Practical GASB 89 implementation for utilities

What is your utility’s implementation plan for GASB 89?

Governmental Accounting Standards Board (GASB) Statement No. 89, Accounting for Interest Cost Incurred Before the End of a Construction Period, is effective for reporting periods beginning after Dec. 15, 2019. This standard requires interest cost incurred before the end of a construction period to be expensed, rather than capitalized as part of the cost of the asset as is utility industry common practice.

The standard has exceptions for regulated utilities, which are many public sector utilities. The criteria for regulated operations are identified in paragraph 476 of GASB Statement No. 62. GASB added language in GASB 89 that the provisions of regulatory accounting still apply under the new GASB 89 standard.[1] The board stated in the GASB Codification[2], “the amounts capitalized for rate-making purposes as part of the cost of acquiring the assets should be capitalized as a regulatory asset for financial reporting purposes.”

In many utilities, the process for capitalizing interest is an integral part of computerized work order systems and is applied automatically as an overhead loading. So, as 2019 year-end approaches, regulated utilities need to evaluate their business approach and decide whether to implement this exception offered by GASB on January 1, 2020.

Practical approach example

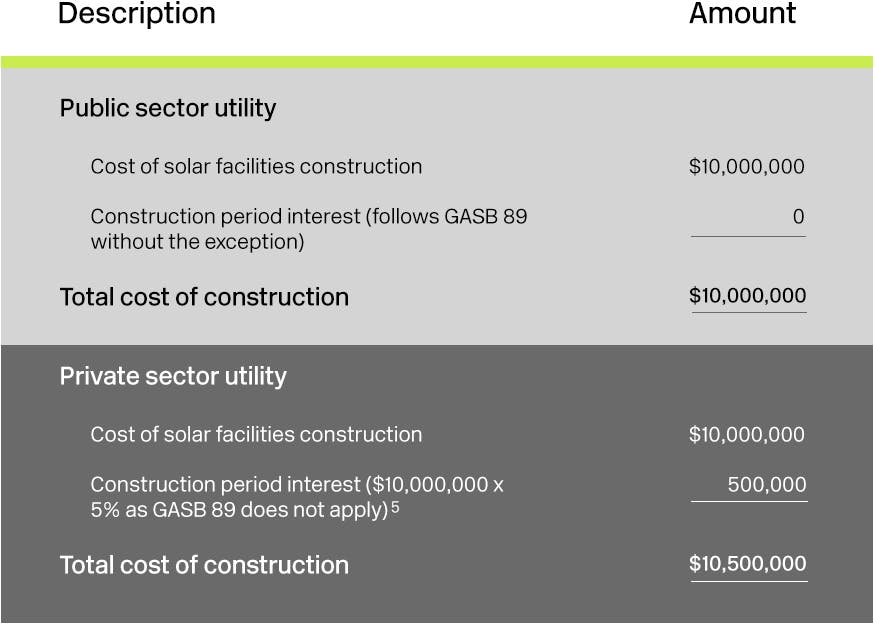

Here is a practical approach to review as part of your GASB 89 evaluation process. Two utilities construct identical $10 million solar facilities, financing the project with internal funds. One of the utilities is a public sector organization, subject to the standards of the Governmental Accounting Standards Board. The other utility is a private sector company, subject to the standard of the Financial Accounting Standards Board. For sake of discussion, let’s assume the cost of capital[3] for each utility is five percent[4].

The total cost of construction for each utility would be calculated as follows:

In analyzing the construction costs, has it really cost the public sector utility $500,000 less to do the construction project? Not really. Both the public sector and private sector utilities used $10 million of funding the project and now have $10 million less of funds to use in other areas. There is an opportunity cost of using that $10 million for the purpose of constructing the solar facilities (which is the cost of capital).

The private sector utility recognizes this through recording $500,000 of construction period interest, while the public sector utility, by not using the GASB 89 exception, reports a lower cost of the constructed assets.

Impact on utility rates

Utility customers will use these solar facilities over the useful life of the assets and those costs will be recovered by each utility through customer rates. The private sector utility will collect $10.5 million in rates while the public sector utility will collect $10 million in rates[6]. The public sector utility would therefore not be including the interest expense in the depreciation expense portion of their rates. There is an opportunity cost for any dollar used in a business, including a public sector utility. If construction period interest is excluded from the capital portion of rate recovery, the utility will need to evaluate if sufficient funds for debt service payments or asset replacement will be recovered through customer rates as currently designed.

Next steps

For calendar-year regulated utilities, it’s important to evaluate your options now for whether or not to capitalize interest during construction periods, as this will affect construction projects beginning on January 1, 2020.

More information about GASB 89 is available in GASB 89: How capitalized interest changes impact utility rate cost recovery. This Baker Tilly insight discusses the accounting mechanics and financial statement presentation for following the GASB 89 exception and capitalization of construction period interest by public sector entities.

For more information on this topic, or to learn how Baker Tilly power and utilities specialists can help, contact our team.

[1] GASB 89, page 11, B20

[2] The GASB Codification is the authoritative summary of GASB standards. The section referenced here is Section Re10.110 – Regulated Operations (after the GASB 89 amended language)

[3] The cost of capital is the opportunity cost of using funds in different manners, i.e. there is an associated cost of using funds in operations, capital expenditures or leaving it in the bank to collect interest. It is calculated based on the utility’s capital structure of short-term debt, long-term debt and internal reserves.

[4] This is for comparable simplified example purposes only. In real life, the private sector utility would have a higher cost of capital, as public sector entities can issue lower interest rate tax-exempt debt to fund projects, whereas private sector entities cannot. So, the long-term debt component of the private sector utility would be higher than the public sector utility.

[5] Private sector utilities that follow FASB would apply the provisions of ASC 835-20 – Capitalization of interest

[6] The cost of replacement of utility assets is recovered through depreciation expense.

© 2024 Baker Tilly US, LLP