Keys to turnaround success

The tide is out

Prior to March 2020, businesses in the United States were at peak earnings as we were enjoying the longest expansionary period in our history. All the hallmarks were in place: significant M&A activity, recapitalizations, IPOs, new startups and general growth investments. The long expansion also meant that corporate leverage was at its peak, with the amount of non-investment grade leveraged debt in the U.S. more than doubling to $1.3 trillion between 2007 and 2020, and the dollar-denominated high yield bond market rising above 65% to $1.6 trillion during the same time period (JPMorgan Chase and S&P Global).

The combination of solid growth prospects, decreasing regulation, increasing valuation multiples and an abundance of available capital fueled this growth. Credit markets were robust – bank and burgeoning non-bank lenders were very much open for business. Now, we are all faced with a global health crisis that has caused a hard stop to the economy, and a rethinking of the path forward.

As Warren Buffett famously stated, “You only know who is swimming naked when the tide goes out.” The quote is apt to what many are unfortunately facing today. Much of the growth we experienced and returns realized through public and private markets were predicated on leverage. Many of these companies and their investors were utilizing proven corporate finance tools while others were banking on growth or speculative adjusted earnings. Many were betting on the next wave and instead got a receding tide.

Riding the lows

There are common themes to many of the businesses that were riding high and now are facing an acute downturn, with the inability to forecast the impact of the downturn being the principal theme. Without a clear plan and internal skills to meet the challenges ahead, businesses could experience significant value destruction. Otherwise successful businesses are now confronted by:

- Sharp revenue declines

- Liquidity challenges

- Inability to forecast

- Debt covenant violations

- Management turnover

- Misaligned or bloated cost structures

- Financial reporting challenges

While some industries that are experiencing especially sharp downturns had structural challenges prior to the pandemic (such as energy, “brick-and-mortar” retail and commercial real estate), few industries will be spared from significant demand shocks either directly or indirectly.

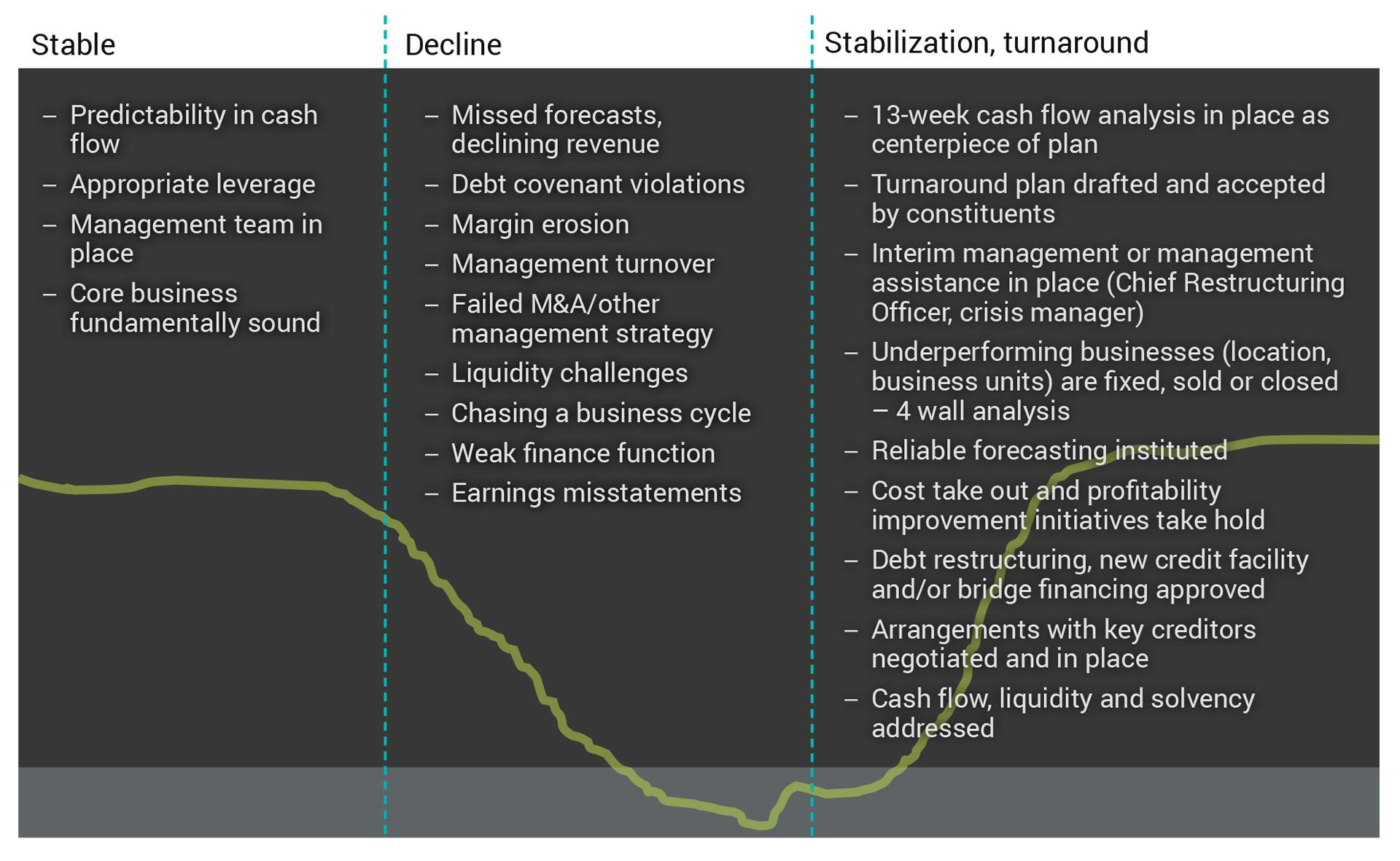

Life cycle of a turnaround

Business challenges requiring a turnaround usually are birthed from growth strategies that stretch an organization’s resources. Whether it is from chasing a cycle or just poor timing, these challenges usually have common themes, such as M&A transactions that fail to deliver planned returns, poorly executed growth strategies and overleverage. The result is often stagnant or declining sales, bloated cost structures and balance sheets that do not allow for management flexibility. The sudden drop in demand following the health crisis is now making these issues more pronounced.

However, these challenges, when met with a clear plan and relentless execution, can lead to turnarounds, future stability and, once again, thriving businesses.

Key elements of a turnaround success

There are certain key ingredients required to execute a successful turnaround. They are intuitive and simple, yet can be elusive in a time of crisis:

- Management team

- Liquidity

- Viable core business

- Speed

No turnaround can be executed without a management team in place that has the skills and experience to see it through. Secondly, preserving adequate liquidity in order to have the resources to maintain operations is the main focus of turnaround managers. In addition, there needs to be a core business. Finally, quick and decisive decision-making is needed to stop the bleeding and start the turnaround.

Where to start?

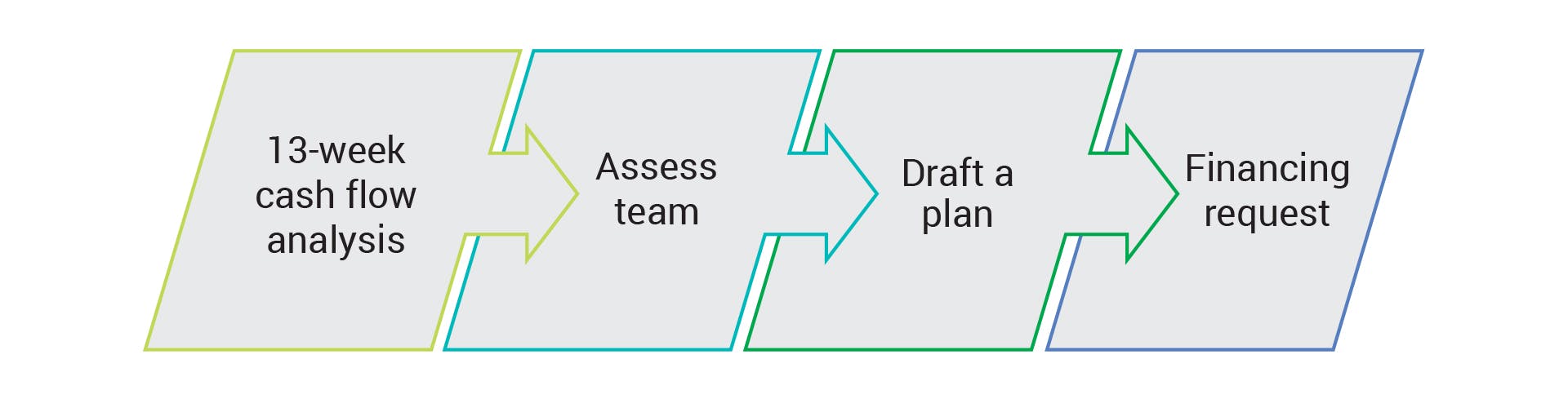

Like any significant and complex problem, it is best to break the issues down into discrete tasks and focus. One of the most important elements of a successful turnaround is speed. The quick development of a plan that is executed vigorously is always preferable over waiting for the perfect plan.

This analysis and tool is at the heart of any turnaround plan. Having a detailed cash flow analysis will help answer key planning questions, such as:

- How far can our current cash flow position extend ongoing operations?

- How do we triage expenses?

- When may we need to implement changes to our workforce?

Start assembling this analysis immediately.

Assess team – Assess whether the organization has the right internal skill sets to execute a turnaround plan and augment where necessary. Consider the need to bring in outside resources (such as a crisis manager, interim CFO or turnaround specialists).

Draft a plan – Formulate a plan and write it down. The document will serve multiple purposes and support discussions with boards, lenders, investors and management. Consider what can be fixed, sold and requires closure. Develop appropriate forecasts to accompany the plan.

Financing request – Most turnarounds require either additional financing or modifications to existing terms. The 13-week analysis, turnaround plan, financial forecasts, sources and uses are the key documents required to support a financing request that can be appropriately underwritten.

Essential business

At Baker Tilly, we understand all businesses are essential to someone. To have the best chance to survive and thrive, consider the elements of a successful corporate renewal and turnaround and get started today.

For more information on this topic, or to learn how Baker Tilly specialists can help, contact our team.