Personal goodwill in a sale can reduce tax liability

Problem

The sale or distribution of assets in a corporate liquidation of a C corporation creates a corporate-level gain on which the corporation must pay the tax. The gain or loss at the entity level is the difference between the amount realized and each asset’s basis. Liquidating the corporation causes the shareholders to be taxed on the difference between the amount realized and their stock basis. This double taxation greatly increases the cost of the sale.

Solution

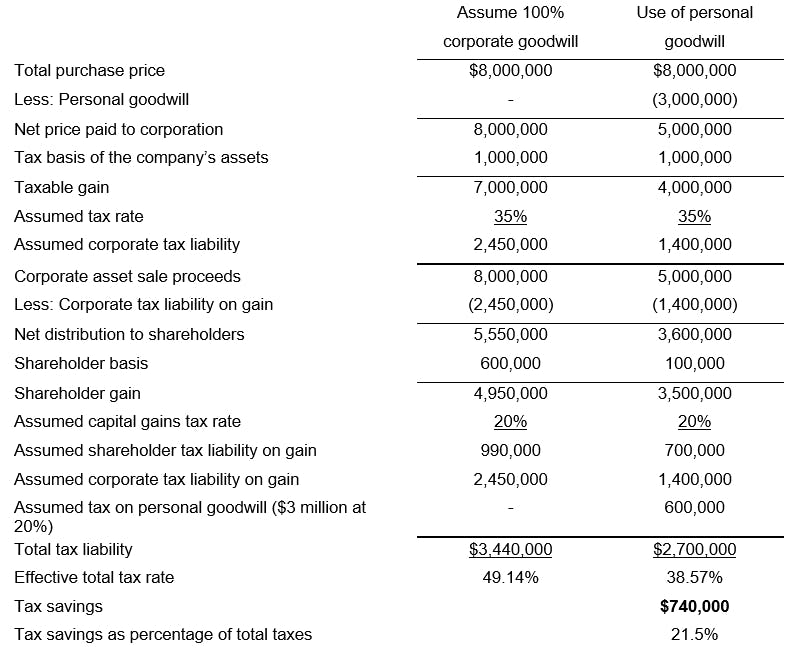

One approach to reducing this double taxation is to separate the intangible assets personally owned by the shareholders, known as the "personal goodwill," from those owned by the corporation. By separating the assets, the gain from the sale of assets can be divided between the corporation and the shareholders. By dividing the gain between assets owned by the corporation and assets owned by the shareholders, one level of tax can be avoided on the sale of the assets owned by the shareholders. This reduces the amount of gain realized at the corporate level, thereby reducing the total tax liability upon liquidating the corporation. Any gain on the sale of assets owned personally by the shareholders incurs only one level of tax—at individual capital gain rates. To the extent that goodwill exists in a corporate asset acquisition, a C shareholder may expect to retain about an additional 25 cents for every dollar of goodwill allocated to the individual rather than to the corporation. We have developed an example to demonstrate the benefits of using personal goodwill as a strategy to reduce a selling shareholder’s tax liability.

This strategy can even be helpful in an S corporation setting. For the first ten years of S corporation status, the built-in gain tax of Section 1374 imposes a corporate level tax on sales or disposition of assets at the maximum corporate rate. Personal goodwill would reduce the exposure to this built-in gain tax.

Background

In two landmark cases, Martin Ice Cream and Norwalk, corporate shareholders were able to separate personal goodwill from the assets owned by the corporation by proving that they generated personal goodwill that they owned and sold separately from the corporation.

A shareholder of a corporation can own goodwill personally, separate from the goodwill of the corporation, if customers view the shareholder, rather than the corporation, as the center of their commercial relationship. Personal goodwill includes the reputation of a person that attracts new customers and induces existing customers to continue purchasing from the corporation.

The value associated with the business owner’s personal relationships or efforts are not corporate assets if the corporation does not have a right—by contract or otherwise—to that individual’s services. Personal goodwill can exist only if there is no non-compete agreement between the corporation and the shareholder. If a noncompete agreement exists, the shareholder may be deemed to have transferred ownership of the goodwill to the corporation. In both Martin Ice Cream and Norwalk, there were no noncompete agreements. This fact was noted in both court decisions and was specifically pointed out as one of the reasons the taxpayers won in Norwalk.

The very existence of a written employment agreement can be fatal to the device even if it does not specifically cover competition. The duty of loyalty and noncompetition is inherent in the employment relationship in most states.

Based on the specific facts and circumstances, the more the business depends on the shareholder’s personal relationships, knowledge, skills, talent, reputation, experience, business ability, integrity, or personal characteristics, the greater the personal goodwill. The use of personal goodwill can extend beyond customer or client relationships of the shareholders to include supplier relationships, employee relationships, company know-how, industry know-how, process, or systems.

Personal goodwill characteristics

- Small entrepreneurial business highly dependent on shareholder’s personal skills and relationships.

- No pre-existing noncompete agreement between selling company and shareholder.

- Personal service is an important selling feature in the company’s products or services.

- Sales largely depend on the shareholder’s personal relationships with customers.

- Product and/or services know-how and supplier relationships rest primarily with the shareholder.

Business goodwill characteristics

- Large business which has formalized organizational structure, systems, and controls.

- Shareholder has pre-existing noncompete agreement with selling company.

- The business is not heavily dependent on personal services.

- Company sales result from name recognition, sales force, and sales contracts.

- Company has supplier contracts and formalized production methods and business systems.

The use of personal goodwill as a strategy to reduce selling a shareholder’s tax liability has gained popularity as advisors are becoming more aware of the legitimacy and beneficial tax benefits of this planning technique. The classification of goodwill depends on the facts and circumstances of each situation. Knowledge of the legal factors and valuation methods can assist in supporting a legitimate case for an allocation to personal goodwill.

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.