Embracing the virtual audit

Whether you like it or not, given the current environment the virtual audit appears here to stay. The pandemic made it necessary to conduct almost all audits remotely, but technology and client demands have been leading in this direction for years. Now clients and auditors are working together to discover a balance of on-site collaboration and virtual efficiency.

During our recent webinar, Auditing in a remote environment: lessons learned and looking forward, Baker Tilly audit partners Dan Buttke and Laurie Horvath hosted a roundtable of clients: Heather Acker, CFO, Gentex Corp.; Chris Kenney, CAO, Hallmark Financial Services; and Jeff Lev, CFO and COO, Jewish Family Service. They discussed the virtual audit process, likes and dislikes of working in a remote environment, and pandemic-related changes that will sustain this unique time.

Historical audit and pandemic problems

The audit process can be broken down into four primary phases: planning, interim, fieldwork and reporting. Planning and other more administrative tasks may be in person, but are more typically done via phone calls, web discussion or emails with the client. For the interim phase, auditors may spend some time on-site, but would traditionally plan to be on site for a large portion of time during final fieldwork. Reporting is usually happening alongside the fieldwork phase, but final reports are often processed and completed once the audit team has left the client site.

What may not be evident, though, is parts of that traditional audit process had already started to become virtual. Like most aspects of life, more and more information is being shared electronically, whether through email or secure portals, like Huddle, which Baker Tilly uses with clients for sharing or requesting data. In fact, even when auditors are on-site, some client staff may be out of the office and need to be reached virtually or prefer electronic updates or questions.

This is not to take away from the importance of being on-site with a client or completing certain sections of an audit face to face. That interaction between an auditor and the client builds trust and instills confidence. Nothing can replace that part of the audit process, but the pandemic forced auditors to figure out how to do that another way.

When Baker Tilly auditors had to pivot from the historical audit process model at the onset of the pandemic, they knew the first thing they had to change was the timeline. Because of when the pandemic-related shutdowns started, some fiscal-year clients either had to have their on-site fieldwork cut short or eliminated altogether, Dan Buttke, audit partner, said. Since auditors had to adjust how they were going to do that rather important phase remotely, they had to push back their timelines, not knowing when they were going to get certain information or how they would be able to meet with audit committees or boards to close out the audits.

Early on, they realized how much they had taken certain audit “basics” for granted, especially how they were going to get certain information from clients. In pre-pandemic times, when auditors needed something from clients, they could request it through Huddle where the client could upload it immediately. When the lockdowns started, there were some situations where not everyone had a laptop or, if they did, the organization did not have a virtual private network (VPN) set up, so they weren’t able to access certain documents from the office server, or they needed an invoice that wasn’t even saved to the network but was physically in a filing cabinet in a building that no one was allowed in. For Buttke, he said he struggled with getting signatures on representation letters since no one was together and some people didn’t have the means to scan theirs and send it to him.

On top of that, everyone has different life circumstances, including possibly having ill family members, caring for small children or running virtual classes for school-aged children. Everyone’s internet capabilities are constantly being stretched to the limit, regardless of who you are or where you live. And even though the commute may have been shortened, all of those other things that are happening are distractions that are creating inefficiencies and affecting production.

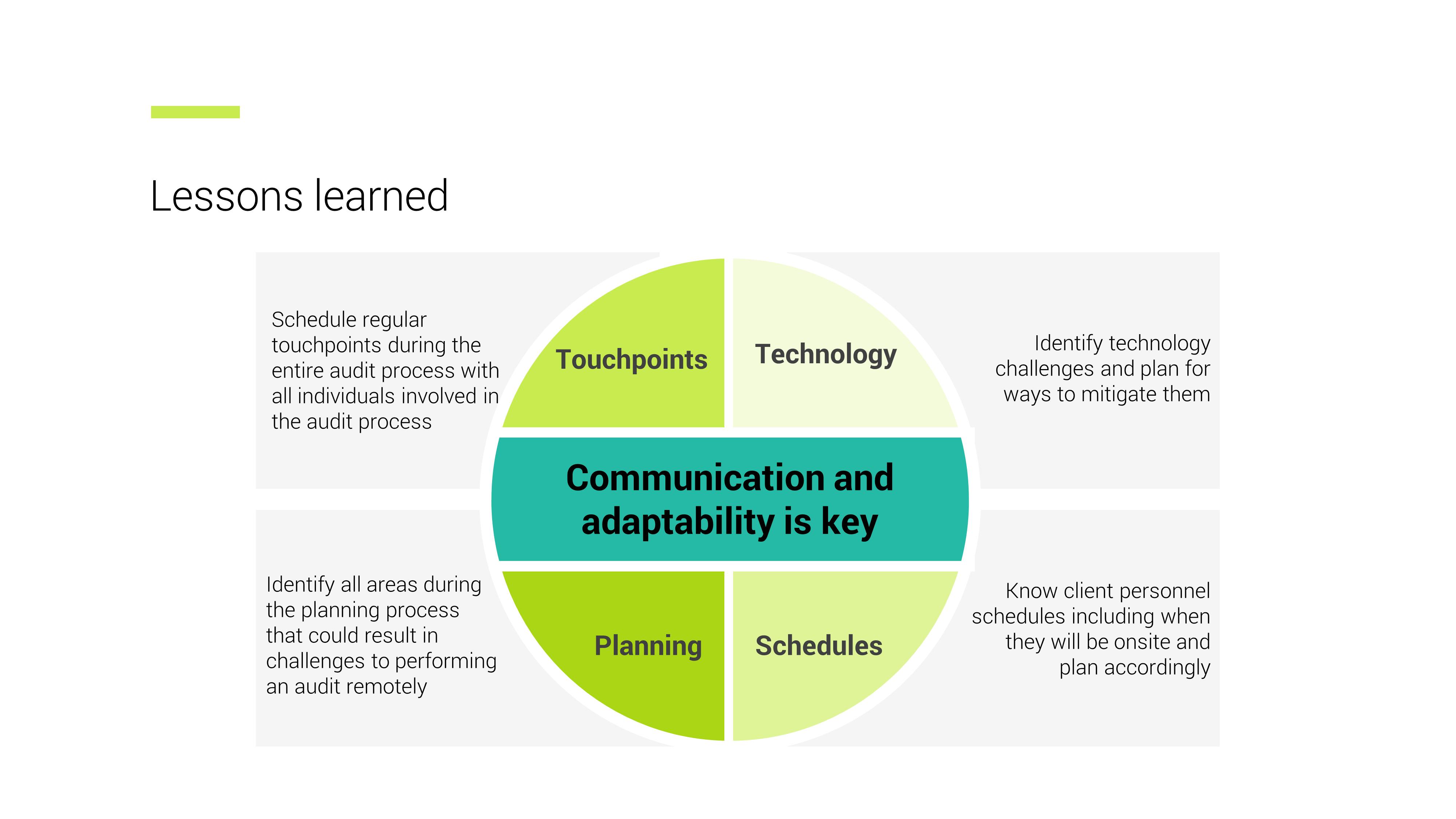

Communication and adaptability

Not surprisingly, Buttke said what his team learned from working remotely for the last nine months was how much the success of the audit depended on not only communication, but also the willingness and ability to adapt to the situation at hand.

They realized that to execute the audit effectively and efficiently, they had to be intentional in all aspects of the process, he said. Having regular touchpoints with their clients was not new, but they needed to be smarter about when they were doing them, with whom and about what. He encouraged them to be intentional in how they were interacting with their other team members as well as their clients, being more cognizant of the differences in schedules since no one was operating on the same timetable.

Clients understood that, too. Kenney said he and his team tried to conduct Zoom meetings when they could with their auditors, but he also asked his team members to treat the auditors like they were on-site, encouraging them to be as available as possible to the auditors.

“It’s a lot easier to respond immediately to them, pick up the phone and call them, share your screen,” Kenney said. “It flows better if you try to be responsive on a daily basis and not let questions get stale.”

Keeping those engagement “norms” and having regular status meetings are aspects that could be overlooked in the virtual audit, but they shouldn’t.

Acker said her team started having weekly meetings with her auditors about two years ago and continued them throughout the pandemic. She and her team have a regular punch-list they go through with their auditors to make sure everyone is on the same page with what is outstanding.

Similarly, Lev said operating in a remote environment reaffirmed the importance of having regular touchpoints with the audit team. The more the audit team understands what is happening in the organization 365 days a year, the less labor intensive the interim fieldwork and final fieldwork seems to be.

“The more often you are speaking to your audit team, the smoother the audit is,” Lev said, adding, “and, for me, that just was hit home during this year.”

What to expect with a virtual audit

While the four phases of the audit process are the same — planning, interim, fieldwork and reporting — they are just executed differently.

For clients that have gone through the audit process at least once with Baker Tilly, the planning discussion is a fairly straightforward conversation about year-to-date results. Occasionally, the organization is going through an acquisition, launching a product, maybe closing a plant or something else requiring a more robust discussion. This year’s planning will be different because nearly every organization has been affected by the pandemic in some way, good or bad. Buttke said no one should be glossing over year-to-date updates this year. He stressed intentionality again here, with a real focus on collaborating with the client to work through any potential challenges.

The interim is often considered the uncomplicated portion of the audit process, but since auditors can’t physically do a walk-through or look over someone’s shoulder as they walk through a process, they have to adapt. In addition to Zoom calls, clients and auditors are using screen sharing to do their walk-throughs. Buttke said clients should anticipate pre- and post-COVID-19 walk-throughs and internal control testing. For now, though, interim is the time to identify other issues that may create risk, including potential impairment and management estimates. Interim discussions will make the actual fieldwork process more efficient.

Elements of fieldwork will be different this year. The timing and extent of testing may vary. In some cases, an organization may create a different risk profile from the auditor’s perspective. Having a lower materiality is a real possibility, which could mean a change in fieldwork and create additional testing or a different kind of testing. Buttke said changes should be discussed early on to make sure the team is deliberate in how they are thinking through these things and addressing them prior to final fieldwork.

The wrap-up process will go through the same exercise, but there will be different things to consider, including materiality and how that could change potential audit adjustments, or internal controls and what may result in deficiencies. Buttke said it is really nothing they haven’t discussed before, but the concept of being intentional in all aspects of this year’s audit will be critical.

Lessons learned that will improve the audit process

As previously mentioned, something that seems so simple now is something that the auditors and their clients did not regularly do before: Share their screens.

“I remember years where we’re on the phone and talking about cell C7 and divide it by cell J9,” Lev said. “Being able to screen share actually made that much more efficient and effective and productive. There’s nothing novel or original about what I’m saying, but just trying to look for the positives of being required to do this remotely helped set the right context for us.”

He also said the silver lining of the pandemic is it accelerated his organization’s efforts to modernize its back-office operations, with the hope in six months’ time, it will be paperless.

For Kenney, a few positive developments that came out of having a pandemic audit that he will continue are using Huddle to share documents and having weekly meetings with his audit team. He also said communication improved dramatically between the audit team and his team because they have spent more time talking with each other over the phone than sending emails, which is a practice he’d like to continue.

In pre-pandemic times, Acker said auditors would have been on-site to ask intermittent questions; the virtual environment forced them to have batch issues and prioritizations for their weekly meetings, which allowed them “to attack them with the right degree of importance.”

Still, she sees a downside in this virtual world: transparency. Acker said when you are across the table from someone, you can read their body language and gauge the situation, which you can’t always do virtually, even with Zoom. She recommends clear communication to avoid possible misunderstandings.

For more information on auditing in a remote environment, or to learn how Baker Tilly specialists can help, contact our team.