How not to ruin the next generation

Baker Tilly’s Duncan Campbell and Dr. Lee Hausner, an internationally recognized clinical psychologist, family wealth/family business advisor, frequent keynote speaker and co-founder of a nationally recognized consulting group, for an interactive discussion on family wealth planning.

Throughout the discussion, Duncan and Lee provide unique perspectives while answering key wealth planning questions, including:

Families should start by writing a mission statement: Where do you see your family in 50 years? Then, they should identify the strategic behavior/plan needed to develop independence and be self-reliant. The next generation isn’t earning the money, but they need to be aware of how to manage and invest it.

A mission statement should be met with an understanding of the values you want to pass down from generation to generation; goals need to be defined at the family level. Then, each individual can develop an intentional coaching plan.

It is never too early to start; the earlier, the better. Children need to be exposed to conversations regarding costs, budgeting, etc. so they can develop the right skills to help make future decisions collaboratively.

Honesty, integrity and perseverance. Dr. Hausner said, “when the going gets tough, you don’t go shopping.” Other important attributes include intellectual curiosity, effective communication skills and stewardship. The next generation is responsible for passing on your family values, but parents are responsible for training their children to understand the foundation/history of their wealth and showing the next generation how to be philanthropic.

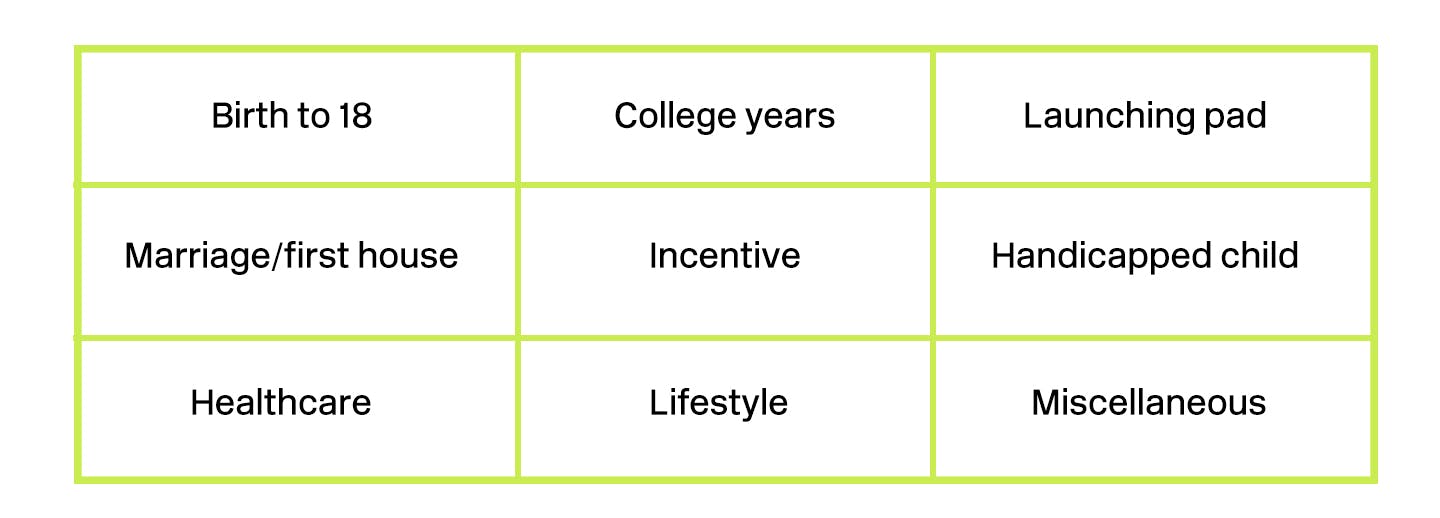

The following table shows the “basket” for wealth allocation; most families will allocate their wealth to these nine areas.

The “launching pad” above refers to the time when your children have finished their education and are venturing out into the world of “work.” For the first few years, you may want to provide financial support while they get their careers going, such as rent, etc.

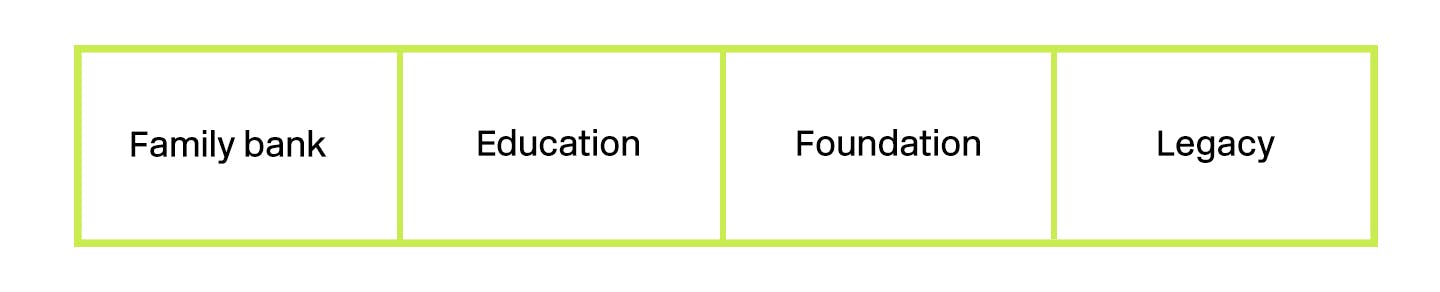

But, what do you do with the leftover wealth? Most families have four accounts. In Dr. Hausner’s book, she refers to the “four capitals” or accounts of the legacy family as FISH: financial, intellectual, social and human. The following table and shows the four long-term trusts that support the FISH: family bank supports financial capital; education supports intellectual capital; foundation supports social capital; and legacy supports human capital.

Every family should have a plan. Every parent wants their children to grow up to be productive and conservative. An intentional structure or plan will help any family and if they have that game plan, with their priorities in place or their FISH, then they can execute. Families with billions will face different issues, such as how much to pass down to each child, etc., but every family needs to plan for the future.

Baker Tilly Wealth Management, LLC (BTWM) is a registered investment advisor. BTWM does not provide tax or legal advice. BTWM is not an attorney. Estate planning can involve a complex web of tax rules and regulations. Consider consulting a tax or legal professional about your particular circumstances before implementing any tax or legal strategy. The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought.

Baker Tilly Wealth Management, LLC is controlled by Baker Tilly Advisory Group, LP. Baker Tilly Advisory Group, LP and Baker Tilly US, LLP, trading as Baker Tilly, operate under an alternative practice structure and are members of the global network of Baker Tilly International Ltd., the members of which are separate and independent legal entities. Baker Tilly US, LLP is a licensed CPA firm that provides assurance services to its clients. Baker Tilly Advisory Group, LP and its subsidiary entities provide tax and consulting services to their clients and are not licensed CPA firms. ©2024 Baker Tilly Wealth Management, LLC