How REITs can leverage financial analytics and dashboard reporting to drive success

Data entry and collection errors can cost a real estate company millions. You’ve heard the horror stories of one small clerical error or miscalculation in Excel resulting in companies reporting up to billion-dollar losses. Not only is manually gathering and analyzing data fraught with potential errors, but it’s cumbersome and time-consuming. Some real estate investment trusts (REITs) are recognizing the need for data transformation and in doing so are leveraging analytic workflows and financial dashboards to make data collection and analyzation easier, while alleviating expensive errors. So, how can you use analytic workflows and dashboard reporting to change the way you approach data?

Efficiency and accessibility

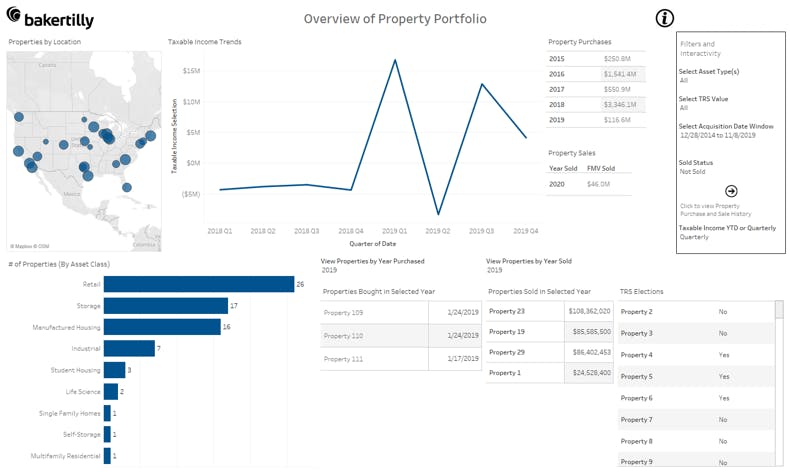

Accessing data in one place is valuable on several levels. By building out workflows of behind-the-scenes logic with your data, you’re enabling high-level reporting. Through these analytic workflows, it allows you to see at-a-glance information at the property, portfolio or transaction level to help draw final conclusions, rather than spending time reviewing and analyzing several reports and spreadsheets for your desired information. Using workflows and dashboards also allows numerous team members to understand the data with little to no training. In addition, streamlining the process of gathering and updating information can trim administrative costs and free up your administrative staff to focus on other organizational needs.

Pictured is a Baker Tilly dashboard comprehensively summarizing a portfolio’s income metrics, property locations and other financial data.

Fraud prevention

Workflows and dashboard reporting can also help prevent potential fraud, a large concern for REITs exchanging sizeable amounts of money regularly across numerous hands and properties via check, electronic transactions and wire transfers. A workflow programmed with a framework and processes to minimize risk will help mitigate fraud. These processes can encompass financial reporting to identify errors that can signal problems, systems to monitor third-party expense and reimbursement patterns, and procedures to promote proper oversight.

Testing and compliance

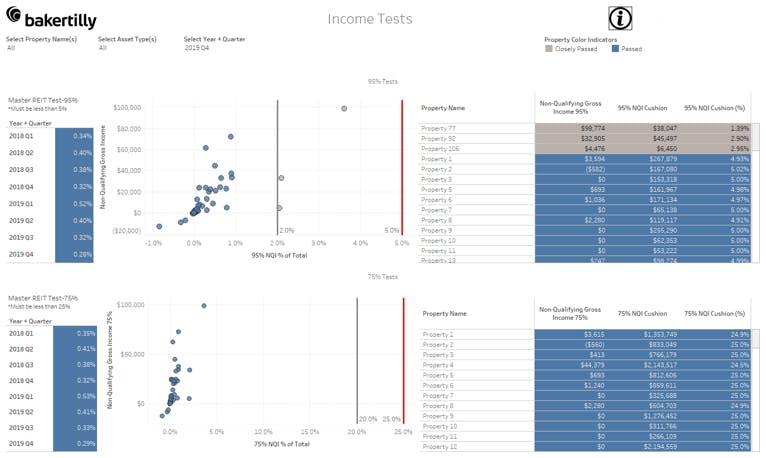

REITs must adhere to the latest tax rules and meet certain compliance tests — quarterly asset, annual income, di minimis and prohibited transactions. The latter, if not handled properly, can result in a punitive 100% tax on capital gain, something no REIT wants to incur. Nor do REITs want to invite a costly IRS audit. Some REITs may question whether they have too much cash, if selling properties in their portfolio would violate the prohibited transactions test, or if it makes sense to distribute cash to comply with the single REIT’s rule for capital gain. Developing an analytic workflow and dashboard by compiling financial company data can help answer these questions and simplify compliance by highlighting trends and any potential issues with properties all in one place.

A Baker Tilly income test dashboard report that holistically summarizes the success of REIT compliance measures, flagging individual properties that have “passed” or “failed” the income test.

Business planning

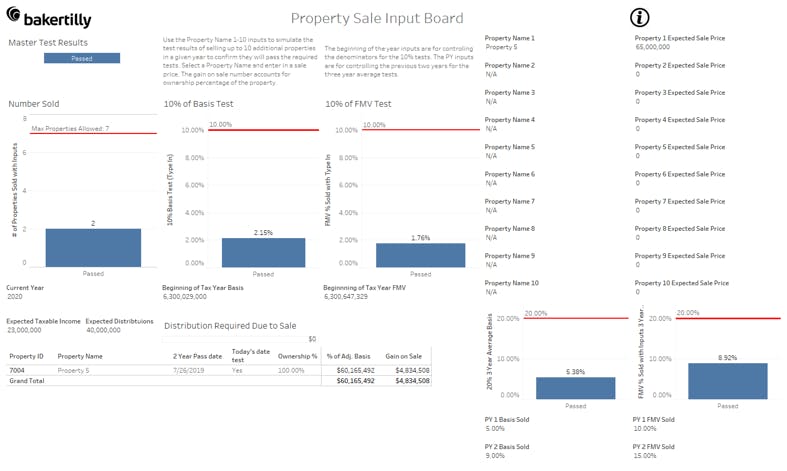

An analytic workflow solution can expedite decision-making and streamline management. With an interactive dashboard report, multiple leaders can view metrics, track trends and summarize compliance measures, accomplishing quicker and more insightful business decisions. This particularly comes in handy when contemplating an exit, performing REIT compliance checks and cash flow forecasting. Scenario simulations, customized for existing properties and those in the sales/purchase pipeline, are another example of how REITs can compile property sale data for viewing via a dashboard report to monitor transactions and determine which assets make the most sense to sell. And when prospective buyers or board members need information to make a decision, the dashboard report makes it easy to share access to applicable data while providing a high-level executive summary of the company financials.

A Baker Tilly customized property sale dashboard report that monitors transaction requirements, allowing for a range of simulation based on transactions to date and pipeline sales.

Implementing analytic workflows and dashboard reports into your financial reporting

The first step in determining if a workflow and dashboard report could be a key financial resource within your team is to identify your organizational needs and goals. Are you looking to increase your reporting efficiency? Or provide accessibility to company financials as you look to sell off properties? If so, utilizing an experienced professional to help accomplish your goals will be essential. A good provider of the service should work with you to develop a customized work plan to ensure the tools will be developed in a way to help you manage your business.

Conclusion

Whether streamlining processes or planning future investments, data transformation is imperative to drive success in your company. With data now the most valuable resource in the world, accurate and accessible data will be key for REITs in their long-term growth strategy.

For more information on this topic, or to learn how Baker Tilly specialists can help, contact our team.