Examining the state of municipal utility rates in today’s inflationary environment

More than any time in modern history, inflation is taking a significant toll on entities and individuals across the United States – and utilities are certainly no exception.

That said, utilities are not helpless when it comes to the increased cost of doing business. You can combat inflation, to some degree, by understanding where you stand today and considering a few basic best practices that can help you prepare for tomorrow – and beyond.

In a recent webinar, Baker Tilly shares steps your utility can take to combat the increased cost of doing business.

Utilities and inflation: setting the stage

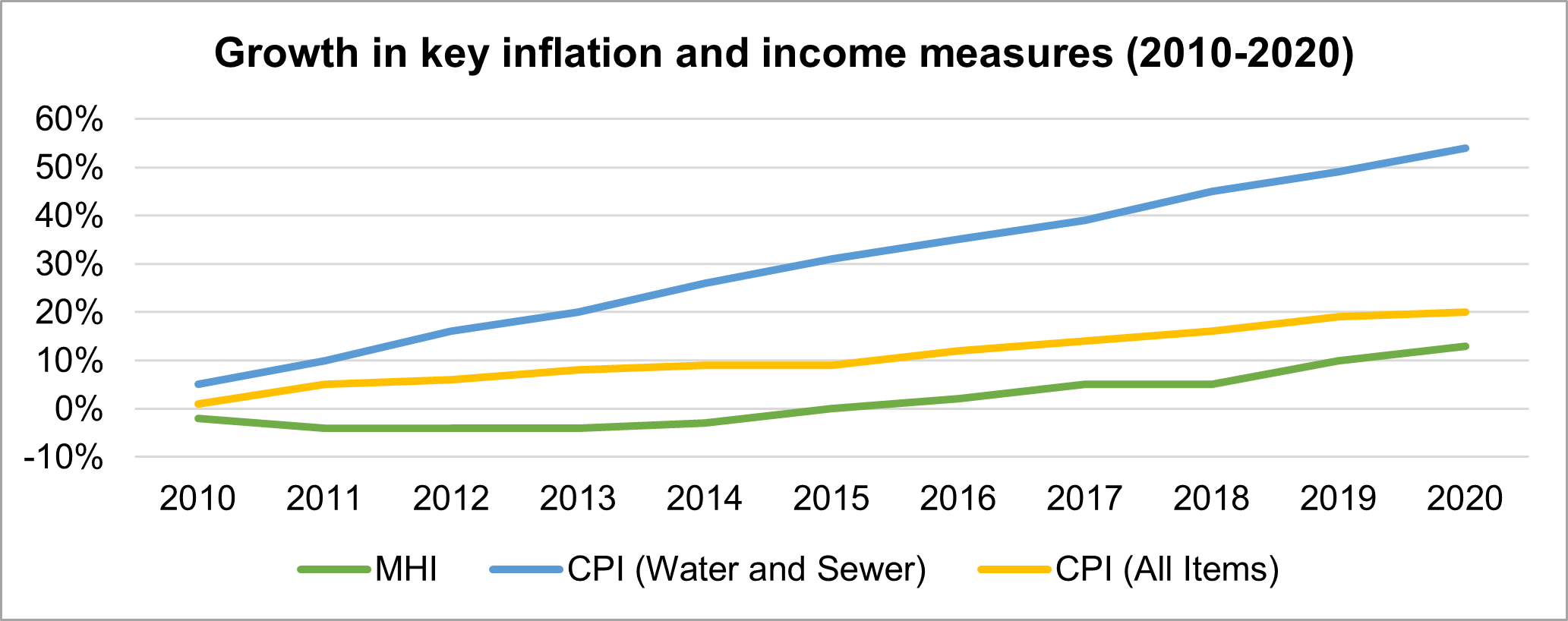

It is important to begin by noting that utility rates as a whole have been increasing at a pace greater than the broader market inflation for years. The pandemic certainly has not helped in that regard, but utility affordability problems existed before COVID-19 threw supply chains and labor markets into disarray. As you can see in the Bureau of Labor Statistics (BLS) data below, the water and sewer Consumer Price Index (CPI) has significantly outpaced total CPI and income growth for the past decade.

This pressure has been even more acute in the past 12 months as significantly higher costs for personnel, materials, chemicals and construction bidding have hit simultaneously at rates not seen in decades. Debt financing plays a key role in addressing the backlog of infrastructure improvements that most utilities are facing, and rising interest rates are an extra burden when combined with new record high construction bids.

The combination of all these factors is putting extra pressure on utilities with many of their budgets tighter than ever and their customers suffering affordability issues as every aspect of daily life gets more expensive.

What can utilities do?

Adjustments to utility rates can have relatively long lead times. Taking into account the time to prepare detailed calculations, regulatory approvals and local council discussions and advertisement requirements, it can be months or even a year before changes take effect. This makes it pivotal for utilities to stay ahead of these cost increases. Depending on their specific situation, which might mean refocusing on the importance of budgeting, or doing more frequent rate analyses, or proactively monitoring results to identify problems before it is too late.

Having realistic and well thought out line item operating budgets and performing regular budget to actual comparisons (monthly or quarterly) are a utility’s first line of defense. By comparing their actual costs to the original estimates, a utility can garner real insights on trends long before they become noticeable in the bottom line of financial results. Budgeting that includes multiyear capital planning also allows a utility to better tailor their rate approach to big picture needs, getting out of a reactive cycle.

With the up-to-date budget information, utilities can stay on top of problem areas before these issues become widespread. This can provide management time to alter operations or begin a detailed rate analysis long before it becomes an emergency. After all, the last thing utilities want to do is hit their customers with larger rate increases because they waited too long to address their cost issues.

Proactive rate adjustments can help utilities ease the shock to customers. Although rate increases are unlikely to be praised, a methodical phased approach allows customers large and small to adapt and budget accordingly. So, in short, not paying attention for months at a time and reviewing your cash balances only at the end of the year is simply too little, too late. Results need to be monitored closely and constantly.

Why is this so important?

The American Rescue Plan Act, the Infrastructure Investment and Jobs Act and the newly signed Inflation Reduction Act all had components that impact utilities. Those programs and the incentives they provide may accelerate some major capital projects. That will in turn result in utilities needing to provide “matching” or subsequent funds at a time when all other costs are also rising. This further strengthens the argument for comprehensive and actively adjusted budgets and capital plans along with rates sufficient to sustain operations.

Frequently, grant applications heavily weigh a utility’s existing and anticipated future user rates in determining where their funding will be most beneficial. Thus, it is critical for utilities to accurately reflect their cost of doing business in these applications. So, if rates are already under-collecting across the rest of your operations – and that’s not even factoring in any new projects – then that is going to negatively impact when you go to finance the non-grant funded portion of the project.

Additionally, there is the issue of local funding requirements for these grants, which makes it even more important to have your finances in order. For instance, producing even a small match likely will be significantly more difficult if the utility has used a portion of its cash reserve balances in an attempt to avoid rate adjustments year after year. Remember that cash is “king” and maintaining adequate cash balances is important not only to run your operations but also in maintaining your bond rating. So, making sure you have a holistic view of your needs and are setting rates appropriately is extremely important in the current environment.

Finally, these grants will be competitive. So, utilities with more organized books and a tighter grip on their own finances are going to have a better chance to take advantage of these funding opportunities.

Clearly, the more planning and budgeting you do, and the more closely you monitor costs and rates, the more prepared you will be to keep up with operating and capital requirements along with landing valuable grants that could benefit your customers and your business.

If your utility has not had a rate study in a few years and/or you see your cash balances declining, it likely is time for a rate study, especially in this high inflationary environment. Do not hesitate to contact us if you have questions or would like additional information regarding a rate study.

Baker Tilly Municipal Advisors, LLC is a registered municipal advisor and controlled subsidiary of Baker Tilly Advisory Group, LP. Baker Tilly Advisory Group, LP and Baker Tilly US, LLP, trading as Baker Tilly, operate under an alternative practice structure and are members of the global network of Baker Tilly International Ltd., the members of which are separate and independent legal entities. Baker Tilly US, LLP is a licensed CPA firm and provides assurance services to its clients. Baker Tilly Advisory Group, LP and its subsidiary entities provide tax and consulting services to their clients and are not licensed CPA firms. ©2024 Baker Tilly Municipal Advisors, LLC