because PEOs already have significant market share and the PEO companies already consider themselves technology companies. In addition to being technology companies, PEOs take on the workers compensation risks of their blue collar clients. While these organizations are not insurance companies, the risk they are taking is precisely workers compensation insurance risk. Since PEOs are technology companies which derive material revenue from taking insurance-type risk, they should be considered InsurTech.

The future of PEOs and InsurTech

The potential benefits InsurTech can bring to any line of insurance are lower expenses and increased profitability (e.g., risk control, underwriting and pricing). Since PEOs have more access to employer data and worksites than insurance companies, big data and technology could potentially be used more effectively by PEOs to develop InsurTech solutions. The path may be similar to technological transformations currently being seen in automobile insurance since driving exposure is a major portion of workers compensation exposure and the risks of operating heavy machinery have parallels with driving as well.

Currently, workers compensation insurers are barely scratching the surface of InsurTech with technology to improve underwriting results. Since any changes to underwriting and pricing procedures of workers compensation need to be approved by a regulator, insurers have little incentive to implement advancements that are expected to meet regulatory scrutiny. Compared with the relationship between the workers compensation insurer and employer, the relationship between the PEO and its clients is relatively unregulated. In this instance, the PEO is free to charge its clients any amount for a bundle of services which include workers compensation coverage. Since the rate it charges its customers for workers compensation is unregulated, this opens the door for the PEO to review new sources of data, greatly increase the number of risk classifications and increase the frequency of rate changes. To blaze the trail leading technology into workers compensation while avoiding the pitfalls encountered by past new entrants into the workers compensation insurance space, PEOs must utilize top-notch underwriting, pricing and actuarial expertise.

For more information on this topic, or to learn how Baker Tilly specialists can help, contact our team.

1 The Wikipedia entry on professional employer organizations has a section on abuses.

2 For example, in 2015, the Missouri Department of Insurance placed Lumberman’s Underwriting Alliance into receivership when its largest PEO client failed to fund its collateral after filing for Chapter 11.

3 “Insurers, reinsurers investing in InsurTech”, Business Insurance, February 1, 2018

4 According to Investopedia, InsurTech refers to the use of technology innovations designed to squeeze out savings and efficiency from the current insurance industry model.

5 “Life after Unicover”, Best’s Review, July 1, 2001