Coronavirus benefit coordination matrix

Employer payroll tax credits, loans, and other Consolidated Appropriations Act incentives

There are numerous relief programs available to lessen the burden of employee expenses and help businesses survive. The Consolidated Appropriations Act, 2021 (“CAA”), funds the government for the next fiscal year and consists of several bills that together mark the fourth economic stimulus package designed to help taxpayers continue to weather coronavirus-related closures. The CAA extends and enhances many relief provisions that were included in the Families First Coronavirus Response Act (FFCRA) and Coronavirus Aid, Relief, and Economic Security (CARES) Act. Each business must determine which relief programs will have the most positive impact on their business, while also ensuring the benefits they choose can work together.

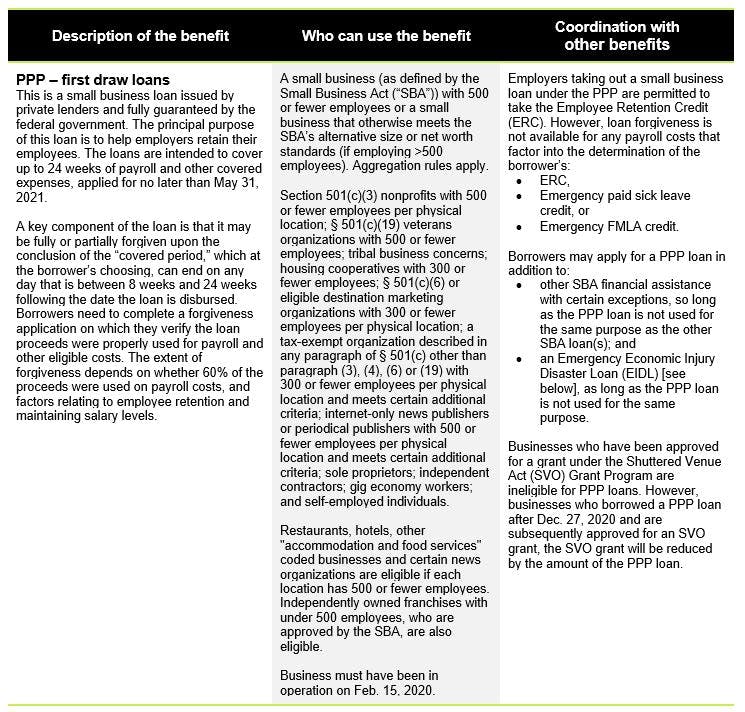

Baker Tilly’s coronavirus benefit coordination matrix not only explains who can use each benefit but also how each benefit coordinates with others.

A preview of the matrix is shown below, highlighting the Paycheck Protection Program:

Paycheck Protection Program (PPP) - first draw loans

This is a small business loan issued by private lenders and fully guaranteed by the federal government. The principal purpose of this loan is to help employers retain their employees. The loans are intended to cover up to 24 weeks of payroll and other covered expenses, applied for no later than May 31, 2021.

A key component of the loan is that it may be fully or partially forgiven upon the conclusion of the “covered period,” which at the borrower’s choosing, can end on any day that is between 8 weeks and 24 weeks following the date the loan is disbursed. Borrowers need to complete a forgiveness application on which they verify the loan proceeds were properly used for payroll and other eligible costs. The extent of forgiveness depends on whether 60% of the proceeds were used on payroll costs, and factors relating to employee retention and maintaining salary levels.

A small business (as defined by the Small Business Act (“SBA”)) with 500 or fewer employees or a small business that otherwise meets the SBA’s alternative size or net worth standards (if employing >500 employees). Aggregation rules apply.

Section 501(c)(3) nonprofits with 500 or fewer employees per physical location; § 501(c)(19) veterans organizations with 500 or fewer employees; tribal business concerns; housing cooperatives with 300 or fewer employees; § 501(c)(6) or eligible destination marketing organizations with 300 or fewer employees per physical location; a tax-exempt organization described in any paragraph of § 501(c) other than paragraph (3), (4), (6) or (19) with 300 or fewer employees per physical location and meets certain additional criteria; internet-only news publishers or periodical publishers with 500 or fewer employees per physical location and meets certain additional criteria; sole proprietors; independent contractors; gig economy workers; and self-employed individuals.

Restaurants, hotels, other "accommodation and food services" coded businesses and certain news organizations are eligible if each location has 500 or fewer employees. Independently owned franchises with under 500 employees, who are approved by the SBA, are also eligible.

Business must have been in operation on Feb. 15, 2020.

Employers taking out a small business loan under the PPP are permitted to take the Employee Retention Credit (ERC). However, loan forgiveness is not available for any payroll costs that factor into the determination of the borrower’s:

- ERC,

- Emergency paid sick leave credit, or

- Emergency FMLA credit.

Borrowers may apply for a PPP loan in addition to:

- other SBA financial assistance with certain exceptions, so long as the PPP loan is not used for the same purpose as the other SBA loan(s); and

- an Emergency Economic Injury Disaster Loan (EIDL) [see below], as long as the PPP loan is not used for the same purpose.

Businesses who have been approved for a grant under the Shuttered Venue Act (SVO) Grant Program are ineligible for PPP loans. However, businesses who borrowed a PPP loan after Dec. 27, 2020 and are subsequently approved for an SVO grant, the SVO grant will be reduced by the amount of the PPP loan.

Download the matrix to learn more about which benefits may help your business during this challenging time, such as:

- PPP – second draw loans

- Employee retention credit – 2021 version

- Emergency Paid Sick Leave credit

- Emergency Paid Family and Medical Leave credit

- Work Opportunity Tax Credit

- Shuttered Venue Operators grant

- Restaurant Revitalization Fund grant

- Emergency Economic Injury Disaster Loan

- R&D credit payroll tax offset