How TCFD and the GHG protocol are driving ESG regulations

Prepare for climate-related risk and reporting today

Updated Oct. 24, 2023, to reflect the passing of California's Climate Accountability Package

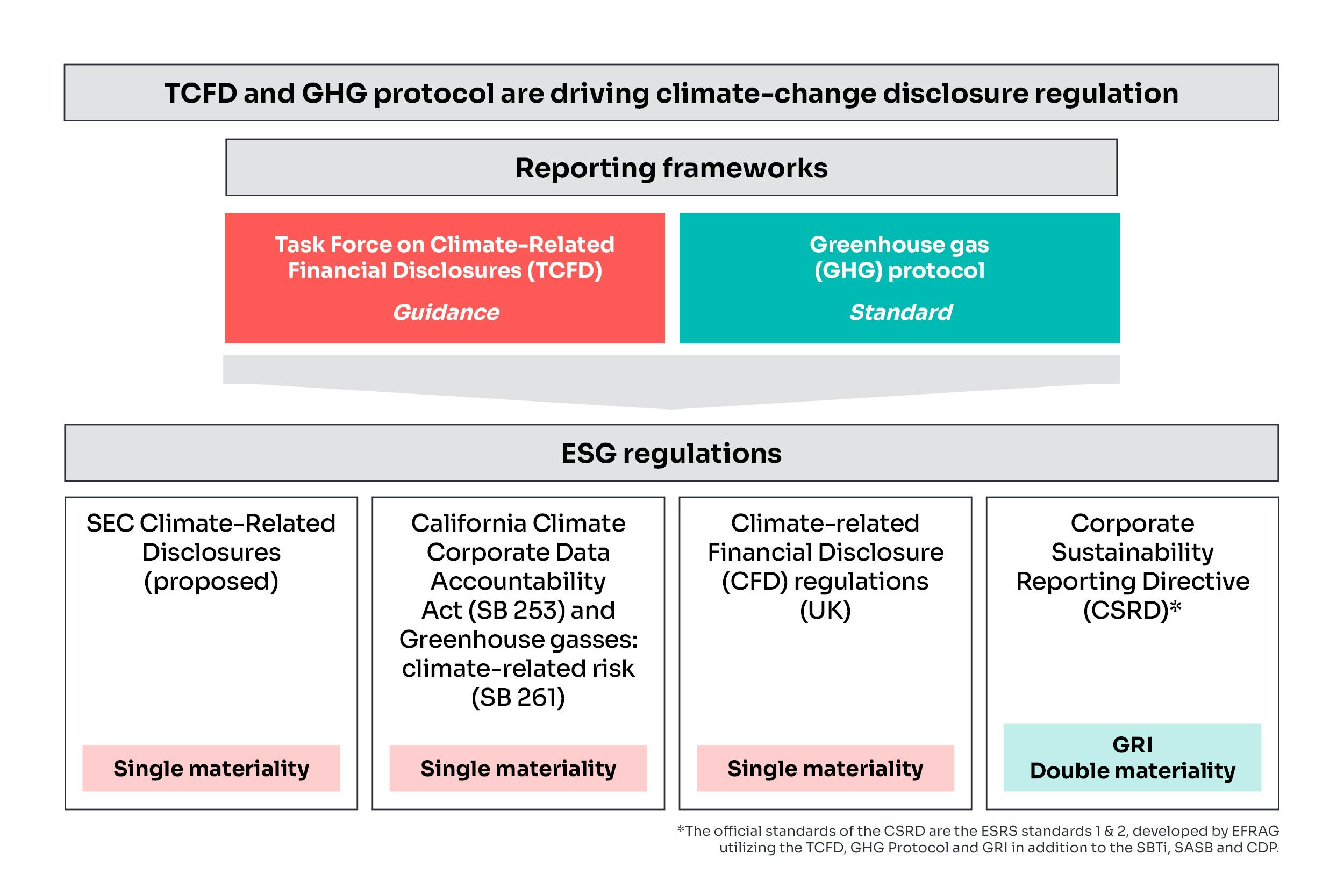

The evolution from voluntary to involuntary ESG disclosure in the United States is ramping up as a result of the SEC’s proposed climate-related disclosures and California’s Climate Accountability Package which includes the California Climate Corporate Data Accountability Act (SB 253) and Greenhouse gasses: climate-related risk (SB 261). Also, Europe is setting the example with the European Union’s adoption of the Corporate Sustainability Reporting Directive (CSRD) in 2021, and the United Kingdom’s Climate-related Financial Disclosure (CFD) regulation, which was introduced in 2022.

When evaluating the requirements of each of the above regulations, there are clear commonalities among them that can help organizations strategically prepare for future ESG reporting requirements. And even if organizations aren’t directly subject to the regulations, all have required action steps.

What are the commonalities across climate-related regulations?

The U.S., U.K. and EU regulations are rooted in two main reporting frameworks:

- Task Force on Climate-Related Financial Disclosures (TCFD)

- Greenhouse gas (GHG) protocol

The reliance ESG regulations have on the TCFD and GHG protocol (and not other reporting frameworks) demonstrates clear acceptance of the two frameworks today and for the future. That said, organizations should prepare for GHG scope 1 and 2 reporting and climate-related risk disclosures through the implementation of the TCFD recommendations and the GHG protocol. Starting with these two reporting frameworks prepares organizations for current and future reporting requirements.

What is the TCFD?

The TCFD is a reporting framework that focuses on governance, strategy, risk management and metrics and targets of climate change disclosures. The framework requires organizations to quantify current baseline data, apply a scenario analysis to understand risks, identify improvement opportunities, set goals and report on the findings and conclusions.

What is the GHG protocol?

The GHG protocol provides global standards and guidance to measure, manage and address greenhouse gases from the organization’s value chain, supply chain and business operations. The protocol was designed to set the standard for organizations requiring accurate, complete, consistent, relevant and transparent accounting and reporting of GHG emissions. While the ESG framework landscape continues to evolve, the GHG protocol has been the fixed point for GHG emissions reporting.

Learn more about GHG reporting basics.

And what aspects of the regulations are different?

The key differences in the proposed ESG regulations lie in the considerations of materiality: financial materiality or double materiality. Financial materiality refers to organizational initiatives that are material enough to impact the organization financially. Double materiality considers the broader society impact, including the financial health and wellness of the organization.

How it all works together

When organizations report in alignment with the TCFD, they will inherently be subject to reporting their GHG emissions following the GHG protocol. Together, these frameworks provide organizations with complete disclosures, from a single materiality perspective, that are also in compliance with several ESG regulations. Most recently, the Financial Stability Board transferred monitoring responsibilities to ISSB and the recommendations of the TCFD have been incorporated within the recently published IFRS S1 and S2.

What to do today

Get started. Organizations just beginning their journey should prioritize reporting in line with TCFD and GHG protocol. How do you begin?

- Define reporting goals and objectives, including the information needs of your key stakeholders and evaluate forthcoming regulations and applicability to your organization.

- Engage management and communicate the reporting plan and objectives by establishing a cross-functional team to support this effort across the organization.

- Understand your organization’s current risk management processes, governance infrastructure and integration across those inclusive of climate-related risks.

- Begin the collection of data and prep for disclosure, establishing organizational and operational reporting boundaries for emissions reporting.

It’s imperative to start developing a climate-related disclosure approach. Though it may seem overwhelming, it doesn’t have to be. Our specialists understand your industry and the impacts ESG regulations will have on it. We’ll help you navigate reporting requirements one step at a time.