Interdependency – the increasing complexity of onshore business interruption energy losses

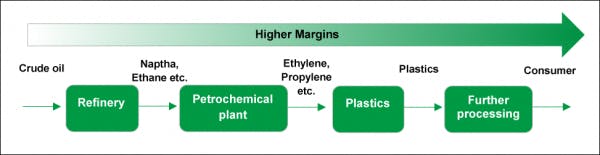

Higher margins are often achieved on downstream speciality products compared to unrefined / commodity products. Some petrochemical and speciality chemical companies have recently announced a second year of record results, showing that there was value in the plants that the oil majors sold off 5 to 10 years ago.

Therefore, a more vertically integrated structure enables companies to retain a greater proportion of the value chain and to help sustain profitability, despite challenging market conditions for unrefined products.

A number of projects which are scheduled to come online in the Middle East over the next 5 years are designed to link oil and gas fields to refineries and petrochemical plants directly. The new downstream capacity will aim to benefit from the Middle East’s market differentiators including comparably low feedstock costs, access to export ports, and greater levels of technology and efficiency that the modern refineries and petrochemical facilities bring.

Interdependencies

These integrated oilfields / refineries / petrochemical complexes will likely result in complex facilities and significant interdependencies in the production process.

This will provide challenges to underwriters in understanding the potential Business Interruption exposure following an insured event. It is not uncommon for relatively small PD losses which result in a partial production loss at a large onshore operation to generate substantial business interruption (BI) losses as a result of the downstream losses.

A simple interdependency example is set out below:

- Incident; a refinery suffers a loss, but would normally sell product to a downstream petrochemical unit in the same group, or “Insured”;

- Impact to the downstream unit:

i) Suffers a loss of production → Loss of gross profit; and/or

ii) Buys feedstock to maintain production → Increased costs of working

Both options would result in a BI loss downstream of the damaged unit. However, a loss to an integrated operation is rarely this straightforward, and reviewing the affected unit in isolation may understate (or even overstate) the potential BI exposure. A full understanding of the critical process units, their role in the production chain, and the bottlenecks / production constraints is required when assessing the materiality of interdependencies.

A common misunderstanding would be to assume a linear relationship between loss of production and the effect on the Insured’s gross profit (i.e. 25% loss of production = 25% loss to the damaged units’ contribution). This is often not the case, due to the following factors:

- Upstream impact; depending on the positioning of the damaged unit, it is possible that there would be upstream ramifications as the refining and petrochemical complex is out of “balance” as a result of the incident. For example, if there is no option of utilising or selling the excess intermediate product, it may be necessary to “scale back” throughput, which will result in significant production and efficiency losses.

- Impact to non-damaged downstream production; it may be possible to divert the excess feedstock / intermediate product to other undamaged downstream units, however this may adversely change the margin achieved at the facility, as a result of the modification to the final product slate or mix, and materially increase the BI loss. In this case, the throughput may have remained largely the same but the profitability may differ significantly.

- Mitigation options; buying in replacement feedstock may seem like a simple solution to avoid or minimise a disruption to downstream production. However, there may be challenges as to whether this is feasible from a logistics standpoint:

a) Infrastructure - a vertically integrated plant may not have the infrastructure to receive third party feedstock to mitigate a loss of production as the facility is designed as a fully integrated plant. This is different to many plants in the US or Europe, where pipeline “grids” and rail networks exist which provide a greater degree of feedstock flexibility, frequently allowing easier mitigation.

b) Economics - Feedstock pricing incentives or discounts are often given to encourage downstream investment; these can be the key drivers to profitability of the project and the pricing advantages are unlikely to be replicated via alternative feedstock supply. In addition to this, the cost of any temporary jetty or storage facilities in order to establish a supply chain to import feedstock / intermediate product may result in the actions being uneconomic. This is before the consideration of the incremental freight costs for replacement product, which may erode a significant portion, if not all, of the loss of margin saved.

Due to the possible escalation of uneconomic costs, careful consideration would need to be given toward the sub-limit applied to any Additional Increased Costs of Working (“AICW”) or Extra Expenses (“EE”) Cover.

Summary

As the complexity of the regional refinery and petrochemical market increases, the need for in-depth risk analysis and expertise will become more essential to understand the critical interdependencies and the potential mitigation options that come into play following an insured event to an integrated oilfield, refinery and petrochemical complex.

This will help ensure that sufficient BI and AICW / EE cover is in place to allow for the often non-linear relationship between a production shortfall and the total potential BI loss.

As published in Dubai - Onshore Energy Conference Magazine - 26 April 2017

For more information on this topic, or to learn how Baker Tilly specialists can help, contact our team.