Rising interest rates spark decline in deals

After experiencing a rebound in H1 2021, M&A activity in Philadelphia and Central Pennsylvania ultimately declined in the first and second quarters of 2022. M&A activity was driven in part by the Federal Reserve increasing interest rates to combat record-high inflation.

M&A activity in Pennsylvania mirrors nationwide trajectory

There were 416 transactions that closed in the Philadelphia and Central Pennsylvania regional markets during the first half of 2022 (H1 2022), down from the 519 closed transactions. There were 31 middle market transactions with reported values that closed during H1 2022, down from the 52 deals with reported data in H2 2021, and down from the 48 middle market deals with reported values for the same period (H1) in 2021.

The H1 2022 closed transactions also marked a 3.7% decrease in deal volume from the same period in 2021. This mirrored the trajectory of the U.S.’s overall M&A markets — with a total transaction value of $795.9 billion in H1 2022, representing a 28.1% decrease from H2 2021.

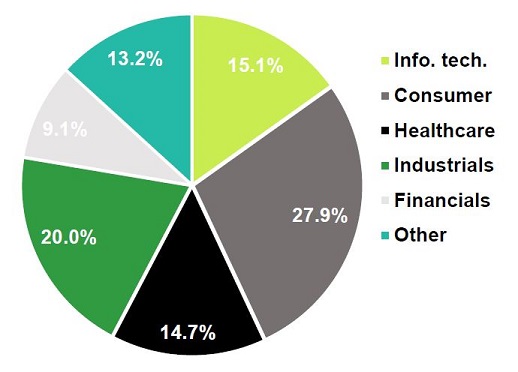

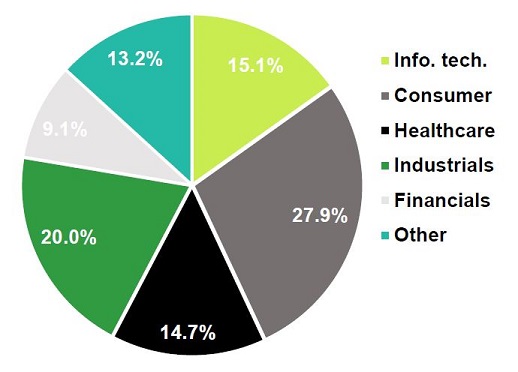

The consumer sector takes the lead in activity

Source: S&P Capital IQ; (June 2022)