Plugged-in: EV revolution fuels "battery belt" emergence from the Midwest to the South

As the market for electric vehicles (EVs) continues to grow, auto and battery manufacturers are scaling up to meet demand with manufacturing site interest concentrated in certain U.S. supply chain hot spots. Driven partially by state tax credits and incentives, as well as federal tax incentives from the Inflation Reduction Act of 2022 (IRA) that require funds be used for North American-based manufacturing and material sourcing, states like Georgia, Kentucky, South Carolina and Tennessee are expanding the footprint of the multitier auto industry into the south through the establishment of a new “battery belt.”

Since the IRA became law in 2022, a substantial number of companies across the country have announced plans to build and expand operations for the manufacturing of EV-related materials and components. The "battery belt" is ideal for new development due to a balanced combination of available labor, utilities, land and state-level support, and expands beyond the Midwest-centric region that historically has attracted most auto manufacturing.

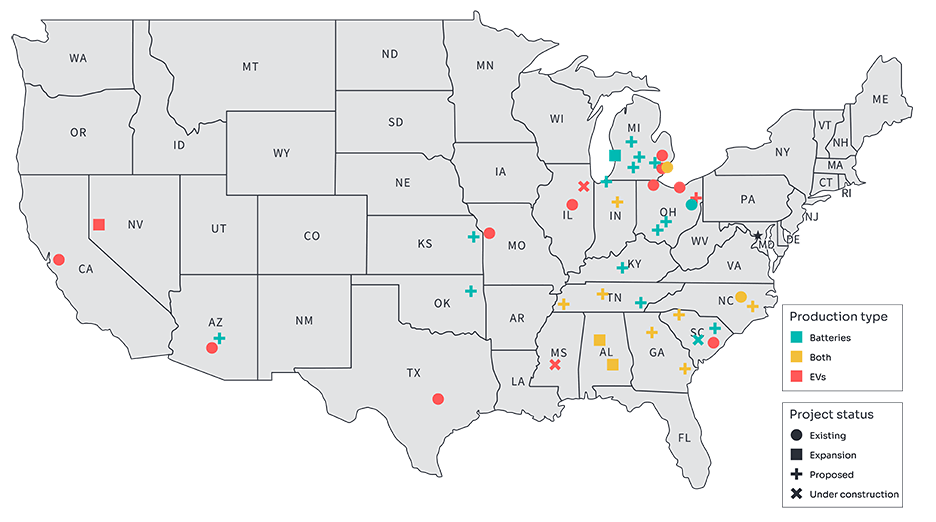

EV manufacturing developments across the U.S.

Throughout the "battery belt", established EV companies are tapping into IRA incentives by building their own battery manufacturing plants or establishing partnerships. Toyota, Ford and BMW are a few of the more prominent companies that have announced plans to make such investments in locations near their auto production plants. Industry-wide, the new gigafactories are expected to help meet worldwide demand of upwards of 4,500 gigawatt-hours (GWh) a year by 2030, with an estimated 1,000 GWh production capacity coming from North America. According to the U.S. Department of Energy (DOE), over a dozen new gigafactories are expected to start producing new batteries in the U.S. by 2025 [1]. In support of these large-scale battery plants is the development of a long supply chain including battery manufacturing, testing, research, recycling, charging and servicing.

Battery recycling projects are also on the rise. Earlier this year, the DOE signed off on a $2 billion loan to Redwood Materials Inc., a North American battery recycler who has recycled scrap from the battery cell production of the Tesla and Panasonic Gigafactory [2]. The company is now building a factory in South Carolina. In March 2023, Ascend Elements celebrated the opening of a Georgia-based lithium-ion battery recycling facility, and has recently announced a multi-year supplier agreement valued at up to $5 billion, starting in late 2024. In early June 2023, the DOE also announced more than $192 million in new funding for recycling batteries from consumer products, launching an advanced battery research and development (R&D) consortium, and the continuation of the Lithium-Ion Battery Recycling Prize, which began in 2019. This announcement supports the Biden-Harris Administration’s goal to have EVs make up half of all vehicle sales in America by 2030 and builds on the nearly $3 billion announced to date from President Biden’s Bipartisan Infrastructure Law for EV and battery technologies [3]. Recycling batteries can generate approximately 95% of these metals to be reused in manufacturing new batteries. By 2030, this EV battery manufacturing capacity will support the manufacturing of between 10 million and 13 million all-electric vehicles per year, putting the U.S. in position to be a global EV competitor [4].

As an emerging consumer and commercial product, many of these electric vehicles require parts not historically manufactured in the auto industry, which creates new or expanded markets. Semiconductors are a critical component leading to announcements in the region, including semiconductor wafer manufacturer Pallidus, Inc. opening a plant in Rock Hill, South Carolina, while Bosch is planning a facility in Charleston, South Carolina, to manufacture electric motors. With all the new EVs expected to flood the market, the charging infrastructure needed to keep them on the road is making an impact in the "battery belt" as well. Autel Energy is opening a factory in North Carolina to manufacture chargers. Daejin plans on opening a factory in Tennessee to manufacture battery trays that hold batteries in place on EVs.

Whether a company is a new entrant to the market or a veteran of automotive production, every player understands the importance of capitalizing on synergies along the supply chain, having confidence in the labor market and reliable access to power, and in many cases accelerated timeline to support speed to market.

Access to raw materials is creating a roadblock

While factories spin up and retool to meet the EV demand, there are challenges with accessing enough raw material and componentry that the legacy automotive industry hasn’t typically dealt with. For certain credits, the IRA requires minerals contained in EV batteries mined in the U.S. or recycled in North America. The required percentage can be 40% increasing over time. A recent report by Goldman Sachs claimed only 7% of the required nickel could be recovered from recycled batteries, and since most of the world’s supply of nickel is not mined in the U.S., this shortage may present a challenge down the road [5]. The shortfall in available raw materials like nickel, cobalt and lithium could be alleviated by more EV batteries reaching their end-of-life charge.

While some companies are pushing forward with battery recycling, others are looking at creative ways to solve the nickel problem. Texas-based Tesla, for example, recently made a deal directly with Canadian mining company Vale for nickel [6]. We anticipate seeing more deals like this in the near future.

Even though the EV market is still in its infancy, demand continues to grow. Just over 7% of cars on U.S. roads today are EVs, but projections are that they will make up 40% of total car purchases by 2030. Spurred on by IRA tax credits and state incentives, EV manufacturers are setting the groundwork for a fully charged, coast–to-coast, electric future.

Finding the right location

Historically, most EV batteries and electronic chips have been produced in Asia. The move stateside creates unique challenges for EV and battery manufacturers; chief among them is finding appropriately sized sites with ready access to power, labor and raw materials needed for production purposes.

States are scrambling to meet the demand by allocating funds to provide the infrastructure needed to make available sites more attractive to prospective buyers. South Carolina, Virginia and North Carolina have each proposed to spend hundreds of millions of dollars on readying industrial sites in the coming years, and Illinois has already committed $40 million to prepare megasites to attract new industry [7].

Finding the ideal or even suitable location can be time-consuming, especially without an organized process backed by access to data, resources and industry expertise. Site selectors with state and local contacts and a knowledge base that includes an understanding of supply chain impact and incentives opportunities are in high demand.

“Plugged-in” is a two-part article series by Baker Tilly’s site selection and location strategy team exploring trends in EV, including tax credits and incentives, transactions, announcements, site selection considerations and more.

Read part one: Manufacturers move to meet domestic EV demand

[1] “FOTW #1217” U.S. Department of Energy, Vehicle Technologies Office, Dec. 20, 2021

[2] “LPO Offers Conditional Commitment to Redwood Materials to Produce Critical Electric Vehicle Battery Components From Recycled Materials” U.S. Department of Energy, Loan Programs Office, Feb. 9, 2023

[3] ”Biden-Harris Administration Announces $192 Million to Advance Battery Recycling Technology” U.S. Department of Energy, June 12, 2023

[4] ”Building a Resilient EV Battery Value Chain” Observer Research Foundation, June 1, 2023

[5] ”EV Battery Recycling Has Boomed Too Soon” Washington Post, Feb. 2, 2023

[6] “Tesla explains its approach to sourcing lithium, nickel, and cobalt directly from mines in impressive detail” Electrek, May 9, 2022

[7] "Gov. Pritzker Announces $40 Million Grant Opportunity to Develop Megasites” Illinois Press Release, Feb. 6, 2023