Incurred cost proposal automation for Native 8(a) Program participants

Tribal firms, Alaska Native Corporations (ANC) and Native Hawaiian Organizations (NHO) enjoy unique opportunities for doing business with the government. The Small Business Administration’s non-affiliation exception affords native firms greater flexibility in how they manage their size status for participation in the SBA 8(a) program. But, this often comes with the administrative burden of running multiple small businesses at once in the hyper-regulated world of government contracting.

Baker Tilly understands the unique aspects of native firms navigating the world of SBA’s 8(a) program. Our clients leverage our support to maximize the benefits of program involvement while mitigating the associated administrative burden of accounting and compliance requirements.

Baker Tilly’s ICP tool

For contractors large and small, native or otherwise, the ubiquitous Federal Acquisition Regulation (FAR) contract clause 52.216-7, Allowable Cost and Payment, requires, among other things, applicable government contractors to complete a final indirect cost rate proposal (better known as the “incurred cost proposal” or “ICP”). The ICP is hard on everyone, but for native entities operating multiple businesses under a common home office, the complexity and level of effort increases tremendously.

What if we told you Baker Tilly has developed a proprietary model that can accommodate the unique cost accounting practices of each of your entities? That some expertly written data reports can significantly cut down or eliminate hours of effort pulling the necessary reports together?

That is the message we are here to deliver.

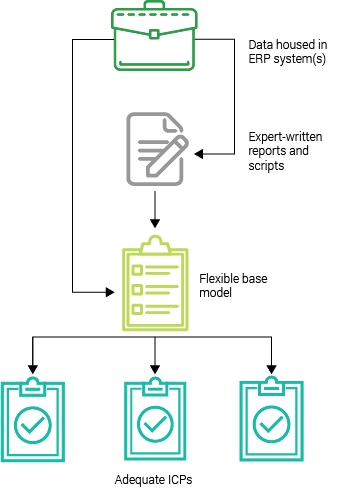

Baker Tilly has developed an ICP tool that, paired with the right data extracts, delivers near push-button ICP preparation capability. Here’s how it works:

- Mine the data: Baker Tilly business system experts assess your enterprise resource planning (ERP) system(s) to identify the requisite source data to complete the ICP. We write reports and scripts that allow ready extraction of source data to feed the ICP model.

- Custom-build the model: Our government contracting compliance team builds a flexible model that churns the source data automatically. One custom-built base model can accommodate multiple business entities, each with their own unique cost accounting practices.

- Deliver push-button mechanics: Using a custom base model set-up form, the end user simply keys in entity-specific attributes, pastes in the ERP system data extracts and clicks “run.” The output is a fully linked ICP, adhering to the requirements of FAR 52.216-7, as well as the components of the Defense Contract Audit Agency’s Incurred Cost Electronically (ICE) model and incurred cost proposal adequacy checklist.

For contractors with the requirement to produce ten, 20, 30 or more individual ICPs annually, this approach can reduce time, effort and risk.

To learn more about Baker Tilly's ICP tool, contact Thomas Tagle and Larissa Simkovich.

Interested in learning more about our native government contracting services?

We help native government contractors:

- Assess opportunities in the Federal market and develop an actionable strategy to increase their Federal contract revenue.

- Leverage technology to strengthen processes, improve efficiencies, optimize resources, streamline operations and deliver more profitable projects.

- Identify control gaps related to regulatory and contractual requirements. Guide tribes through a compliance transformation process to correct underlying issues and create a platform for future compliance.

- Rethink and improve their business policies, practices and controls to withstand today’s heightened level of scrutiny.