Central Pennsylvania regional M&A update: Q2 2020

M&A Activity

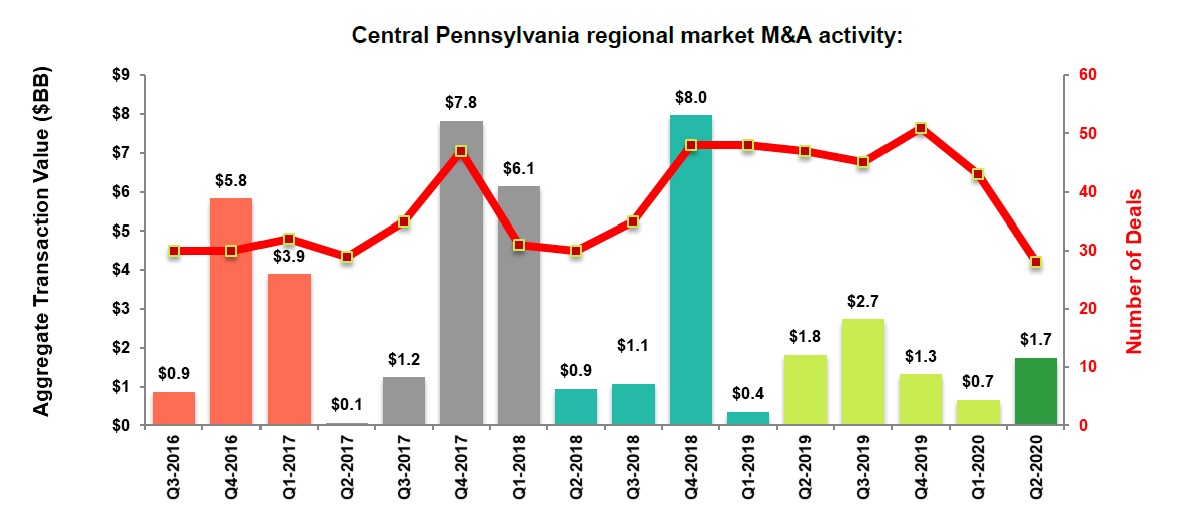

There were 28 transactions that closed in the Central Pennsylvania regional market during the second quarter of 2020 (Q2 2020), a decrease from the 43 closed transactions in the prior quarter. The 28 closed transactions also marked a significant 40.4% decrease from the 47 closed transactions during the same period in 2019.

In Q2 2020, M&A activity experienced a sharp decline as COVID-19 continued to ravage the global economy. North America’s overall M&A transaction value was $336.8 billion, representing a 33.1% year-over-year (YoY) decline. Additionally, M&A volume by transactions closed decreased 26.7% YoY. However, these figures fail to fully capture the substantial decline in M&A markets as Q2 2019 was also a weak quarter for transaction activity. To better illustrate the detrimental impact of COVID-19, Q2 2020 saw quarter-over-quarter (QoQ) declines of 41.1% and 24.2% for overall M&A transaction value and M&A volume by transactions closed, respectively. Unfortunately, there is no indication as to when the virus will subdue and M&A markets will likely feel the effects of this uncertainty in the following months.

Although the virus contributed to reduced M&A activity, valuations have increased as of Q2 2020. The median EV / EBITDA multiple for M&A transactions increased to 10.5x in Q2 2020, up from 9.8x in Q2 2019. The increase was primarily driven by the prevalence of sponsor-backed add-on acquisitions. In Q2 2020, sponsor-backed add-on acquisitions accounted for roughly 70% of all buyouts.

Source: S&P Capital IQ; (August 2020)

For more information on this topic, or to learn how Baker Tilly specialists can help, contact our team.