Exposure analysis: expanding the use of modeling and decision trees

In January 2022, Law360 reported on the technology and analytical tools available, which allow the legal profession to move cases towards early resolution. One of the key tools discussed was the use of decision trees. As counsel or organizations approach a case, they need to be aware of some of the considerations in building a tree, understanding the probabilities from the tree and how weighting may be applied.

It’s common to see settlement recommendations that simply fall in the midpoint of best-case and worst-case scenarios. However, even in cases where there are multiple legal or factual issues being disputed, all of which have an equal chance of being won or lost, it doesn’t necessarily mean the case should be valued at the midpoint, or 50% of the damages gap.

Scenario-based models

Working with both in-house and external Counsel on complex cases, forensic accountants are often engaged to assist with exposure analysis. The forensic specialist develops scenario-based models that allow for understanding of the damages exposure under a variety of scenarios and situations. These scenarios address the many legal issues in dispute, allowing the parties to understand the financial implications of each argument, and thus develop the right strategy.

In developing these models, the forensic expert works closely with Counsel to understand the key issues of the case and the potential outcome of those key issues. Once identified, the expert constructs a model that allows the user to modify the potential outcome of those issues. This result is a model which illustrates the impact of financial damages. Changes the parameters and potential outcomes in the model, and an alternative financial damages exposure is shown. Spending time at the outset to understand the issues and the legal arguments, the variables in the damages, and the data available enables an analytical model to be built which can quickly accommodate change.

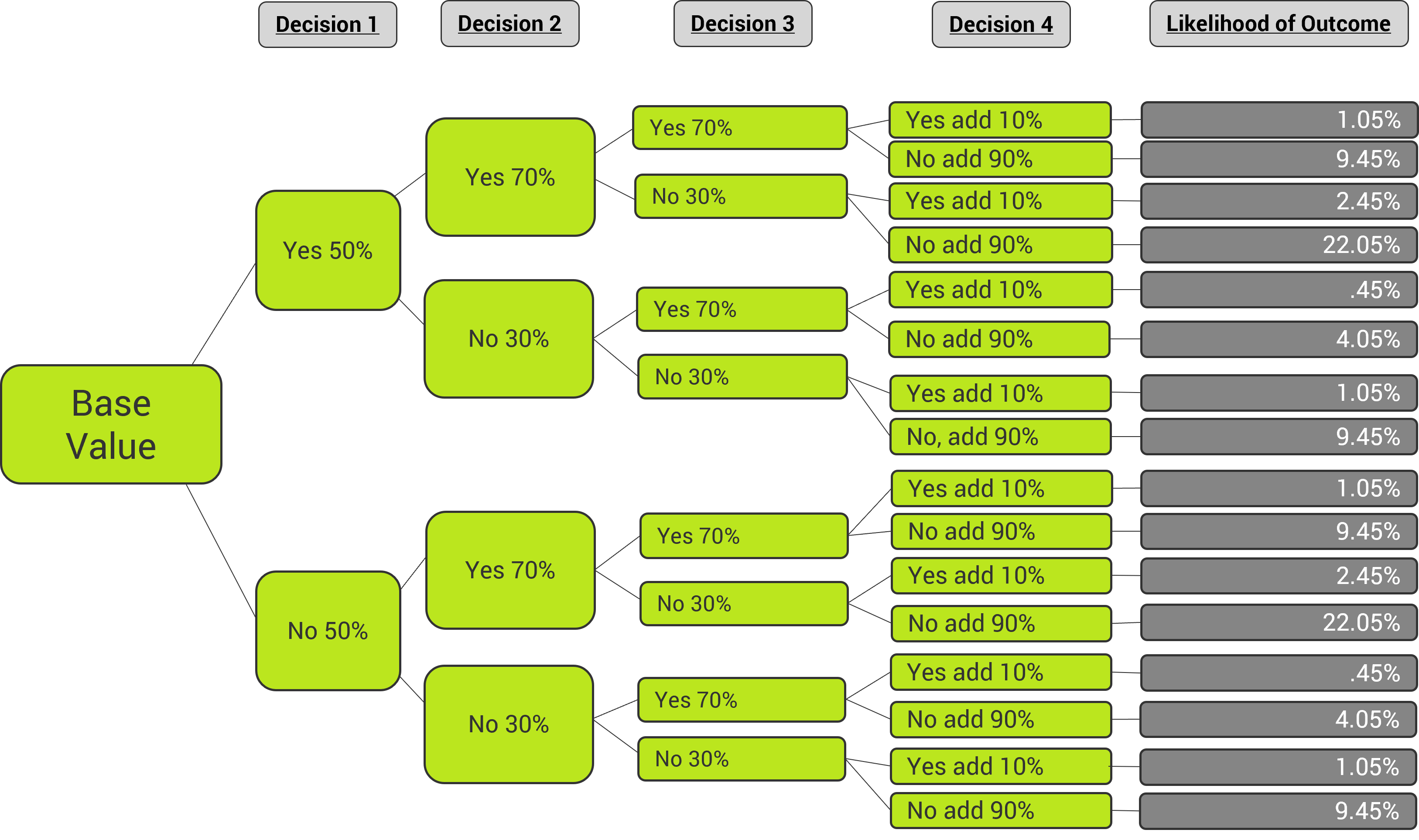

Many analytical models result in hundreds of thousands of possible outcomes. We set out below just one example of such a variety of outcomes, with four decisions resulting in 16 scenarios.

For the analytical model to have an appropriate use value to our clients, changing the outcome of each disputed item (each decision point) needs to immediately show the impact on the financial damages.

Such decisions often revolved around applicable policy language, occurrence disputes, applicable time periods, interpretation of data points. The scale of such issues and decisions can quickly lead to analytical models that become complex. However, the aim of such a model is to take a complex of issues, and quickly demonstrate the outcome of various “what if” questions.

Knowing how these legal arguments will impact the overall damages, it enables Counsel to make suitable strategy decisions on where a reasonable settlement may lay.

Forensic accountants often find themselves involved in cases where clients are the only party who has taken the time and expense involved to review the data to a suitable degree, analyze the issues, and apply those facts and figures in understanding the true damages values.

Risk adjusted damages values

To take the use of the modelling to the next level, Counsel and clients often seek to understand what impact a risk adjustment for legal arguments may have on financial damages. For example, the model will calculate the outcome assuming a particular issue is won or lost. However, for mediation purposes a client may believe they have a 70% chance of winning the argument on that issue. What is the risk adjusted value for that issue then accounting for the 30% chance they lose?

This is where decision tree analysis meets with analytical modelling to deliver a valuable case management solution. At this stage, the case data has been analyzed, cleaned, and tested, and a functioning model has been developed. Overlaid on that model is a decision tree analysis, which allows for a risk adjusted damages value to be identified, with a view to suitable settlement discussions. Such a model will weigh the various arguments and address the possibilities of winning or losing such disputed issues.

Through this decision tree analysis, every scenario gets extracted and the value of that scenario from the model. Those scenarios produce settlement values the client can consider based on their risks of each issue.

Such an analytical tool has significant value in litigation case management. While it may not be a necessary step in all situations it is certainly of tremendous value in cases with large data sets, multiple policy application issues, and significant financial impact. The ability to modify the model and get an immediate financial analysis is a huge advantage when legal arguments are presented, and the financial impact of such argument needs to be known. Immediate access to the financial impact during mediations enables the legal team, and their clients, to properly consider the arguments, and move, if appropriate towards a favorable and measured settlement. It’s not simply a situation where the gap between two financial measurements should be split 50/50.

Both the model and decision tree are extremely valuable tools for use in mediation. This allows clients to consider all outcomes, while also considering their risks of winning and losing in litigation, so that they may be best equipped for their negations.

For more information on these topics, or to learn how Baker Tilly’s Value Architects™ can help, contact our team.